Region:Global

Author(s):Shubham

Product Code:KRAA0973

Pages:80

Published On:August 2025

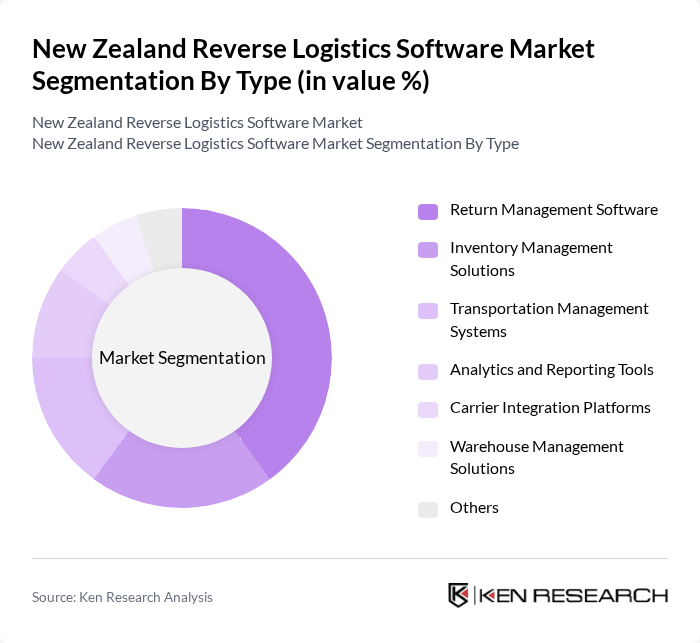

By Type:The reverse logistics software market is segmented into Return Management Software, Inventory Management Solutions, Transportation Management Systems, Analytics and Reporting Tools, Carrier Integration Platforms, Warehouse Management Solutions, and Others. Among these, Return Management Software is the most prominent segment, driven by the increasing volume of product returns in retail and e-commerce sectors. Businesses are focusing on optimizing return processes to enhance customer satisfaction, reduce operational costs, and integrate advanced analytics and automation for improved efficiency .

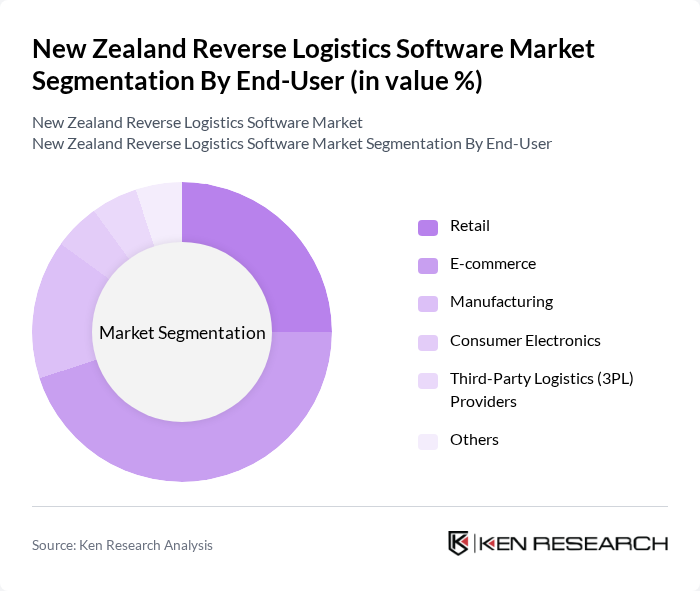

By End-User:The market is segmented by end-users, including Retail, E-commerce, Manufacturing, Consumer Electronics, Third-Party Logistics (3PL) Providers, and Others. The E-commerce segment is leading the market due to the exponential growth of online shopping, which has significantly increased the volume of returns. E-commerce companies are investing in reverse logistics software to manage returns efficiently, maintain customer loyalty, and leverage data analytics for better decision-making .

The New Zealand Reverse Logistics Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as ReverseLogix, Return Rabbit, Orderhive (Cin7 Orderhive), Loop Returns, Returnly, 12Return, AfterShip, Optoro, ReturnLogic, ZapERP, Metapack, G2 Reverse Logistics, Increff, Global Freight Solutions, and FlavorCloud contribute to innovation, geographic expansion, and service delivery in this space .

The future of the New Zealand reverse logistics software market appears promising, driven by increasing e-commerce activities and a growing emphasis on sustainability. As businesses recognize the importance of efficient return management, investments in advanced technologies are expected to rise. Furthermore, the integration of AI and machine learning will enhance operational efficiencies, enabling companies to respond swiftly to consumer demands. This trend will likely lead to a more streamlined and customer-centric approach to reverse logistics, fostering long-term growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Return Management Software Inventory Management Solutions Transportation Management Systems Analytics and Reporting Tools Carrier Integration Platforms Warehouse Management Solutions Others |

| By End-User | Retail E-commerce Manufacturing Consumer Electronics Third-Party Logistics (3PL) Providers Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Functionality | Returns Processing Asset Recovery Repair and Refurbishment Recycling and Disposal Warranty and RMA Management |

| By Industry Vertical | Automotive Healthcare Consumer Goods Electronics Food & Beverage Others |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Freemium/Trial-Based |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 70 | Operations Managers, Customer Service Managers |

| Automotive Parts Recovery | 50 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 40 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 60 | E-commerce Managers, Fulfillment Center Supervisors |

The New Zealand Reverse Logistics Software Market is valued at approximately USD 140 million, reflecting a five-year historical analysis. This growth is driven by the need for efficient return management and sustainability in supply chains.