Region:Europe

Author(s):Dev

Product Code:KRAB3055

Pages:89

Published On:October 2025

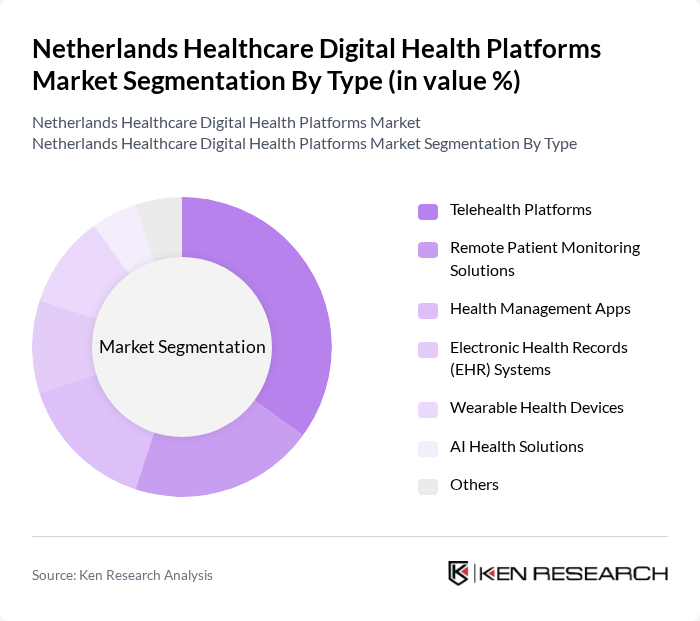

By Type:The market is segmented into various types, including Telehealth Platforms, Remote Patient Monitoring Solutions, Health Management Apps, Electronic Health Records (EHR) Systems, Wearable Health Devices, AI Health Solutions, and Others. Among these, Telehealth Platforms have emerged as the leading sub-segment due to the increasing demand for remote consultations and the convenience they offer to patients. The COVID-19 pandemic significantly accelerated the adoption of telehealth services, making them a preferred choice for many individuals seeking healthcare.

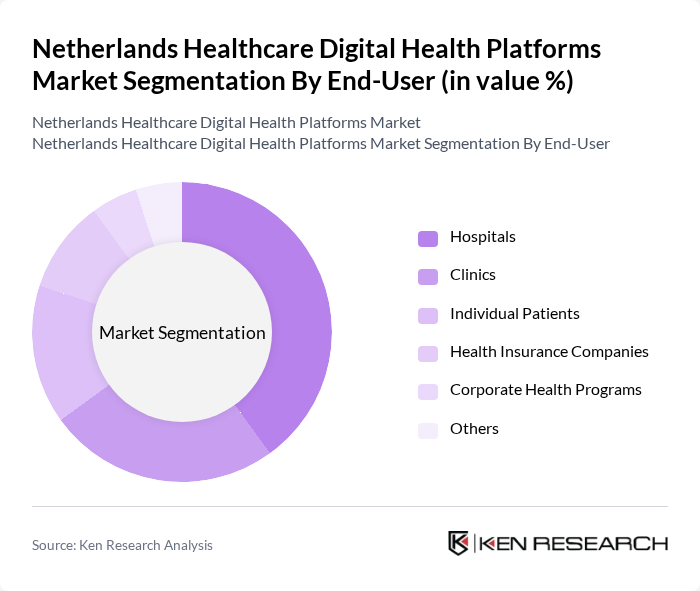

By End-User:The end-user segmentation includes Hospitals, Clinics, Individual Patients, Health Insurance Companies, Corporate Health Programs, and Others. Hospitals are the dominant end-user segment, driven by their need for efficient patient management systems and the integration of digital health solutions into their operations. The increasing focus on improving patient outcomes and operational efficiency has led hospitals to invest significantly in digital health platforms.

The Netherlands Healthcare Digital Health Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Siemens Healthineers, Cerner Corporation, Allscripts Healthcare Solutions, Medtronic, IBM Watson Health, GE Healthcare, Epic Systems Corporation, Teladoc Health, Health Catalyst, Dignity Health, Zocdoc, Babylon Health, Doctolib, MyTomorrows contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands healthcare digital health platforms market appears promising, driven by technological advancements and a shift towards value-based care. As healthcare providers increasingly adopt AI-driven solutions, patient engagement and personalized care will improve significantly. Furthermore, the expansion of remote patient monitoring and telehealth services is expected to enhance healthcare accessibility, particularly in rural areas. The focus on mental health solutions will also gain traction, addressing the growing demand for comprehensive healthcare services in the Netherlands.

| Segment | Sub-Segments |

|---|---|

| By Type | Telehealth Platforms Remote Patient Monitoring Solutions Health Management Apps Electronic Health Records (EHR) Systems Wearable Health Devices AI Health Solutions Others |

| By End-User | Hospitals Clinics Individual Patients Health Insurance Companies Corporate Health Programs Others |

| By Application | Chronic Disease Management Mental Health Services Preventive Healthcare Emergency Care Rehabilitation Services Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Healthcare Providers Distributors Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium One-Time Purchase Others |

| By Customer Segment | B2B B2C Government Non-Profit Organizations Others |

| By Region | North Netherlands South Netherlands East Netherlands West Netherlands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Adoption in Primary Care | 100 | General Practitioners, Clinic Managers |

| Electronic Health Records Implementation | 80 | IT Directors, Health Information Managers |

| Wearable Health Technology Usage | 70 | Healthcare Providers, Patient Engagement Specialists |

| Mobile Health App Integration | 60 | App Developers, Digital Health Strategists |

| Remote Patient Monitoring Solutions | 90 | Nurse Practitioners, Telehealth Coordinators |

The Netherlands Healthcare Digital Health Platforms Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by the adoption of telehealth services, advancements in healthcare technology, and a focus on patient-centered care.