Region:Africa

Author(s):Geetanshi

Product Code:KRAB5182

Pages:87

Published On:October 2025

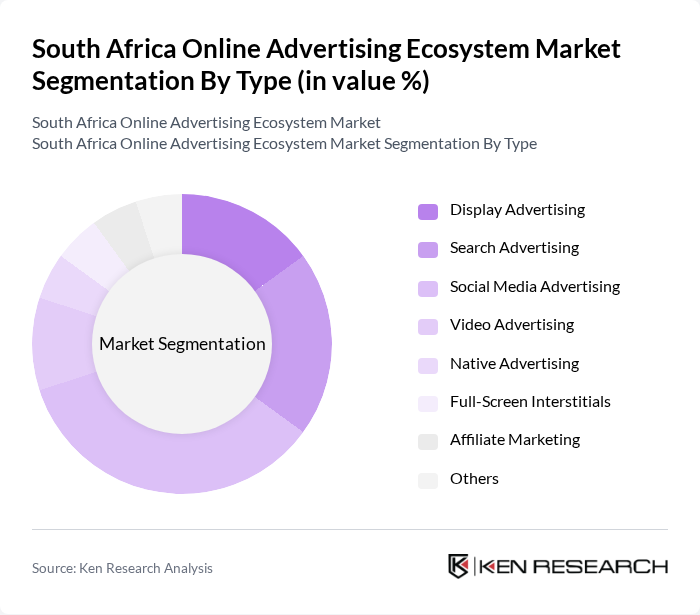

By Type:The online advertising ecosystem in South Africa is segmented into Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Native Advertising, Full-Screen Interstitials, Affiliate Marketing, and Others. Social Media Advertising remains the dominant segment, driven by the widespread use of platforms such as Facebook, Instagram, and X (formerly Twitter), which enable businesses to target specific demographics with high precision. The surge in immersive ad formats, including shoppable content and live-streamed promotions, has further increased user engagement, making social media advertising particularly attractive for brands seeking to maximise reach and return on investment .

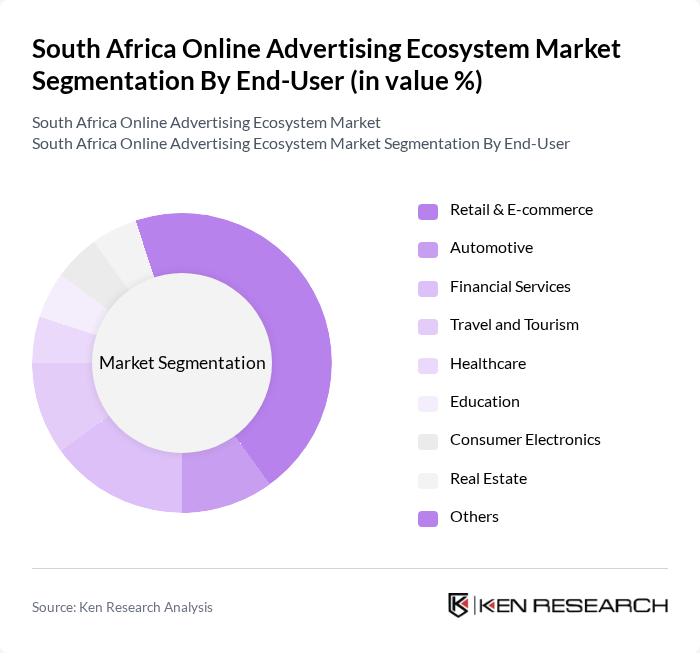

By End-User:The end-user segmentation of the online advertising ecosystem includes Retail & E-commerce, Automotive, Financial Services, Travel and Tourism, Healthcare, Education, Consumer Electronics, Real Estate, and Others. The Retail & E-commerce sector leads the market, propelled by the rapid expansion of online shopping and the increasing number of consumers engaging with digital platforms for purchasing. This trend has prompted retailers to invest heavily in targeted online advertising, leveraging programmatic and personalised campaigns to capture consumer attention and drive sales .

The South Africa Online Advertising Ecosystem Market is characterized by a dynamic mix of regional and international players. Leading participants such as Naspers Limited, Media24, Google South Africa, Meta Platforms South Africa (Facebook & Instagram), Amazon Advertising South Africa, AdColony South Africa, Ad Dynamo, The Digital Media Collective, The SpaceStation, Primedia Group, IOL Media, Caxton and CTP Publishers and Printers, 24.com, Bizcommunity, The Media Shop, Wunderman Thompson South Africa, Ogilvy South Africa, Dentsu South Africa, Publicis Groupe Africa, TBWA\South Africa, Havas South Africa, Takealot.com, Superbalist, Makro South Africa, X (formerly Twitter) South Africa, WPP South Africa, iProspect South Africa contribute to innovation, geographic expansion, and service delivery in this space.

The South African online advertising ecosystem is poised for dynamic growth, driven by technological advancements and evolving consumer behaviors. As digital platforms continue to innovate, advertisers will increasingly adopt programmatic buying and AI-driven analytics to enhance targeting and efficiency. Additionally, the integration of augmented reality in advertising campaigns is expected to engage consumers more effectively. These trends, coupled with a growing emphasis on sustainability in marketing practices, will shape the future landscape of online advertising in South Africa.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Native Advertising Full-Screen Interstitials Affiliate Marketing Others |

| By End-User | Retail & E-commerce Automotive Financial Services Travel and Tourism Healthcare Education Consumer Electronics Real Estate Others |

| By Platform | Mobile Devices (Smartphones) Desktop Computers Tablets Smart TVs Social Media Platforms Video Streaming Platforms Others |

| By Advertising Format | Text Ads Image Ads Video Ads Interactive Ads (including AR/VR) Shoppable Content Sponsored Content Retargeting Ads Others |

| By Campaign Type | Brand Awareness Campaigns Lead Generation Campaigns Conversion Campaigns Engagement Campaigns Others |

| By Budget Size | Small Budget Campaigns Medium Budget Campaigns Large Budget Campaigns Others |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Social Media Advertising | 80 | Social Media Managers, Digital Marketing Directors |

| Search Engine Marketing | 60 | PPC Specialists, SEO Managers |

| Display Advertising | 50 | Brand Managers, Advertising Executives |

| Content Marketing Strategies | 40 | Content Strategists, Marketing Analysts |

| Influencer Marketing | 40 | Influencer Coordinators, PR Managers |

The South Africa Online Advertising Ecosystem Market is valued at approximately USD 3.1 billion, reflecting significant growth driven by increased internet penetration and the adoption of data-driven digital marketing strategies.