Region:Middle East

Author(s):Rebecca

Product Code:KRAD4326

Pages:92

Published On:December 2025

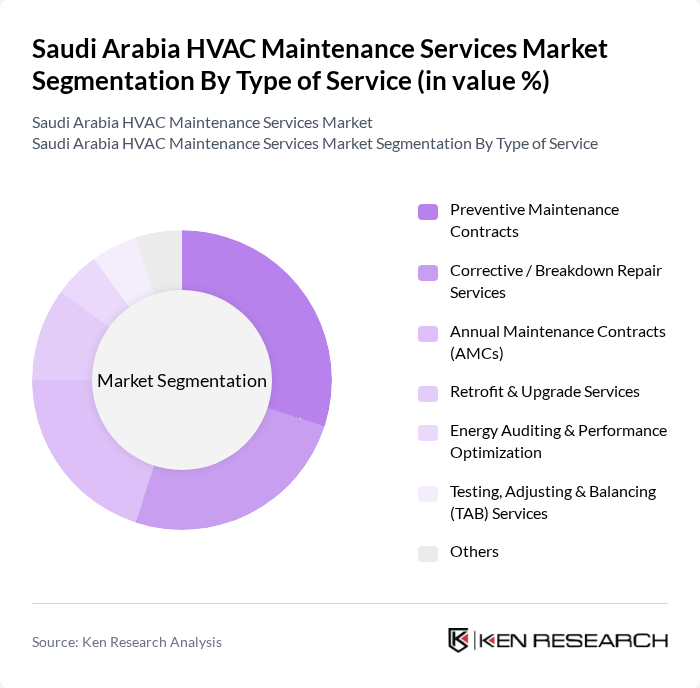

By Type of Service:The HVAC maintenance services market is segmented into various types of services, including preventive maintenance contracts, corrective/breakdown repair services, annual maintenance contracts (AMCs), retrofit & upgrade services, energy auditing & performance optimization, testing, adjusting & balancing (TAB) services, and others. Among these, preventive maintenance contracts are gaining traction due to their cost-effectiveness and ability to prevent system failures.

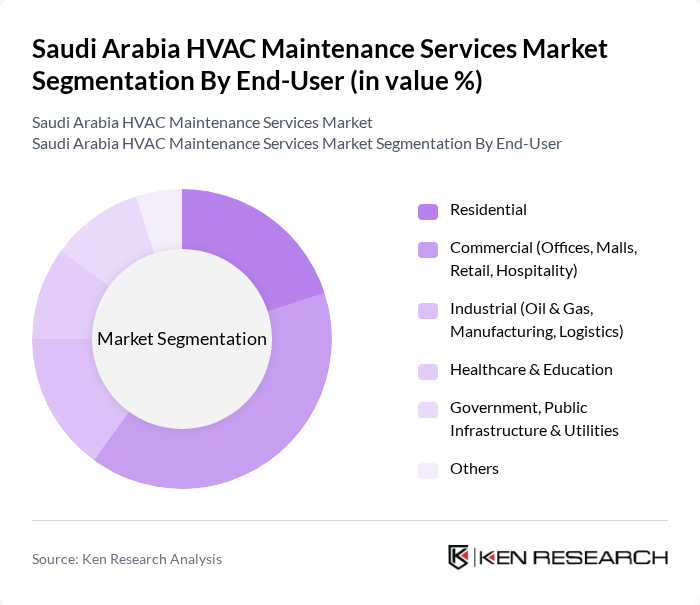

By End-User:The market is segmented by end-user into residential, commercial (offices, malls, retail, hospitality), industrial (oil & gas, manufacturing, logistics), healthcare & education, government, public infrastructure & utilities, and others. The commercial segment is the largest due to the increasing number of shopping malls, hotels, and office buildings, which require regular HVAC maintenance to ensure optimal performance and energy efficiency.

The Saudi Arabia HVAC Maintenance Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zamil Air Conditioners & Home Appliances Co. Ltd. (Zamil Air Conditioners), Saudi Air Conditioning Manufacturing Co. Ltd. (Carrier Saudi Arabia), Johnson Controls Arabia, Daikin Saudi Arabia, Trane Saudi Arabia, LG Electronics Saudi Arabia, Mitsubishi Electric Saudi Ltd., Al Salem Johnson Controls (YORK), Al-Futtaim Engineering & Technologies Saudi Arabia, Al Hassan Ghazi Ibrahim Shaker Co. (Shaker Group), Petro Air Cooling (Industrial & Oil and Gas HVAC Services), Khudairi Group – HVAC Services Division, Honeywell Saudi Arabia, Schneider Electric Saudi Arabia, Siemens Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the HVAC maintenance services market in Saudi Arabia appears promising, driven by technological advancements and a growing emphasis on sustainability. The integration of IoT and AI technologies is expected to enhance service efficiency and predictive maintenance capabilities. Additionally, as the government continues to promote energy efficiency and environmental sustainability, the demand for regular HVAC maintenance will likely increase, creating a robust market landscape for service providers in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type of Service | Preventive Maintenance Contracts Corrective / Breakdown Repair Services Annual Maintenance Contracts (AMCs) Retrofit & Upgrade Services Energy Auditing & Performance Optimization Testing, Adjusting & Balancing (TAB) Services Others |

| By End-User | Residential Commercial (Offices, Malls, Retail, Hospitality) Industrial (Oil & Gas, Manufacturing, Logistics) Healthcare & Education Government, Public Infrastructure & Utilities Others |

| By Region | Central Region (Riyadh & Surrounding) Western Region (Jeddah, Makkah, Madinah) Eastern Region (Dammam, Dhahran, Al Khobar) Southern Region Northern Region |

| By HVAC System Type | Chilled Water & Central Plant Systems VRF/VRV Systems Packaged & Rooftop Units Split & Ducted Units District Cooling-Connected Systems Others |

| By Maintenance Approach | Time-Based Preventive Maintenance Condition-Based Maintenance Predictive / Remote Monitoring-Based Maintenance Run-to-Failure / Reactive Maintenance |

| By Contract Model | Long-Term Comprehensive AMCs Labor-Only AMCs Short-Term / Project-Based Contracts On-Demand / Call-Out Services |

| By Technology Adoption | Conventional Maintenance Practices IoT-Enabled Remote Monitoring & BMS-Integrated Services Energy-Efficient & Green Building-Compliant Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential HVAC Maintenance | 120 | Homeowners, Residential Property Managers |

| Commercial HVAC Services | 110 | Facility Managers, Building Owners |

| Industrial HVAC Maintenance | 75 | Operations Managers, Plant Engineers |

| Energy Efficiency Upgrades | 60 | Energy Managers, Sustainability Managers |

| HVAC Equipment Suppliers | 65 | Sales Managers, Product Managers |

The Saudi Arabia HVAC Maintenance Services Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, infrastructure expansion, and the increasing demand for energy-efficient HVAC systems.