Region:Middle East

Author(s):Dev

Product Code:KRAB8795

Pages:80

Published On:October 2025

Market.png)

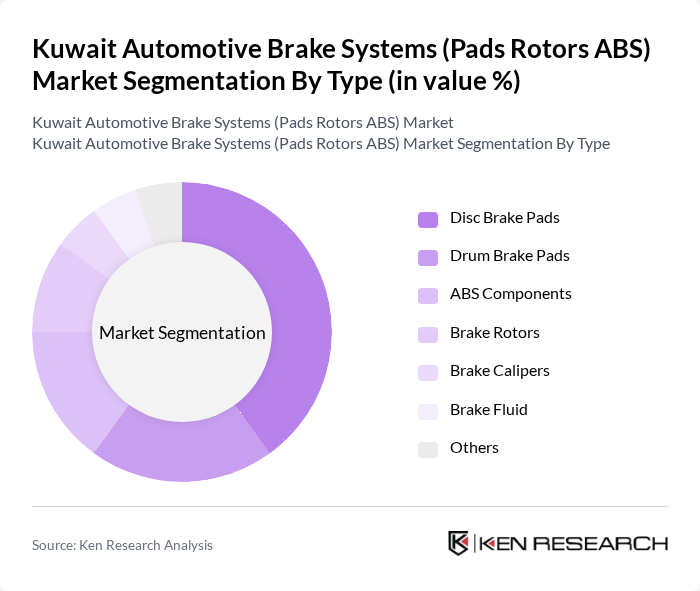

By Type:The market is segmented into various types of brake systems, including Disc Brake Pads, Drum Brake Pads, ABS Components, Brake Rotors, Brake Calipers, Brake Fluid, and Others. Among these, Disc Brake Pads are the most widely used due to their superior performance and efficiency in modern vehicles. The increasing adoption of disc brakes in both passenger and commercial vehicles is a significant factor driving this segment's growth.

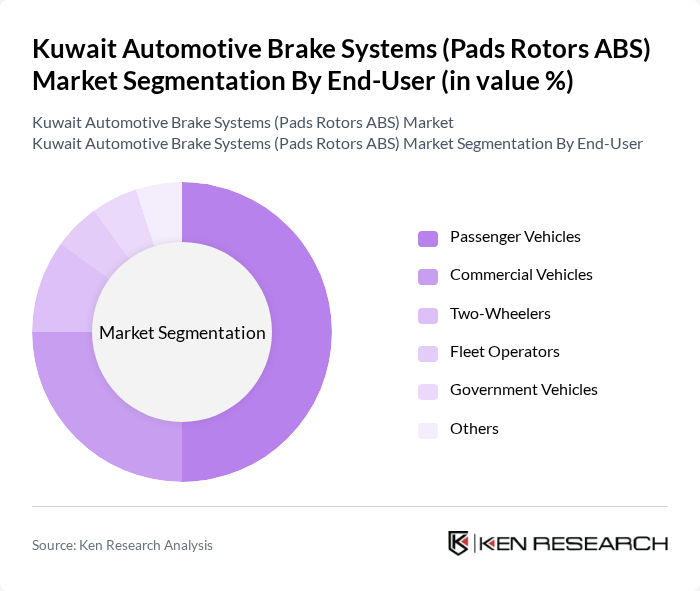

By End-User:The end-user segmentation includes Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Fleet Operators, Government Vehicles, and Others. The Passenger Vehicles segment dominates the market due to the high volume of personal vehicle ownership in Kuwait. The increasing trend of vehicle ownership and the demand for enhanced safety features in personal vehicles are key drivers for this segment.

The Kuwait Automotive Brake Systems (Pads Rotors ABS) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Automotive, Al-Mansour Automotive, Gulf Automotive, Al-Sayer Group, Al-Jazeera Automotive, Al-Muhalab Group, Al-Mazaya Holding, Al-Khaldiya Automotive, Al-Hamra Group, Al-Qabas Automotive, Al-Muhaidib Group, Al-Sabhan Group, Al-Mutawa Group, Al-Bahar Group, Al-Mansour Al-Mohammed Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive brake systems market in Kuwait appears promising, driven by technological advancements and regulatory changes. As manufacturers increasingly adopt smart technologies and sustainable materials, the market is expected to evolve significantly. Additionally, the rise of electric vehicles will necessitate innovative braking solutions, further enhancing market dynamics. The focus on lightweight components will also play a crucial role in improving vehicle efficiency and performance, shaping the industry's trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Disc Brake Pads Drum Brake Pads ABS Components Brake Rotors Brake Calipers Brake Fluid Others |

| By End-User | Passenger Vehicles Commercial Vehicles Two-Wheelers Fleet Operators Government Vehicles Others |

| By Sales Channel | OEMs Aftermarket Online Retail Physical Retail Stores Distributors Others |

| By Distribution Mode | Direct Sales Indirect Sales E-commerce Platforms Wholesale Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Application | Personal Use Commercial Use Industrial Use Others |

| By Component | Mechanical Components Electronic Components Hydraulic Components Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 100 | Product Development Managers, Quality Assurance Engineers |

| Aftermarket Service Providers | 80 | Service Managers, Parts Distributors |

| Automotive Retailers | 70 | Sales Managers, Inventory Control Specialists |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Automotive Technology Experts | 60 | Consultants, Industry Analysts |

The Kuwait Automotive Brake Systems market is valued at approximately USD 250 million, reflecting a significant growth driven by increased vehicle production, demand for safety features, and technological advancements in braking systems.