Region:Europe

Author(s):Geetanshi

Product Code:KRAA1975

Pages:83

Published On:August 2025

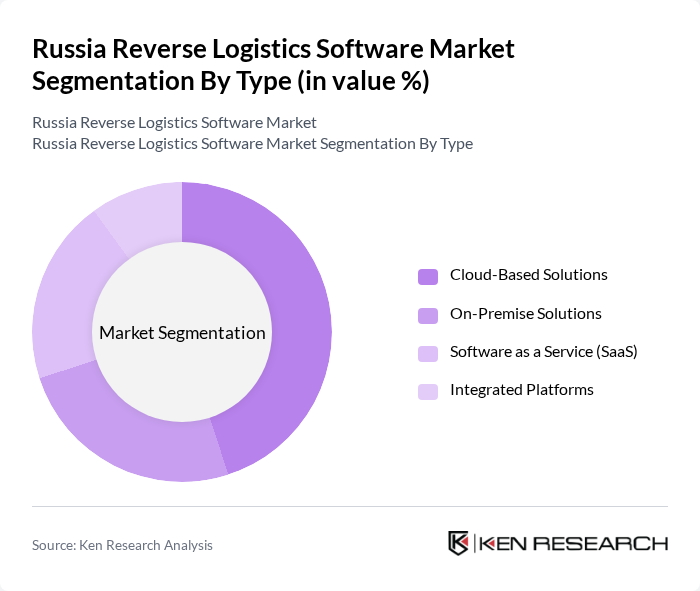

By Type:The market is segmented into various types of software solutions tailored to operational needs. The primary subsegments include Cloud-Based Solutions, On-Premise Solutions, Software as a Service (SaaS), and Integrated Platforms. Cloud-Based Solutions are gaining significant traction due to their scalability, cost-effectiveness, and ability to support real-time data access and process automation. These features allow businesses to manage logistics operations efficiently without heavy upfront investments. The flexibility and accessibility of cloud solutions are especially attractive to small and medium enterprises seeking to optimize reverse logistics processes and enhance responsiveness to returns and recycling demands .

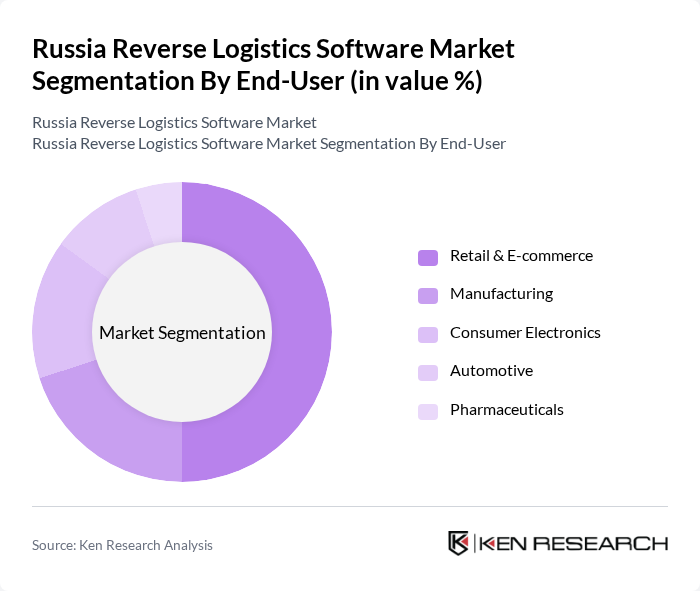

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Consumer Electronics, Automotive, and Pharmaceuticals. Retail & E-commerce is the leading segment, propelled by the rapid expansion of online shopping and the increasing need for efficient returns management. As consumer expectations for hassle-free returns rise, retailers are investing in reverse logistics software to improve customer experience and streamline operations. The manufacturing sector is also prominent, focusing on remanufacturing, recycling, and circular supply chain initiatives to reduce waste and enhance sustainability. Consumer electronics and automotive sectors are leveraging reverse logistics software for efficient product recalls and end-of-life management, while pharmaceutical companies utilize these solutions to comply with regulatory requirements for safe disposal and returns .

The Russia Reverse Logistics Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Manhattan Associates, Inc., Blue Yonder (formerly JDA Software Group, Inc.), Infor, Inc., IBM Corporation, Microsoft Corporation, Cargowise (WiseTech Global), Descartes Systems Group Inc., Logiwa, ShipBob, Flexport, FourKites, Project44, Reverse Logistics Group (RLG), 1C Company, Axelor, Softline, KORUS Consulting, Cleverence contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Russia reverse logistics software market appears promising, driven by the increasing integration of technology and sustainability practices. As e-commerce continues to expand, companies will prioritize efficient return management systems to enhance customer satisfaction. Additionally, the growing emphasis on environmental responsibility will encourage businesses to adopt circular economy principles, fostering innovation in reverse logistics solutions. Overall, the market is poised for significant transformation, with technological advancements and regulatory support playing crucial roles in shaping its trajectory.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-Based Solutions On-Premise Solutions Software as a Service (SaaS) Integrated Platforms |

| By End-User | Retail & E-commerce Manufacturing Consumer Electronics Automotive Pharmaceuticals |

| By Application | Returns Management Remanufacturing Recycling & Waste Management Asset Recovery Refurbishment |

| By Distribution Channel | Direct Sales Online Sales Distributors/Resellers |

| By Industry Vertical | Automotive Electronics & Electricals Pharmaceuticals & Healthcare Consumer Goods Food & Beverage |

| By Company Size | Small Enterprises Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 80 | Operations Managers, Customer Service Heads |

| Automotive Parts Recovery | 60 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 40 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 70 | eCommerce Managers, Fulfillment Center Supervisors |

The Russia Reverse Logistics Software Market is valued at approximately USD 1.1 billion, reflecting its share in the global market, which is growing due to increased e-commerce activities and a focus on efficient supply chain management.