Region:Africa

Author(s):Shubham

Product Code:KRAB4416

Pages:95

Published On:October 2025

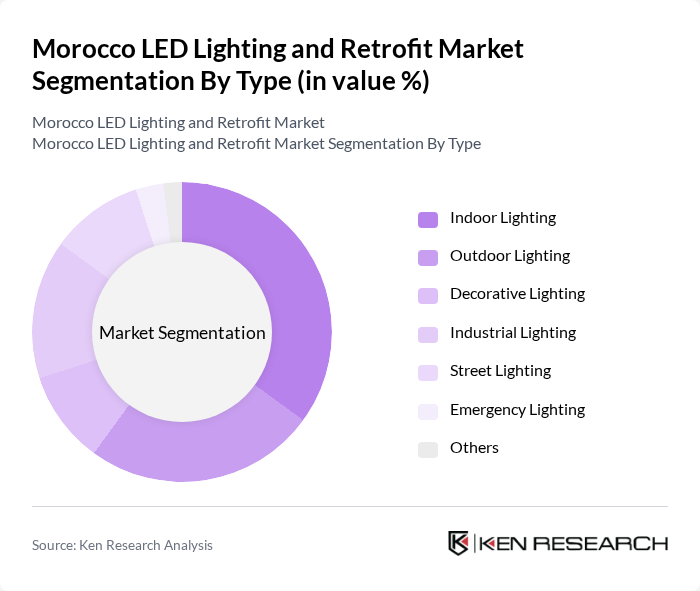

By Type:The market can be segmented into various types of lighting solutions, including Indoor Lighting, Outdoor Lighting, Decorative Lighting, Industrial Lighting, Street Lighting, Emergency Lighting, and Others. Each of these segments caters to specific consumer needs and preferences, with Indoor and Outdoor Lighting being the most prominent due to their widespread application in residential and commercial settings.

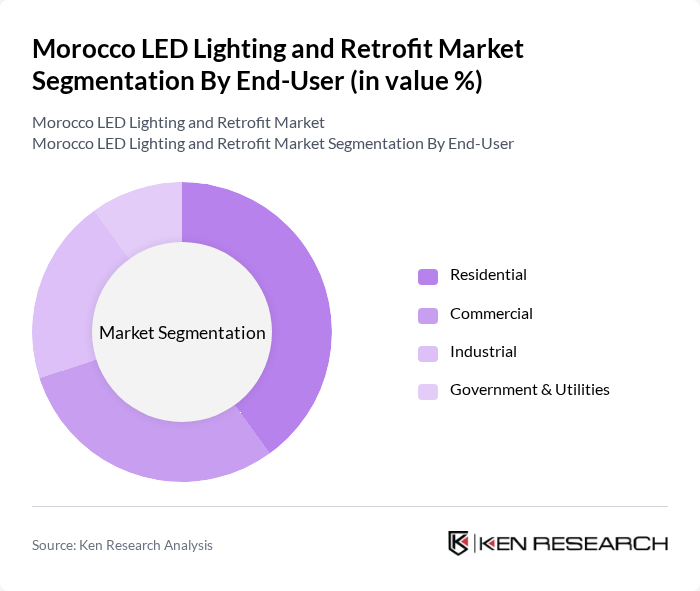

By End-User:The market is further segmented by end-users, which include Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is particularly significant, driven by the growing trend of energy-efficient home solutions and the increasing awareness of sustainability among consumers.

The Morocco LED Lighting and Retrofit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Lighting, Osram Licht AG, Cree, Inc., General Electric Company, Signify N.V., Acuity Brands, Inc., Eaton Corporation, Zumtobel Group AG, Hubbell Lighting, Inc., Panasonic Corporation, Toshiba Lighting, Samsung Electronics, LG Electronics, Dialight plc, FSL Lighting contribute to innovation, geographic expansion, and service delivery in this space.

The future of the LED lighting market in Morocco appears promising, driven by increasing urbanization and a growing emphasis on sustainability. As the government continues to implement energy efficiency standards and incentives, the adoption of LED technology is expected to rise significantly. Additionally, the integration of smart lighting solutions will likely enhance user engagement and operational efficiency. With ongoing investments in renewable energy and infrastructure, the market is poised for substantial growth, aligning with global trends towards eco-friendly solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Indoor Lighting Outdoor Lighting Decorative Lighting Industrial Lighting Street Lighting Emergency Lighting Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Retail Spaces Offices Public Spaces Hospitality Healthcare Facilities Educational Institutions Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Wholesalers Retail Stores |

| By Price Range | Low-End Mid-Range High-End |

| By Component | LED Chips Drivers Heat Sinks Lenses Fixtures |

| By Policy Support | Subsidies Tax Exemptions Grants Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential LED Adoption | 150 | Homeowners, Property Managers |

| Commercial Lighting Retrofit | 100 | Facility Managers, Business Owners |

| Industrial Energy Efficiency Projects | 80 | Plant Managers, Energy Auditors |

| Government Energy Initiatives | 60 | Policy Makers, Energy Consultants |

| LED Manufacturer Insights | 70 | Product Development Managers, Sales Directors |

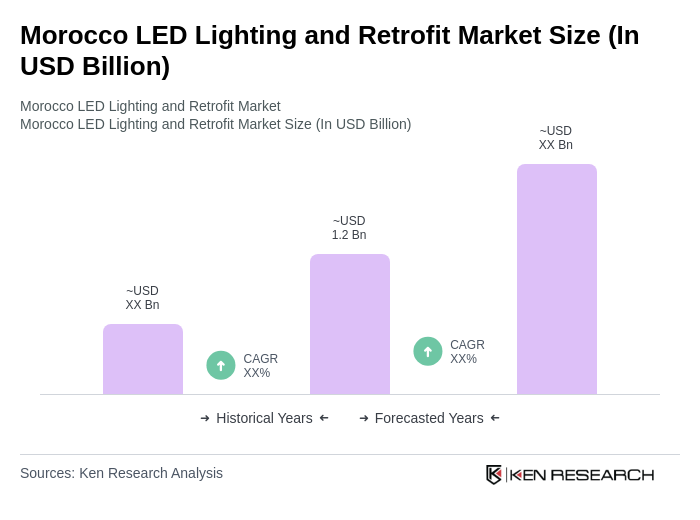

The Morocco LED Lighting and Retrofit Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increased energy efficiency awareness and government initiatives promoting sustainable lighting solutions.