Region:Middle East

Author(s):Shubham

Product Code:KRAA8661

Pages:80

Published On:November 2025

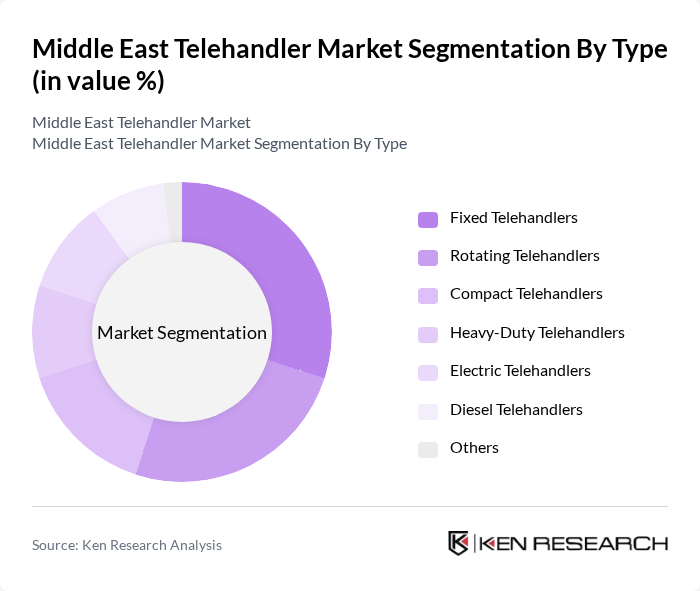

By Type:The telehandler market is segmented into Fixed Telehandlers, Rotating Telehandlers, Compact Telehandlers, Heavy-Duty Telehandlers, Electric Telehandlers, Diesel Telehandlers, and Others. Fixed telehandlers are widely used for general material handling in construction and agriculture, while rotating telehandlers offer enhanced versatility for industrial and logistics applications. Compact telehandlers are preferred for urban projects and confined spaces, and heavy-duty models serve mining and oil & gas sectors. Electric telehandlers are gaining traction due to sustainability initiatives, and diesel models remain prevalent in high-capacity operations.

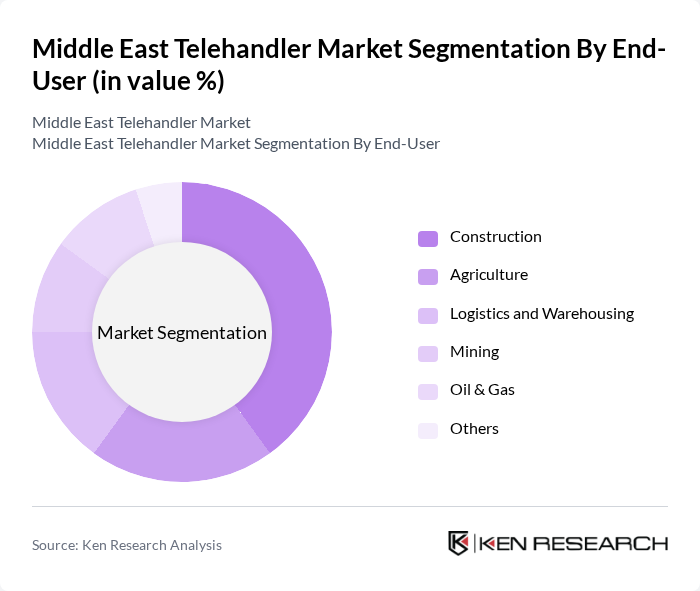

By End-User:The telehandler market is segmented by end-user industries, including Construction, Agriculture, Logistics and Warehousing, Mining, Oil & Gas, and Others. Construction remains the largest segment, driven by infrastructure expansion and urbanization. Agriculture utilizes telehandlers for crop handling and farm logistics, while logistics and warehousing sectors benefit from telehandlers for material movement and stacking. Mining and oil & gas sectors require heavy-duty telehandlers for rugged operations, and other industries include manufacturing and utilities.

The Middle East Telehandler Market is characterized by a dynamic mix of regional and international players. Leading participants such as JCB, Caterpillar Inc., Manitou Group, Bobcat Company, Genie (Terex Corporation), Doosan Bobcat, Merlo S.p.A., Haulotte Group, Skyjack (Linamar Corporation), Liebherr Group, CASE Construction Equipment (CNH Industrial), Hyundai Construction Equipment, JLG Industries (Oshkosh Corporation), Wacker Neuson SE, SANY Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East telehandler market appears promising, driven by technological advancements and increasing automation in material handling. As companies adopt smart technologies, telehandlers integrated with IoT capabilities are expected to enhance operational efficiency. Additionally, the growing emphasis on sustainability will likely lead to a rise in electric telehandlers, aligning with global environmental goals. These trends indicate a dynamic shift in the market, fostering innovation and improved productivity in the construction and logistics sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed Telehandlers Rotating Telehandlers Compact Telehandlers Heavy-Duty Telehandlers Electric Telehandlers Diesel Telehandlers Others |

| By End-User | Construction Agriculture Logistics and Warehousing Mining Oil & Gas Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Iraq, Syria) North Africa (Egypt, Libya, Algeria, Morocco, Tunisia) |

| By Application | Material Handling Lifting Operations Construction Support Agricultural Operations Mining Operations Others |

| By Payload Capacity | Less than 2 Tons to 4 Tons to 7 Tons Above 7 Tons |

| By Drive Type | Wheel Drive Wheel Drive |

| By Policy Support | Subsidies for Equipment Purchase Tax Incentives for Green Technology Government Grants for Infrastructure Projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Telehandler Usage | 120 | Project Managers, Site Supervisors |

| Agricultural Equipment Rental | 60 | Farm Equipment Managers, Agricultural Consultants |

| Logistics and Warehousing Operations | 50 | Warehouse Managers, Logistics Coordinators |

| Telehandler Maintenance and Service Providers | 40 | Service Technicians, Maintenance Managers |

| Telehandler Sales and Distribution Channels | 45 | Sales Managers, Distribution Network Coordinators |

The Middle East Telehandler Market is valued at approximately USD 1.1 billion, driven by increasing construction and infrastructure development, particularly in GCC countries. This growth reflects a robust demand for efficient material handling solutions across various sectors.