Region:Asia

Author(s):Rebecca

Product Code:KRAD3139

Pages:83

Published On:January 2026

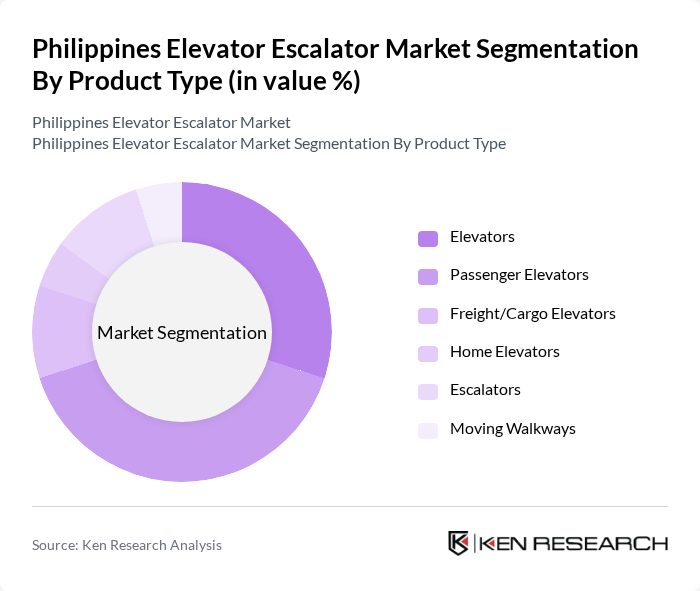

By Product Type:The product type segmentation includes various categories such as elevators, passenger elevators, freight elevators, home elevators, escalators, and moving walkways. Among these, passenger elevators are the most dominant due to the increasing number of high-rise buildings and commercial spaces that require efficient vertical transportation solutions, with machine room-less traction models leading popularity. The demand for escalators is also rising, particularly in shopping malls, public transit stations, and commercial buildings, driven by the need for seamless movement in crowded areas and parallel configurations.

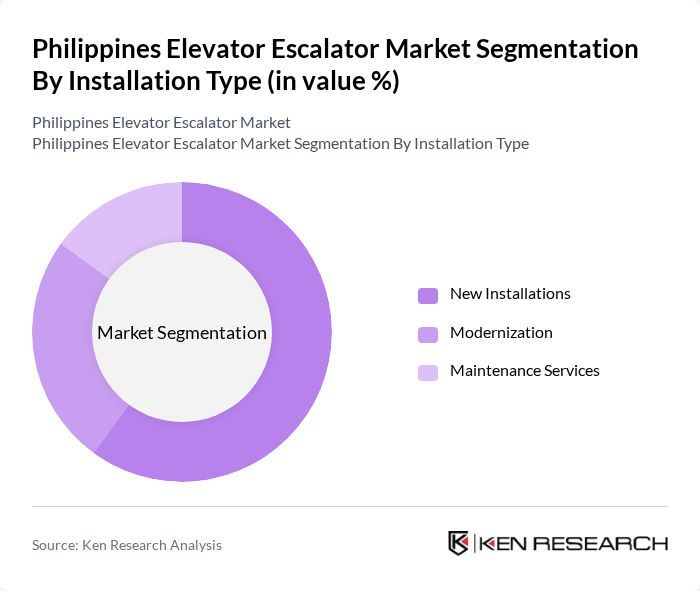

By Installation Type:The installation type segmentation includes new installations, modernization, and maintenance services. New installations dominate the market as the construction of new buildings continues to rise, particularly in urban areas amid surging infrastructure projects and real estate investments. Modernization services are also gaining traction as older buildings seek to upgrade their systems to meet current safety and efficiency standards. Maintenance services are essential for ensuring the longevity and reliability of installed systems.

The Philippines Elevator Escalator Market is characterized by a dynamic mix of regional and international players. Leading participants such as Otis Elevator Company, Schindler Group, KONE Corporation, TK Elevator, Mitsubishi Electric Corporation, Fujitec Co., Ltd., Hitachi, Ltd., Hyundai Elevator Co., Ltd., Toshiba Elevator and Building Systems Corporation, Sigma Elevator Company, Eita Resources Berhad, Schmitt + Sohn Group, Elevator Systems, Inc., Elevator Technologies, Inc., Cibes Lift Group contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines elevator and escalator market is poised for significant growth, driven by urbanization, technological advancements, and government initiatives. As cities expand and infrastructure projects gain momentum, the demand for efficient vertical transportation solutions will increase. The integration of smart technologies and eco-friendly practices will shape the future landscape, enhancing user experience and operational efficiency. Stakeholders must adapt to evolving consumer preferences and regulatory requirements to capitalize on emerging opportunities in this dynamic market.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Elevators Passenger Elevators Freight Elevators Home Elevators Escalators Moving Walkways |

| By Installation Type | New Installations Modernization Maintenance Services |

| By End-User | Residential Commercial Industrial Public Transit & Infrastructure Others |

| By Elevator Machine Type | Hydraulic and Pneumatic Machine Room Traction Machine Room-Less Traction Others |

| By Escalator Type | Parallel Multi Parallel Walkway Crisscross |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Building Developers | 45 | Project Managers, Development Directors |

| Commercial Real Estate Firms | 38 | Property Managers, Leasing Agents |

| Public Infrastructure Projects | 32 | Government Officials, Urban Planners |

| Elevator and Escalator Manufacturers | 28 | Sales Managers, Product Development Engineers |

| Maintenance Service Providers | 22 | Service Managers, Technical Supervisors |

The Philippines Elevator Escalator Market is valued at approximately USD 3.2 billion, driven by urbanization, construction activities, and government infrastructure projects aimed at enhancing vertical transportation solutions in high-rise buildings and commercial complexes.