Region:Africa

Author(s):Geetanshi

Product Code:KRAE4081

Pages:95

Published On:December 2025

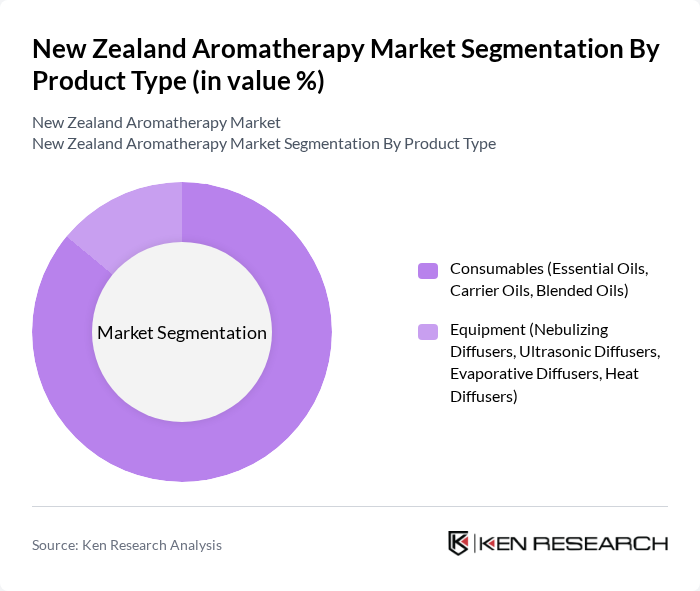

By Product Type:The product type segmentation includes consumables and equipment. Consumables consist of essential oils, carrier oils, and blended oils, while equipment includes various types of diffusers such as nebulizing, ultrasonic, evaporative, and heat diffusers. The consumables segment is currently dominating the market due to the increasing consumer preference for natural and organic products, with consumables expected to account for approximately 86 percent of the market share.

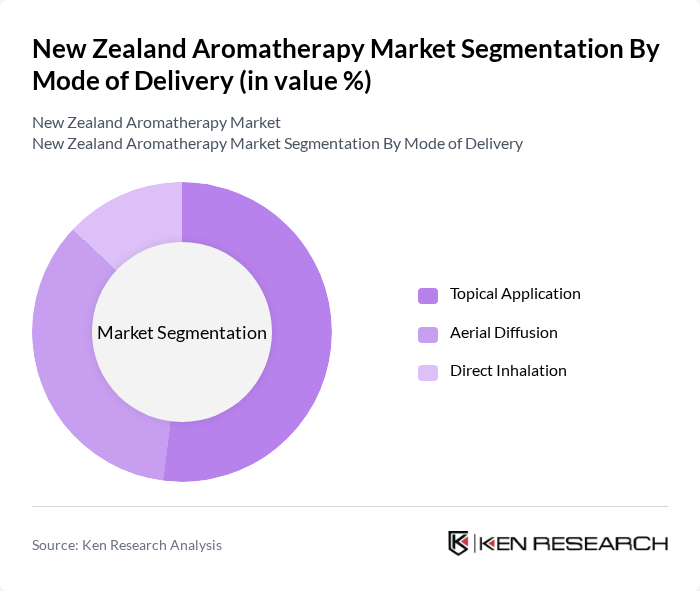

By Mode of Delivery:The mode of delivery segmentation includes topical application, aerial diffusion, and direct inhalation. Topical application is the most popular method among consumers, as it allows for direct skin benefits and is widely used in personal care products, commanding approximately 52 percent market share. Aerial diffusion is also gaining traction in wellness spaces, while direct inhalation is preferred for therapeutic purposes.

The New Zealand Aromatherapy Market is characterized by a dynamic mix of regional and international players. Leading participants such as doTERRA International LLC, Rocky Mountain Oils LLC, Plant Therapy Essential Oils, Edens Garden, EO Products, Sparoom, Biolandes SAS, Frontier Cooperative, Stadler Aktiengesellschaft, Ryohin Keikaku Co. Ltd, Pure Essential Oils, Living Nature, Aroha Oils, The Herb Farm, Essence of New Zealand contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand aromatherapy market is poised for significant growth, driven by increasing consumer interest in holistic health and wellness. As more individuals seek natural remedies, the demand for innovative product formulations and personalized solutions is expected to rise. Additionally, the integration of technology in aromatherapy devices will enhance user experience, while sustainability trends will push brands towards eco-friendly practices. These factors collectively indicate a vibrant future for the aromatherapy sector, with opportunities for expansion and diversification.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Consumables (Essential Oils, Carrier Oils, Blended Oils) Equipment (Nebulizing Diffusers, Ultrasonic Diffusers, Evaporative Diffusers, Heat Diffusers) |

| By Mode of Delivery | Topical Application Aerial Diffusion Direct Inhalation |

| By Application | Relaxation Skin & Hair Care Pain Management Cold & Cough Insomnia Scar Management Other Remedies |

| By End-User | Home Use Spa & Wellness Centers Hospitals & Clinics Yoga & Meditation Centers |

| By Distribution Channel | Direct-to-Consumer (DTC) Business-to-Business (B2B) Online Retail Specialty Stores Supermarkets/Hypermarkets Pharmacies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aromatherapy Product Retailers | 100 | Store Managers, Product Buyers |

| Wellness Centers and Spas | 80 | Wellness Practitioners, Spa Managers |

| Consumers of Aromatherapy Products | 120 | Health-Conscious Individuals, Aromatherapy Users |

| Manufacturers of Essential Oils | 60 | Production Managers, Quality Control Officers |

| Distributors and Wholesalers | 70 | Sales Representatives, Distribution Managers |

The New Zealand Aromatherapy Market is valued at approximately USD 48 million, reflecting a growing consumer interest in natural wellness solutions and holistic health practices, particularly in major cities like Auckland, Wellington, and Christchurch.