Region:Middle East

Author(s):Shubham

Product Code:KRAA8530

Pages:91

Published On:November 2025

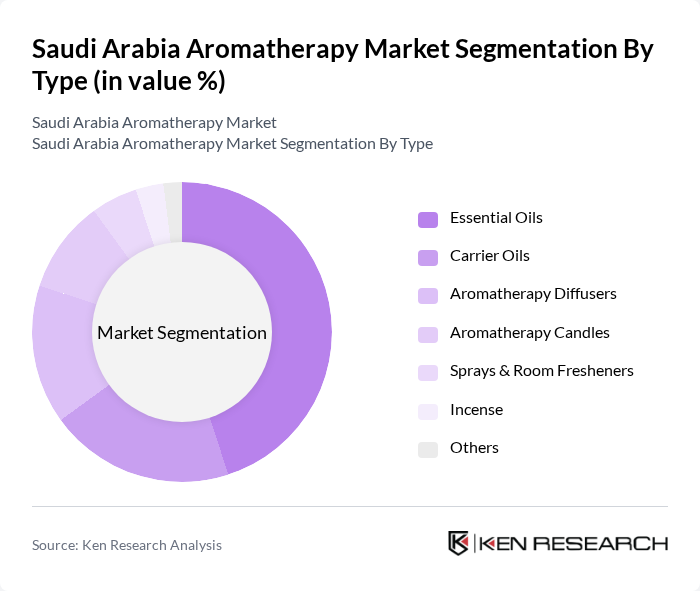

By Type:The aromatherapy market can be segmented into various types, including essential oils, carrier oils, aromatherapy diffusers, aromatherapy candles, sprays & room fresheners, incense, and others. Among these, essential oils are the most dominant segment due to their versatility and wide range of applications in personal care, wellness, and home fragrance. The increasing popularity of natural and organic products has led to a surge in demand for essential oils, which are often perceived as healthier alternatives to synthetic fragrances. The aromatherapy diffusers segment is also experiencing robust growth, supported by rising consumer interest in home wellness and the integration of diffusers into modern living spaces .

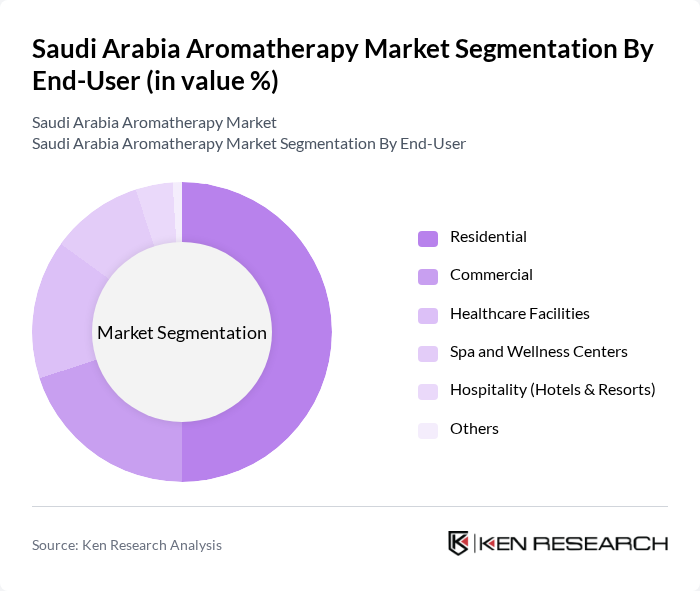

By End-User:The end-user segmentation includes residential, commercial, healthcare facilities, spa and wellness centers, hospitality (hotels & resorts), and others. The residential segment is the largest due to the growing trend of using aromatherapy products for home ambiance and personal wellness. Consumers are increasingly incorporating essential oils and diffusers into their daily routines, driving demand in this segment. The spa and wellness centers segment is also expanding, reflecting the broader adoption of aromatherapy in professional wellness services .

The Saudi Arabia Aromatherapy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Young Living Essential Oils, doTERRA International, Plant Therapy, Edens Garden, Rocky Mountain Oils, Aura Cacia, NOW Foods, Saje Natural Wellness, Tisserand Aromatherapy, Healing Solutions, Al Haramain Perfumes, Saudi Aromatics Company, Givaudan SA, Takasago International Corporation, Firmenich AG, International Flavors & Fragrances Inc., Nature's Truth, ArtNaturals, Plantlife contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Saudi Arabia aromatherapy market appears promising, driven by increasing consumer interest in holistic health practices and natural wellness solutions. As the market evolves, innovations in product formulations and the integration of aromatherapy into corporate wellness programs are expected to gain traction. Additionally, the rise of e-commerce platforms will facilitate broader access to aromatherapy products, enhancing consumer engagement and driving sales growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Essential Oils Carrier Oils Aromatherapy Diffusers Aromatherapy Candles Sprays & Room Fresheners Incense Others |

| By End-User | Residential Commercial Healthcare Facilities Spa and Wellness Centers Hospitality (Hotels & Resorts) Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Convenience Stores Others |

| By Application | Personal Care Home Care Medical Applications Spa Treatments Food & Beverage Flavoring Others |

| By Packaging Type | Bottles Jars Roll-ons Sachets Others |

| By Consumer Demographics | Age Group (18-25, 26-35, 36-50, 51+) Gender Income Level Others |

| By Price Range | Premium Mid-range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aromatherapy Product Retailers | 100 | Store Managers, Product Buyers |

| Wellness Centers and Spas | 70 | Owners, Therapists |

| Consumers of Aromatherapy Products | 120 | Health-Conscious Individuals, Regular Users |

| Manufacturers of Essential Oils | 50 | Production Managers, Quality Control Officers |

| Distributors and Wholesalers | 60 | Sales Managers, Logistics Coordinators |

The Saudi Arabia Aromatherapy Market is valued at approximately USD 115 million, reflecting a growing consumer interest in wellness and natural products, particularly essential oils and aromatherapy items.