Region:Europe

Author(s):Dev

Product Code:KRAB3015

Pages:86

Published On:October 2025

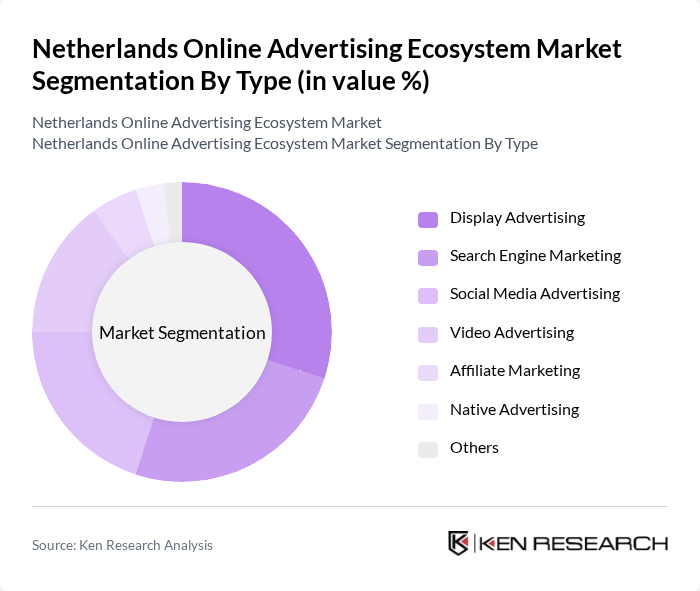

By Type:The online advertising ecosystem in the Netherlands can be segmented into various types, including Display Advertising, Search Engine Marketing, Social Media Advertising, Video Advertising, Affiliate Marketing, Native Advertising, and Others. Among these, Display Advertising and Search Engine Marketing are particularly prominent due to their effectiveness in reaching targeted audiences and driving conversions.

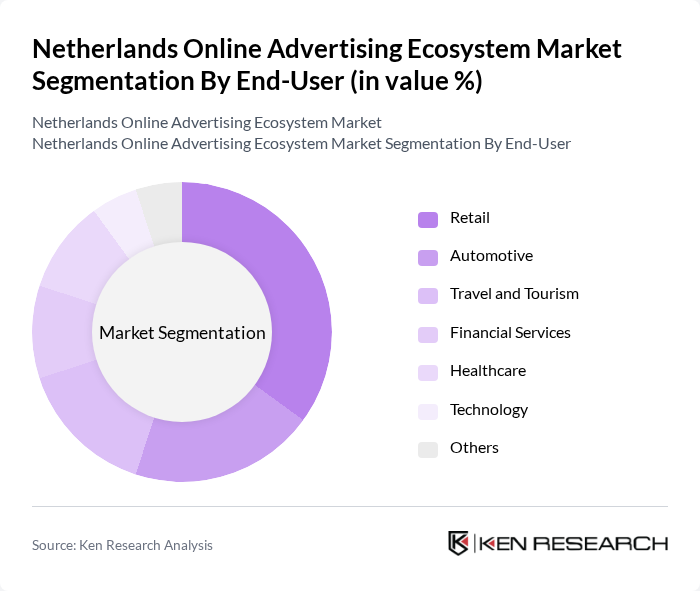

By End-User:The end-user segmentation of the online advertising ecosystem includes Retail, Automotive, Travel and Tourism, Financial Services, Healthcare, Technology, and Others. The Retail sector is the most significant contributor, driven by the increasing shift towards online shopping and the need for effective digital marketing strategies to attract consumers.

The Netherlands Online Advertising Ecosystem Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google Netherlands, Facebook Netherlands, Adform A/S, Sanoma Media Netherlands, RTL Nederland, Teads, Criteo, MediaMonks, Dentsu Aegis Network, GroupM, IPG Mediabrands, Publicis Groupe, Havas Media, Adyen N.V., Outbrain contribute to innovation, geographic expansion, and service delivery in this space.

The Netherlands online advertising ecosystem is poised for significant evolution, driven by technological advancements and changing consumer preferences. As brands increasingly adopt data-driven strategies, the demand for personalized advertising will intensify. Additionally, the integration of innovative technologies such as artificial intelligence and augmented reality will reshape advertising formats, enhancing user engagement. The focus on sustainability will also influence advertising practices, prompting brands to adopt eco-friendly approaches that resonate with environmentally conscious consumers, thereby fostering brand loyalty and trust.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Video Advertising Affiliate Marketing Native Advertising Others |

| By End-User | Retail Automotive Travel and Tourism Financial Services Healthcare Technology Others |

| By Platform | Mobile Platforms Desktop Platforms Social Media Platforms Video Streaming Platforms Others |

| By Advertising Format | Banner Ads Sponsored Content Pop-up Ads Interstitial Ads Others |

| By Campaign Type | Brand Awareness Campaigns Lead Generation Campaigns Conversion Campaigns Retargeting Campaigns Others |

| By Budget Size | Small Budget Campaigns Medium Budget Campaigns Large Budget Campaigns Others |

| By Geographic Focus | National Campaigns Regional Campaigns Local Campaigns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Marketing Agencies | 100 | Agency Owners, Digital Strategists |

| Brand Managers in Retail | 80 | Marketing Directors, Brand Strategists |

| Media Buyers in Technology Sector | 70 | Media Planners, Advertising Executives |

| Consumer Insights from E-commerce | 90 | Market Researchers, Customer Experience Managers |

| Advertising Effectiveness Analysts | 60 | Data Analysts, Performance Marketing Managers |

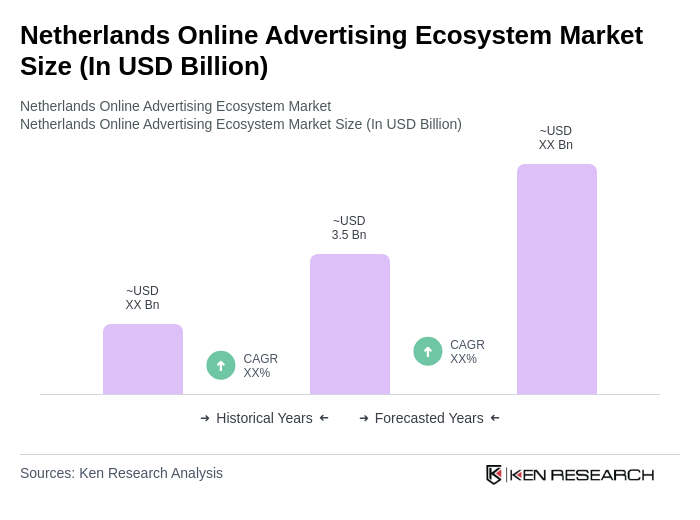

The Netherlands Online Advertising Ecosystem Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by digitalization, e-commerce expansion, and targeted advertising strategies over the past five years.