Region:Middle East

Author(s):Geetanshi

Product Code:KRAA1938

Pages:82

Published On:August 2025

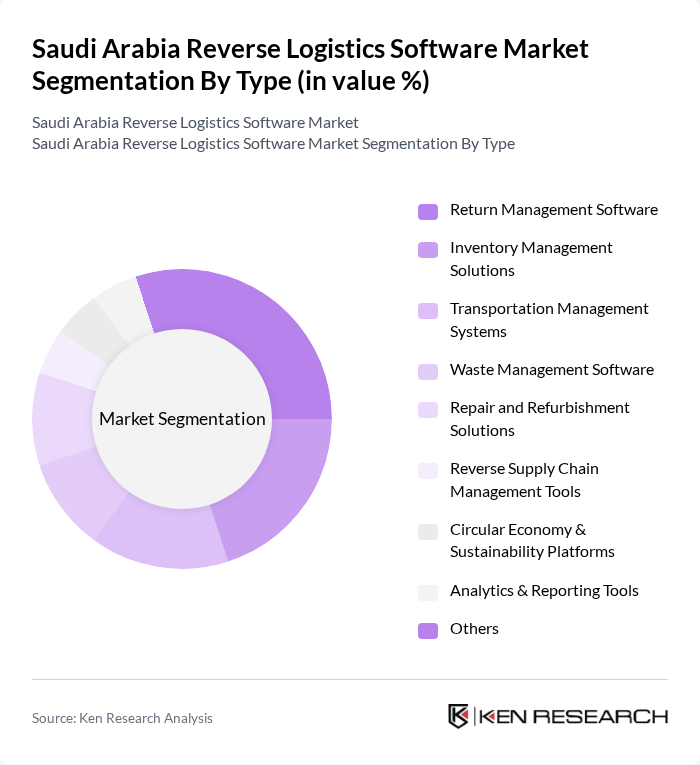

By Type:The market is segmented into various types of software solutions that address distinct aspects of reverse logistics. Subsegments include Return Management Software, Inventory Management Solutions, Transportation Management Systems, Waste Management Software, Repair and Refurbishment Solutions, Reverse Supply Chain Management Tools, Circular Economy & Sustainability Platforms, Analytics & Reporting Tools, and Others. These solutions are integral for improving operational efficiency, optimizing asset recovery, and enhancing customer experience, especially as businesses prioritize circular supply chains and compliance with sustainability mandates.

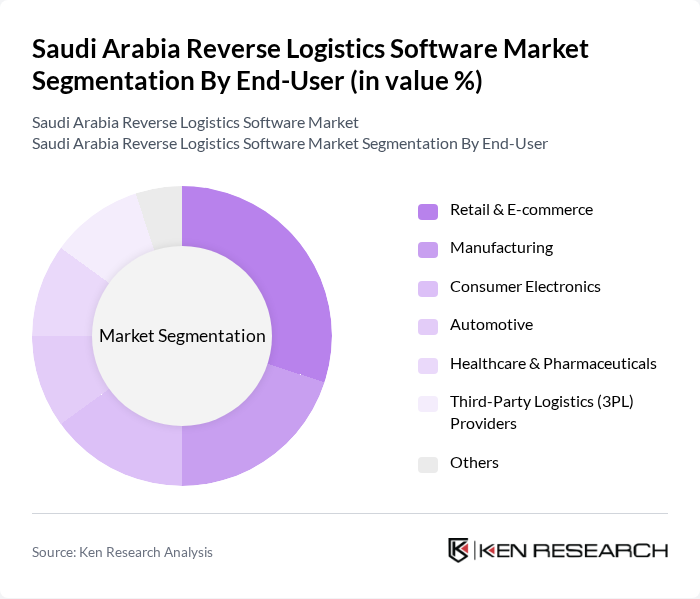

By End-User:The end-user segmentation encompasses industries utilizing reverse logistics software. Key sectors include Retail & E-commerce, Manufacturing, Consumer Electronics, Automotive, Healthcare & Pharmaceuticals, Third-Party Logistics (3PL) Providers, and Others. Each sector faces distinct challenges, such as high product return rates in retail and e-commerce, compliance requirements in healthcare, and asset recovery needs in automotive and electronics. The growing adoption of digital platforms and integration of analytics tools is driving demand for tailored solutions across these segments.

The Saudi Arabia Reverse Logistics Software Market features a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Manhattan Associates, Inc., Blue Yonder (formerly JDA Software Group, Inc.), Infor, Inc., IBM Corporation, Microsoft Corporation, WiseTech Global (CargoWise), Descartes Systems Group Inc., FourKites, Inc., Locus.sh, ShipBob, Inc., Flexport, Inc., Returnly (an Affirm company), Cartlow, ReverseLogix Corp., ReBOUND Returns, FarEye, LogiNext Solutions, and Salla contribute to innovation, geographic expansion, and enhanced service delivery. These companies are increasingly focusing on integrating advanced analytics, automation, and sustainability features into their platforms to address evolving market needs.

The future of the reverse logistics software market in Saudi Arabia appears promising, driven by increasing e-commerce activities and government sustainability initiatives. As businesses adapt to evolving consumer preferences and regulatory requirements, the integration of advanced technologies such as AI and IoT will become essential. Companies that embrace these innovations will likely enhance their operational efficiency and customer satisfaction, positioning themselves favorably in a competitive landscape. The focus on sustainability will further propel the demand for effective reverse logistics solutions, ensuring long-term growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Return Management Software Inventory Management Solutions Transportation Management Systems Waste Management Software Repair and Refurbishment Solutions Reverse Supply Chain Management Tools Circular Economy & Sustainability Platforms Analytics & Reporting Tools Others |

| By End-User | Retail & E-commerce Manufacturing Consumer Electronics Automotive Healthcare & Pharmaceuticals Third-Party Logistics (3PL) Providers Others |

| By Application | Product Returns & Exchanges Warranty & Service Management Recycling and Disposal Asset Recovery & Reuse Repair and Maintenance Recall Management Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors Value-Added Resellers (VARs) Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Company Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Region | Central Region Eastern Region Western Region Southern Region Northern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 80 | Operations Managers, Customer Service Managers |

| Automotive Parts Recovery | 60 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 40 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 90 | E-commerce Managers, Fulfillment Center Supervisors |

The Saudi Arabia Reverse Logistics Software Market is valued at approximately USD 6.3 billion, reflecting significant growth driven by e-commerce expansion, increased product returns, and a focus on sustainability and resource optimization among businesses.