Region:Middle East

Author(s):Dev

Product Code:KRAD6426

Pages:88

Published On:December 2025

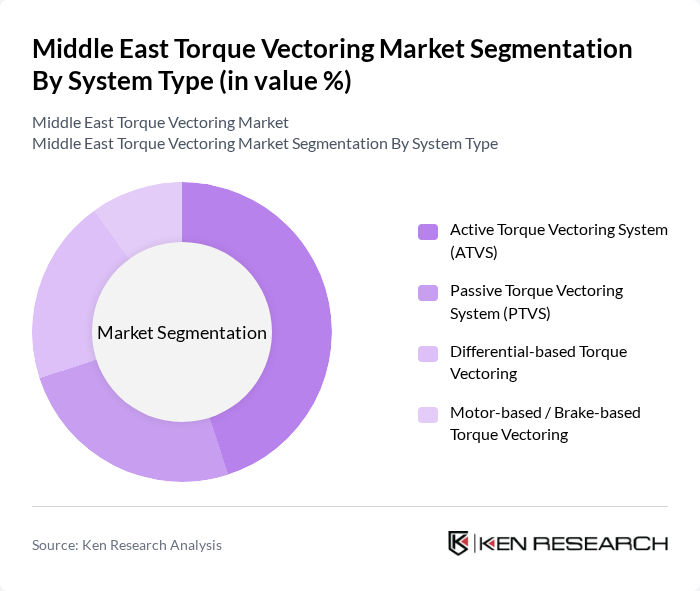

By System Type:The segmentation of the market by system type includes various technologies that enhance vehicle performance and handling. The subsegments are Active Torque Vectoring System (ATVS), Passive Torque Vectoring System (PTVS), Differential-based Torque Vectoring, and Motor-based / Brake-based Torque Vectoring. Among these, Active Torque Vectoring Systems are gaining traction due to their ability to provide real-time adjustments to torque distribution, significantly improving vehicle stability and handling, and they are increasingly specified in premium SUVs, crossovers, and performance-oriented electric vehicles in markets such as the UAE.

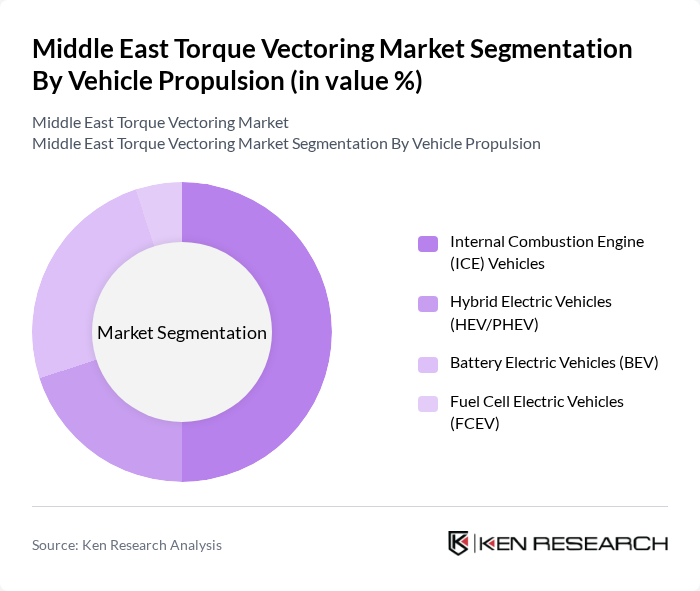

By Vehicle Propulsion:The market is segmented based on vehicle propulsion types, including Internal Combustion Engine (ICE) Vehicles, Hybrid Electric Vehicles (HEV/PHEV), Battery Electric Vehicles (BEV), and Fuel Cell Electric Vehicles (FCEV). The Internal Combustion Engine Vehicles segment remains dominant due to the established fuel distribution infrastructure, large on-road fleet, and continuing consumer preference for conventional vehicles in many Middle Eastern markets, while hybrid and electric propulsion are growing from a smaller base. At the same time, the BEV segment is rapidly gaining ground as electric mobility becomes more mainstream, supported by government incentives, fleet electrification targets, and investments in public charging networks in countries such as the UAE and Saudi Arabia, which accelerates the adoption of torque vectoring in high-performance and dual?motor electric models.

The Middle East Torque Vectoring Market is characterized by a dynamic mix of regional and international players. Leading participants such as ZF Friedrichshafen AG, BorgWarner Inc., GKN Automotive Limited, Continental AG, Eaton Corporation plc, Aisin Corporation, Dana Incorporated, JTEKT Corporation, Hyundai Mobis Co., Ltd., Valeo SA, Ricardo plc, Magna International Inc., Robert Bosch GmbH, Toyota Motor Corporation, Nissan Motor Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East torque vectoring market is poised for significant growth, driven by technological advancements and increasing consumer demand for high-performance vehicles. As automakers invest in R&D and collaborate with tech companies, innovations in torque vectoring systems will enhance vehicle dynamics and safety. Additionally, the rising adoption of electric and hybrid vehicles will further propel market expansion, aligning with regional sustainability goals and consumer preferences for eco-friendly solutions.

| Segment | Sub-Segments |

|---|---|

| By System Type | Active Torque Vectoring System (ATVS) Passive Torque Vectoring System (PTVS) Differential-based Torque Vectoring Motor-based / Brake-based Torque Vectoring |

| By Vehicle Propulsion | Internal Combustion Engine (ICE) Vehicles Hybrid Electric Vehicles (HEV/PHEV) Battery Electric Vehicles (BEV) Fuel Cell Electric Vehicles (FCEV) |

| By Vehicle Category | Passenger Cars (Sedans & Hatchbacks) SUVs & Crossovers Light Commercial Vehicles (LCVs) High-performance & Sports Cars |

| By Technology | Mechanical / Differential-based Systems Electronic / Software-based Torque Vectoring Hydraulic Clutch-based Torque Vectoring Integrated Vehicle Dynamics Control Systems |

| By Application | Stability & Traction Control Cornering & Handling Performance Off-road & All-terrain Capability Energy Efficiency & Range Optimization in EVs |

| By Sales Channel | OEM-fitted Systems OEM-backed Performance Packages Independent Aftermarket Upgrades Fleet & Specialty Vehicle Integrators |

| By Country | United Arab Emirates Saudi Arabia Qatar Kuwait Oman Bahrain Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 100 | Product Development Managers, Engineering Leads |

| Commercial Vehicle OEMs | 80 | Fleet Managers, Technical Directors |

| Automotive Component Suppliers | 70 | Supply Chain Managers, Sales Directors |

| Automotive Research Institutions | 50 | Research Analysts, Automotive Engineers |

| Regulatory Bodies and Associations | 40 | Policy Makers, Industry Advocates |

The Middle East Torque Vectoring Market is valued at approximately USD 1.0 billion, reflecting a significant growth trend driven by the demand for advanced vehicle dynamics and enhanced driving performance, particularly in luxury and high-performance vehicle segments.