Region:Middle East

Author(s):Rebecca

Product Code:KRAD1483

Pages:93

Published On:November 2025

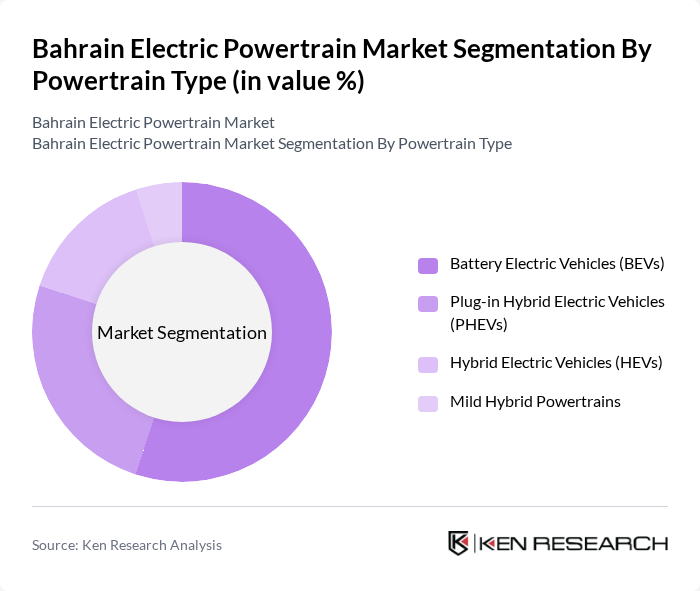

By Powertrain Type:

The powertrain type segmentation includes Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs), and Mild Hybrid Powertrains. Among these, Battery Electric Vehicles (BEVs) are gaining traction due to their zero-emission capabilities and growing consumer preference for fully electric options. The increasing availability of charging infrastructure—particularly home charging in premium residential areas—and advancements in battery technology further bolster the adoption of BEVs. PHEVs and HEVs also contribute, appealing to consumers seeking flexibility in fuel options. Mild hybrids remain a smaller segment as consumers increasingly lean towards fully electric solutions .

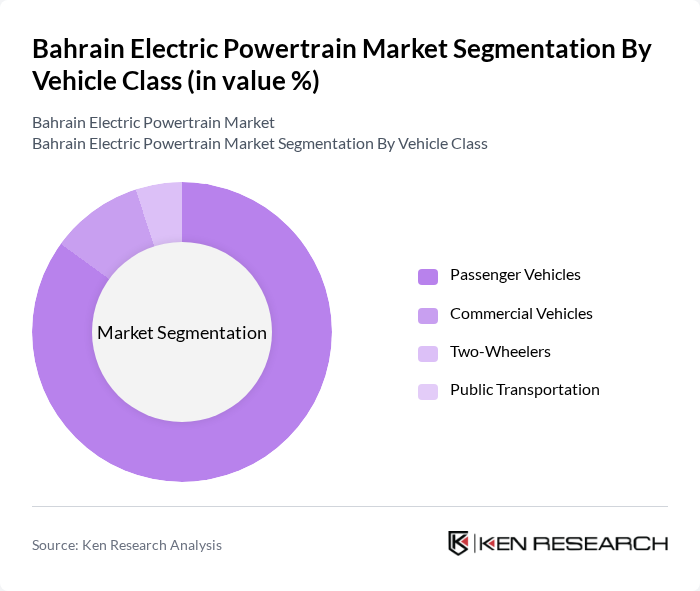

By Vehicle Class:

This segmentation includes Passenger Vehicles, Commercial Vehicles, Two-Wheelers, and Public Transportation. Passenger Vehicles lead the market, driven by consumer demand for personal electric mobility solutions and a strong preference for premium brands among urban professionals and high-income families. The rise in urbanization and the need for sustainable transport options have further propelled the adoption of electric passenger vehicles. Commercial Vehicles are also gaining traction as businesses seek to reduce operational costs and carbon footprints, though this segment is still emerging. Two-Wheelers, while a smaller segment, are popular among urban commuters, and Public Transportation is gradually integrating electric buses to enhance sustainability in public transit .

The Bahrain Electric Powertrain Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tesla, Hyundai Motor Company, BMW Group, Nissan Motor Corporation, Lexus (Toyota Motor Corporation), Porsche AG, Audi AG (Volkswagen Group), BYD Company Limited, Jaguar Land Rover (JLR), Mercedes-Benz Group AG, Volvo Car Corporation, Almoayyed International Group (Regional Distributor) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the electric powertrain market in Bahrain appears promising, driven by increasing government support and technological advancements. In future, the market is expected to witness a surge in electric vehicle adoption, with projections indicating that the number of EVs could reach 25,000 units. Additionally, the expansion of charging infrastructure and partnerships with technology providers will enhance the overall ecosystem, making electric vehicles more accessible and appealing to consumers. The focus on sustainability will further propel market growth.

| Segment | Sub-Segments |

|---|---|

| By Powertrain Type | Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Hybrid Electric Vehicles (HEVs) Mild Hybrid Powertrains |

| By Vehicle Class | Passenger Vehicles Commercial Vehicles Two-Wheelers Public Transportation |

| By Battery Technology | Lithium-Ion Batteries Lithium Titanate Oxide (LTO) Batteries Solid-State Batteries Others |

| By End-User Segment | Personal Use Commercial Fleets Government Agencies Ride-Sharing Services |

| By Charging Infrastructure Type | Home Charging Stations Public Charging Stations Fast Charging Stations Workplace Charging |

| By Distribution Channel | Authorized Dealerships Direct Sales Online Sales Platforms Regional Distributors |

| By Government Support Mechanism | Tax Exemptions and Incentives Subsidies and Rebates Free Parking and Road Privileges R&D Grants and Support Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Manufacturers | 45 | Product Managers, R&D Directors |

| Charging Infrastructure Providers | 40 | Operations Managers, Business Development Executives |

| Government Regulatory Bodies | 50 | Policy Makers, Regulatory Affairs Specialists |

| Automotive Component Suppliers | 45 | Supply Chain Managers, Sales Directors |

| Electric Vehicle Users | 50 | End Users, Fleet Managers |

The Bahrain Electric Powertrain Market is valued at approximately USD 1.2 billion, reflecting a growing demand for electric vehicles driven by government initiatives, consumer awareness of sustainability, and advancements in battery technology.