Region:Middle East

Author(s):Shubham

Product Code:KRAD0849

Pages:94

Published On:November 2025

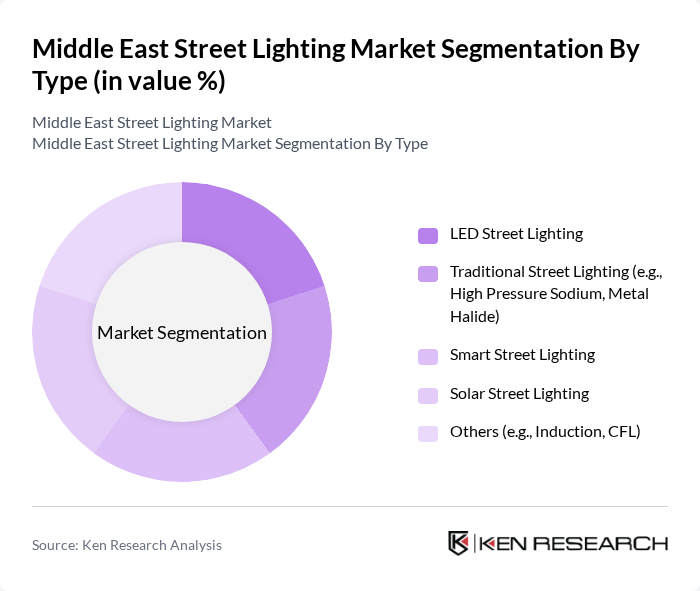

By Type:The market is segmented into various types, including LED, Traditional, Smart, Solar, and Others. Among these, LED street lighting is the most dominant segment due to its energy efficiency, longer lifespan, and decreasing costs. The growing awareness of environmental sustainability and government incentives for energy-efficient solutions have further propelled the adoption of LED technology. Traditional street lighting, while still prevalent, is gradually being replaced by more advanced options. Smart street lighting is gaining traction as cities look to integrate IoT technologies for better management and efficiency.

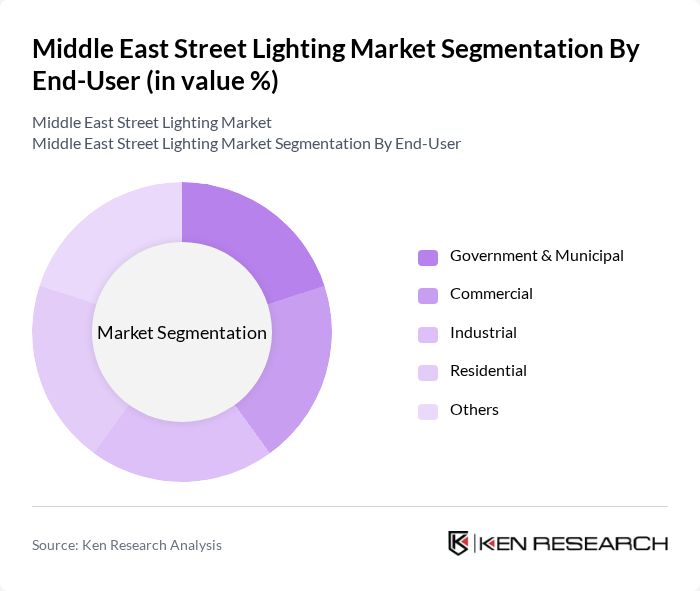

By End-User:The market is segmented by end-users, including Government & Municipal, Commercial, Industrial, Residential, and Others. The Government & Municipal segment holds the largest share, driven by public sector investments in infrastructure and urban development. Municipalities are increasingly adopting energy-efficient lighting solutions to enhance public safety and reduce operational costs. The Commercial segment is also significant, as businesses seek to improve their energy efficiency and reduce lighting expenses. The Residential segment is growing as consumers become more aware of energy-saving technologies.

The Middle East Street Lighting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify (Philips Lighting), Schréder, Zumtobel Group, Thorn Lighting, Ams-OSRAM AG, Acuity Brands Inc., Hubbell Inc., Cooper Lighting Solutions (Eaton), Cree Lighting, Itron Inc., Al Nasser Lighting, HEBA Lighting, Zumtobel Group AG ADR, SolarOne Solutions, Streetlight.Vision contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East street lighting market is poised for significant transformation, driven by technological advancements and sustainability initiatives. As urban areas expand, the demand for smart lighting solutions will increase, with municipalities focusing on integrating IoT technologies for enhanced efficiency. Furthermore, the emphasis on renewable energy sources will likely lead to a rise in solar-powered street lighting systems, aligning with global sustainability goals and reducing reliance on traditional energy sources.

| Segment | Sub-Segments |

|---|---|

| By Type (LED, Traditional, Smart, Solar, Others) | LED Street Lighting Traditional Street Lighting (e.g., High Pressure Sodium, Metal Halide) Smart Street Lighting Solar Street Lighting Others (e.g., Induction, CFL) |

| By End-User (Government & Municipal, Commercial, Industrial, Residential, Others) | Government & Municipal Commercial Industrial Residential Others |

| By Region (GCC, Levant, North Africa, Others) | Gulf Cooperation Council (GCC) Levant North Africa Others |

| By Installation (New Installation, Retrofit) | New Installation Retrofit |

| By Application (Highways & Roadways, Public Places, Industrial Parks, Residential Streets, Others) | Highways & Roadways Public Places (e.g., Parks, Stadiums) Industrial Parks Residential Streets Others |

| By Distribution Channel (Direct Sales, Distributors/Wholesalers, E-commerce) | Direct Sales Distributors/Wholesalers E-commerce |

| By Technology (Standalone, Networked/Connected) | Standalone Lighting Systems Networked/Connected Lighting Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Street Lighting Projects | 100 | City Planners, Urban Development Officials |

| Lighting Technology Suppliers | 60 | Product Managers, Sales Directors |

| Contractors for Street Lighting Installation | 50 | Project Managers, Operations Supervisors |

| Energy Efficiency Consultants | 40 | Energy Auditors, Sustainability Experts |

| Government Policy Makers | 40 | Regulatory Affairs Managers, Policy Analysts |

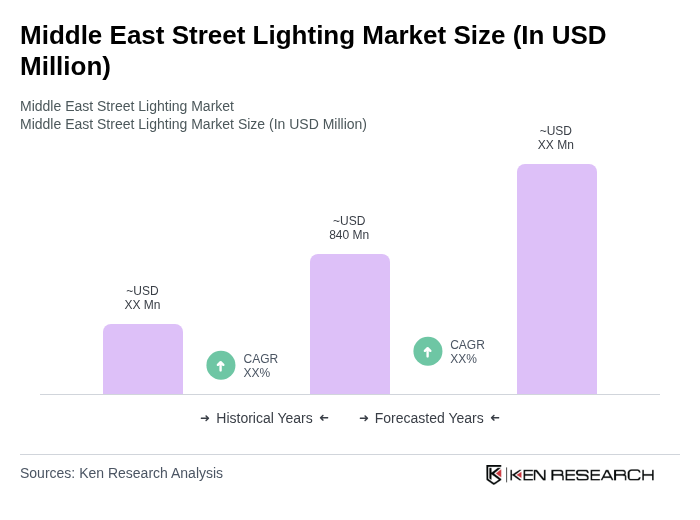

The Middle East Street Lighting Market is valued at approximately USD 840 million, driven by urbanization, government initiatives for smart cities, and the adoption of energy-efficient lighting solutions, particularly LED and solar technologies.