Region:Asia

Author(s):Rebecca

Product Code:KRAD3145

Pages:80

Published On:January 2026

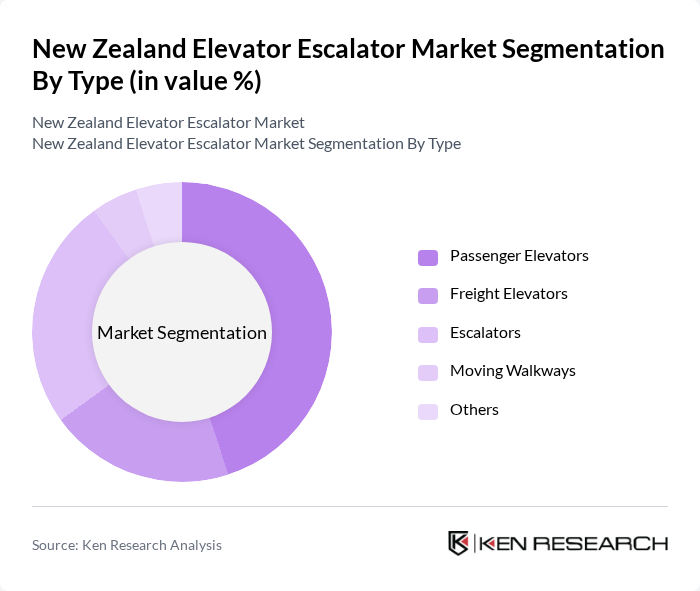

By Type:The market is segmented into various types, including Elevators, Passenger Elevators, Cargo Elevators, Home Elevators, Escalators, and Moving Walkways. Among these, Passenger Elevators dominate the market due to their widespread use in commercial and residential buildings. The increasing number of high-rise buildings and the demand for efficient transportation solutions in urban areas have significantly contributed to the growth of this segment. Escalators and Moving Walkways are also gaining traction, particularly in shopping malls and airports, where high foot traffic necessitates efficient movement.

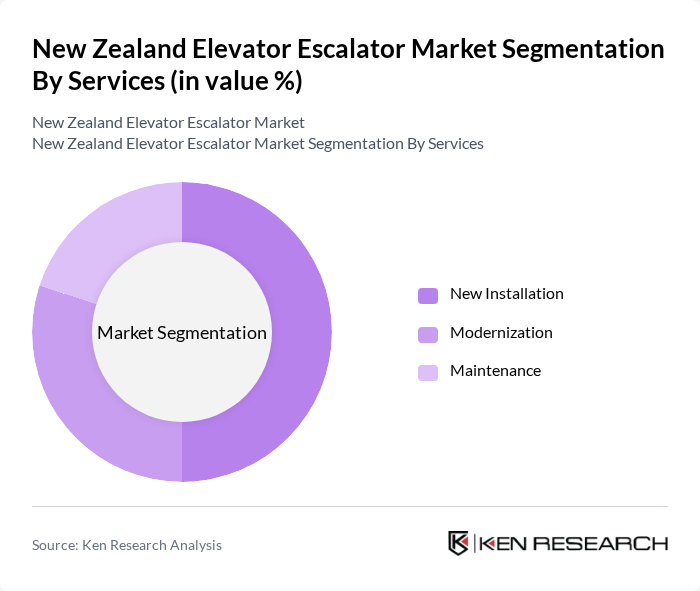

By Services:The services segment includes New Installation, Modernization, and Maintenance. New Installation is the leading service type, driven by the ongoing construction of residential and commercial buildings. The modernization of existing systems is also gaining importance as building owners seek to upgrade to energy-efficient models. Maintenance services are crucial for ensuring the longevity and safety of elevator and escalator systems, contributing to the overall market growth.

The New Zealand Elevator Escalator Market is characterized by a dynamic mix of regional and international players. Leading participants such as Otis Elevator Company, Schindler Group, KONE Corporation, TK Elevator, Mitsubishi Electric Corporation, Fujitec Co., Ltd., Hitachi, Ltd., Johnson Lifts, Aritco Lift AB, Express Elevators, Schmitt + Sohn Aufzüge GmbH, Canny Elevator, Eita Elevator, Stannah Lifts, Thyssenkrupp Access contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand elevator and escalator market is poised for significant growth, driven by urbanization, technological advancements, and a shift towards energy-efficient solutions. As infrastructure projects gain momentum, particularly in urban centers, the demand for modern vertical transportation systems will increase. Additionally, the integration of smart technologies and eco-friendly designs will enhance user experience and operational efficiency, positioning the market for robust expansion in the coming years, despite existing challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Elevators Passenger Elevators Cargo Elevators Home Elevators Escalators Moving Walkways |

| By Services | New Installation Modernization Maintenance |

| By End-User | Residential Commercial Industrial |

| By Elevator Technology | Traction Elevators Machine Room-Less Elevators Hydraulic Elevators |

| By Region | North Island South Island |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Elevators | 45 | Building Managers, Facility Directors |

| Residential Elevator Installations | 40 | Homeowners, Property Developers |

| Escalator Usage in Retail Spaces | 42 | Retail Managers, Operations Supervisors |

| Maintenance Services for Elevators | 41 | Service Technicians, Maintenance Managers |

| Regulatory Compliance in Vertical Transport | 40 | Compliance Officers, Safety Inspectors |

The New Zealand Elevator Escalator Market is valued at approximately USD 110 million, driven by urbanization, increased construction activities, and a demand for efficient vertical transportation solutions in both residential and commercial sectors.