Region:Asia

Author(s):Rebecca

Product Code:KRAD3144

Pages:84

Published On:January 2026

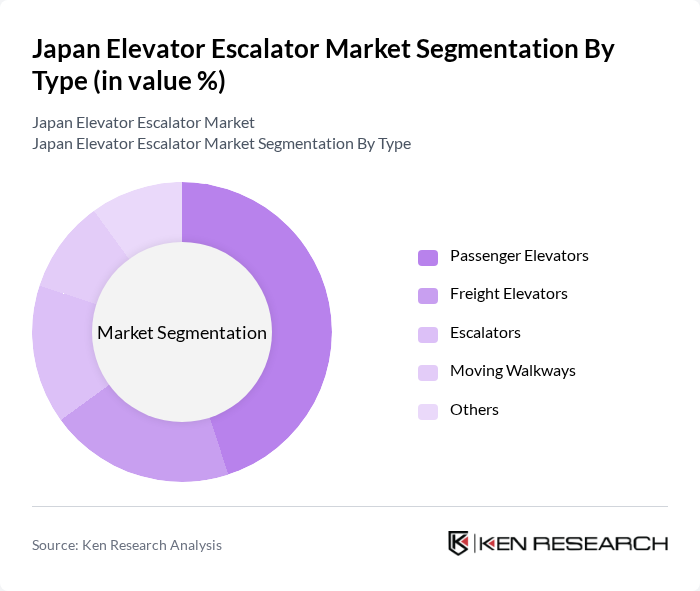

By Type:The market is segmented into various types, including Passenger Elevators, Freight Elevators, Escalators, Moving Walkways, and Others. Among these, Passenger Elevators dominate the market due to their widespread use in residential and commercial buildings. The increasing number of high-rise structures and the need for efficient vertical transportation solutions contribute to the growth of this segment. Escalators also hold a significant share, particularly in shopping malls and public transport stations, where they facilitate the movement of large crowds.

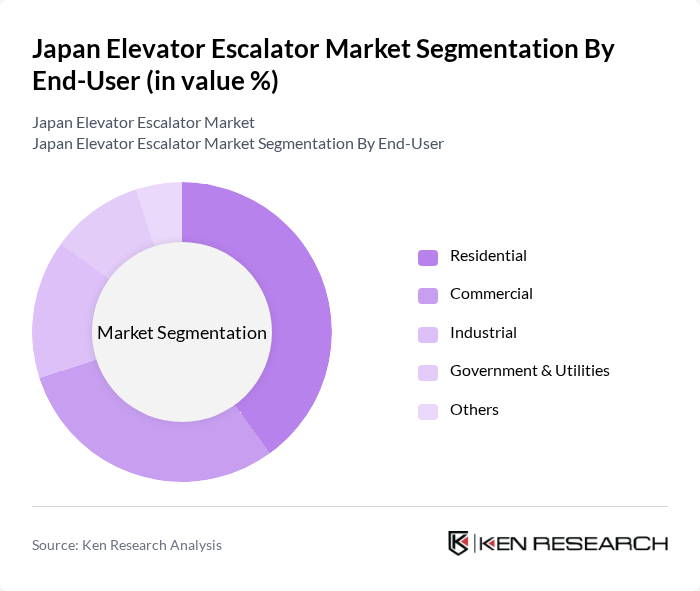

By End-User:The market is categorized into Residential, Commercial, Industrial, Government & Utilities, and Others. The Commercial segment is the leading end-user, driven by the rapid growth of office buildings, shopping malls, and hotels. The increasing focus on enhancing customer experience in commercial spaces has led to a higher demand for advanced elevator and escalator systems. The Residential segment is also significant, as more high-rise apartments are being constructed to accommodate urban populations.

The Japan Elevator Escalator Market is characterized by a dynamic mix of regional and international players. Leading participants such as Otis Elevator Company, Schindler Group, KONE Corporation, Mitsubishi Electric Corporation, Thyssenkrupp AG, Hitachi, Ltd., Fujitec Co., Ltd., Toshiba Elevator and Building Systems Corporation, Hyundai Elevator Co., Ltd., Panasonic Corporation, Johnson Lifts, Sigma Elevator Company, Schmitt + Sohn Aufzüge GmbH, Eita Elevator, SANYO Elevator contribute to innovation, geographic expansion, and service delivery in this space.

The Japan elevator and escalator market is poised for significant transformation driven by urbanization, technological advancements, and demographic shifts. As cities expand and the population ages, the demand for efficient vertical transportation solutions will intensify. Innovations in smart technologies and sustainability will shape future developments, while regulatory compliance will remain a critical factor. Companies that invest in energy-efficient and accessible systems will likely lead the market, ensuring they meet evolving consumer needs and government mandates.

| Segment | Sub-Segments |

|---|---|

| By Type | Passenger Elevators Freight Elevators Escalators Moving Walkways Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Application | High-Rise Buildings Shopping Malls Airports Hospitals Others |

| By Technology | Hydraulic Elevators Traction Elevators Machine Room-Less Elevators Smart Elevators Others |

| By Maintenance Type | Preventive Maintenance Predictive Maintenance Corrective Maintenance Others |

| By Installation Type | New Installations Modernization Others |

| By Service Type | Repair Services Maintenance Services Consulting Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Building Elevators | 120 | Property Managers, Building Owners |

| Commercial Escalator Installations | 90 | Facility Managers, Retail Operations Heads |

| Industrial Elevator Solutions | 60 | Operations Managers, Safety Compliance Officers |

| Maintenance and Service Contracts | 80 | Service Managers, Technical Support Leads |

| Smart Elevator Technologies | 50 | Innovation Managers, Technology Officers |

The Japan Elevator Escalator Market is valued at approximately USD 3.2 billion, driven by urbanization, construction activities, and the demand for advanced mobility solutions in high-rise buildings and commercial spaces.