Region:Global

Author(s):Shubham

Product Code:KRAA0686

Pages:99

Published On:August 2025

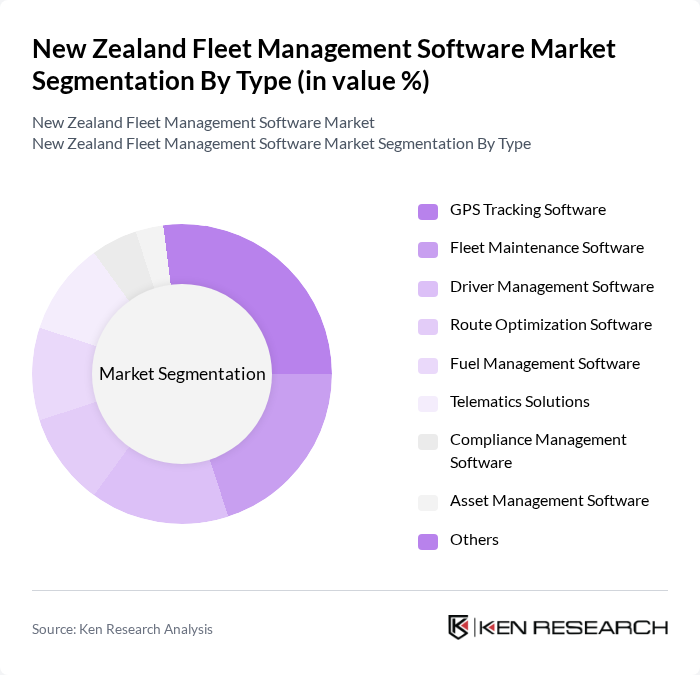

By Type:The market is segmented into various types of fleet management software, including GPS Tracking Software, Fleet Maintenance Software, Driver Management Software, Route Optimization Software, Fuel Management Software, Telematics Solutions, Compliance Management Software, Asset Management Software, and Others. Each of these sub-segments plays a crucial role in enhancing fleet operations and efficiency. GPS Tracking Software is widely adopted for real-time vehicle tracking, while Telematics Solutions and Compliance Management Software are increasingly important due to regulatory and safety requirements .

The GPS Tracking Software segment is currently dominating the market due to its critical role in real-time vehicle tracking and monitoring. Businesses are increasingly recognizing the importance of visibility in fleet operations, which enhances security and efficiency. The growing trend of remote fleet management, integration of telematics, and the need for compliance with safety regulations further drive the adoption of GPS tracking solutions. As a result, this segment is expected to maintain its leadership position in the market .

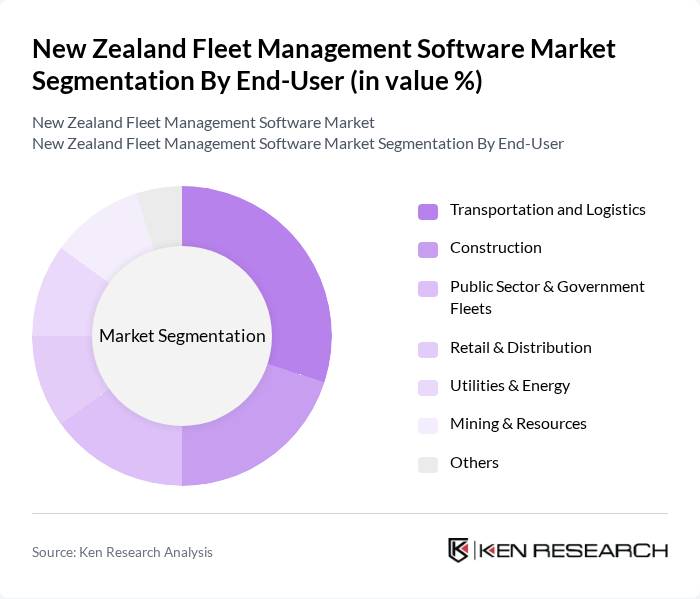

By End-User:The market is segmented by end-user industries, including Transportation and Logistics, Construction, Public Sector & Government Fleets, Retail & Distribution, Utilities & Energy, Mining & Resources, and Others. Each sector has unique requirements and challenges that fleet management software addresses. Transportation and Logistics companies require advanced route planning and asset tracking, while Public Sector fleets focus on compliance and safety. Utilities and Mining sectors emphasize equipment monitoring and maintenance .

The Transportation and Logistics sector is the leading end-user of fleet management software, driven by the need for efficient route planning, cost management, and compliance with regulations. The increasing demand for timely deliveries, the rise of e-commerce, and the need for digital compliance have further intensified the need for advanced fleet management solutions in this sector. As logistics companies seek to optimize their operations, this segment is expected to continue its dominance in the market .

The New Zealand Fleet Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Teletrac Navman, EROAD, MTData, Fleet Complete, Geotab, Trimble, Verizon Connect, Fleetio, TomTom Telematics, Zubie, GpsGate, Navman Wireless, Microlise, Samsara, and Coretex contribute to innovation, geographic expansion, and service delivery in this space .

The future of the New Zealand fleet management software market appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly prioritize sustainability, the demand for software that supports green logistics initiatives is expected to rise. Additionally, the integration of artificial intelligence and machine learning into fleet management solutions will enhance operational efficiency and decision-making processes, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | GPS Tracking Software Fleet Maintenance Software Driver Management Software Route Optimization Software Fuel Management Software Telematics Solutions Compliance Management Software Asset Management Software Others |

| By End-User | Transportation and Logistics Construction Public Sector & Government Fleets Retail & Distribution Utilities & Energy Mining & Resources Others |

| By Deployment Model | On-Premise Cloud-Based Hybrid |

| By Fleet Size | Small Fleets (1-10 vehicles) Medium Fleets (11-50 vehicles) Large Fleets (51+ vehicles) |

| By Geographic Coverage | National Coverage Regional Coverage Local Coverage |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| By Integration Capability | API Integration Third-Party Software Integration Custom Integration |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics and Transportation Fleets | 120 | Fleet Managers, Operations Directors |

| Construction Equipment Management | 60 | Site Managers, Equipment Supervisors |

| Public Sector Fleet Operations | 50 | Government Fleet Coordinators, Procurement Officers |

| Small Business Fleet Management | 40 | Business Owners, Logistics Coordinators |

| Technology Adoption in Fleet Management | 45 | IT Managers, Software Developers |

The New Zealand Fleet Management Software Market is valued at approximately USD 130 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for operational efficiency, cost reduction, and enhanced fleet visibility among businesses.