Region:Middle East

Author(s):Rebecca

Product Code:KRAD4904

Pages:100

Published On:December 2025

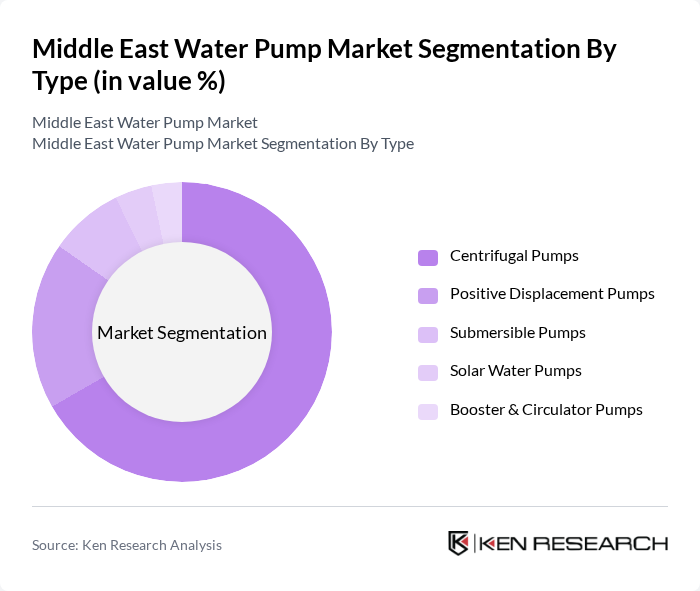

By Type:The market is segmented into various types of pumps, including centrifugal pumps, positive displacement pumps, submersible pumps, solar water pumps, and booster & circulator pumps. Each type serves specific applications and industries, contributing to the overall market dynamics. Centrifugal pumps lead the market due to their efficiency in handling large volumes of water and industrial fluids, with widespread use in desalination plants, municipal water supply, and oil & gas operations.

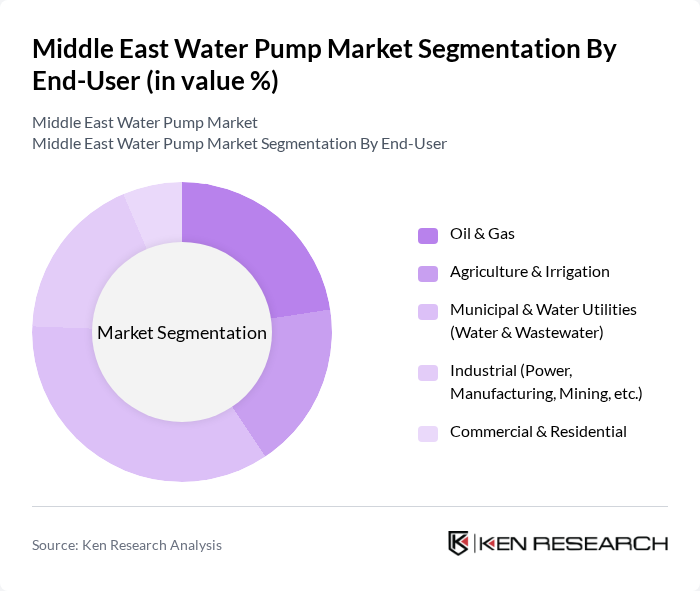

By End-User:The end-user segmentation includes agriculture & irrigation, municipal & water utilities, oil & gas, industrial applications, and commercial & residential sectors. Each end-user category has distinct requirements and influences the demand for various types of water pumps. The oil and gas sector currently leads the market with approximately 22.6% revenue share, driven by the region's vast hydrocarbon reserves and critical pumping requirements in extraction, refining, and transportation processes.

The Middle East Water Pump Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grundfos Holding A/S, KSB SE & Co. KGaA, Xylem Inc., Pentair plc, Ebara Corporation, Flowserve Corporation, Sulzer Ltd., Wilo SE, Franklin Electric Co., Inc., Kirloskar Brothers Limited, The Gorman-Rupp Company, ANDRITZ AG, Torishima Pump Mfg. Co., Ltd., Saudi Pump Factory Company, Sulzer Saudi Pump Company Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East water pump market is poised for transformative growth, driven by technological advancements and increasing environmental awareness. The integration of smart technologies, such as IoT and AI, is expected to enhance operational efficiency and water management practices. Additionally, the push for renewable energy sources will likely lead to the development of solar-powered pumps, aligning with sustainability goals. As urbanization continues, the demand for customized and efficient pumping solutions will further shape the market landscape, fostering innovation and investment.

| Segment | Sub-Segments |

|---|---|

| By Type | Centrifugal Pumps Positive Displacement Pumps Submersible Pumps Solar Water Pumps Booster & Circulator Pumps |

| By End-User | Agriculture & Irrigation Municipal & Water Utilities (Water & Wastewater) Oil & Gas Industrial (Power, Manufacturing, Mining, etc.) Commercial & Residential |

| By Application | Agricultural Irrigation Municipal Water Supply & Distribution Wastewater & Sewage Handling Desalination & Brackish Water Treatment HVAC, Fire Protection & Building Services |

| By Material | Stainless Steel Cast Iron Engineered Plastics & Composites Bronze & Special Alloys Others |

| By Power Source | Grid-Connected Electric Diesel & Other Fossil Fuel Driven Solar PV Powered Hybrid (Solar-Diesel / Solar-Grid) Others |

| By Distribution Channel | Direct Sales to Projects / EPCs Authorized Distributors & Dealers OEM & System Integrator Sales Online / E-Commerce Platforms Retail & Trade Counters |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman & Bahrain Turkey Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Water Pump Usage | 140 | Farm Managers, Irrigation Specialists |

| Municipal Water Supply Systems | 100 | City Water Managers, Infrastructure Planners |

| Industrial Water Pump Applications | 80 | Plant Operations Managers, Facility Engineers |

| Residential Water Pump Installations | 70 | Homeowners, Plumbing Contractors |

| Water Pump Distribution Channels | 90 | Distributors, Retail Managers |

The Middle East Water Pump Market is valued at approximately USD 1.15 billion, driven by increasing demand for water supply and irrigation solutions, rapid urbanization, and infrastructure development across the region.