Nigeria Animal Health and Veterinary Services Market Overview

- The Nigeria Animal Health and Veterinary Services Market is valued at USD 1.1 billion, based on a five-year historical analysis. This growth is primarily driven by increasing livestock production, rising pet ownership, and heightened awareness of animal health issues among farmers and pet owners. The demand for veterinary services and products has surged as the agricultural sector continues to expand, reflecting the importance of animal health in ensuring food security and economic stability. Recent trends highlight the adoption of advanced veterinary technologies, expansion of pharmaceutical company operations, and a growing emphasis on animal welfare and preventive care as key market drivers .

- Key cities such as Lagos, Abuja, and Port Harcourt dominate the market due to their large populations, economic activities, and concentration of veterinary services. These urban centers serve as hubs for livestock trade and veterinary care, attracting investments and fostering innovation in animal health. The presence of educational institutions and research facilities in these cities further enhances their role in advancing veterinary practices and animal health services .

- The Animal Disease Control Act, 2022, issued by the National Assembly of Nigeria, provides the current regulatory framework for veterinary practices. This legislation mandates the registration and licensing of veterinary practitioners, sets standards for veterinary service delivery, and establishes compliance requirements for disease surveillance and reporting. The Act strengthens quality control and enhances public trust in animal health services across the country by requiring all veterinary facilities to meet defined operational standards .

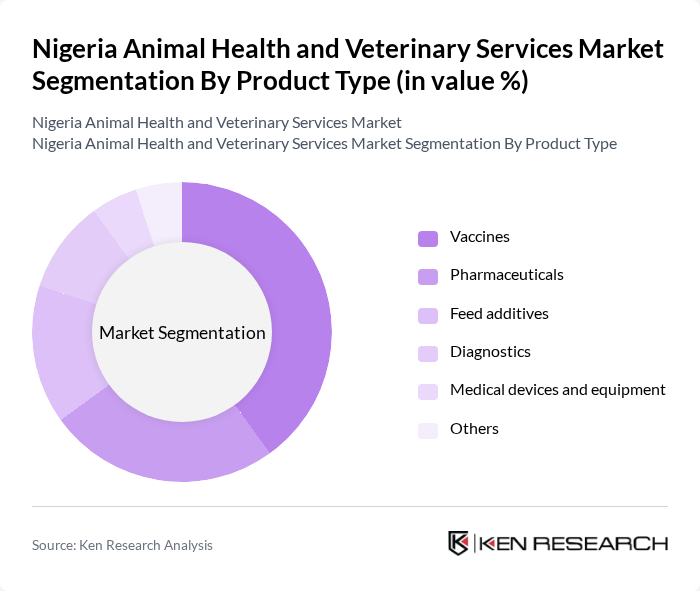

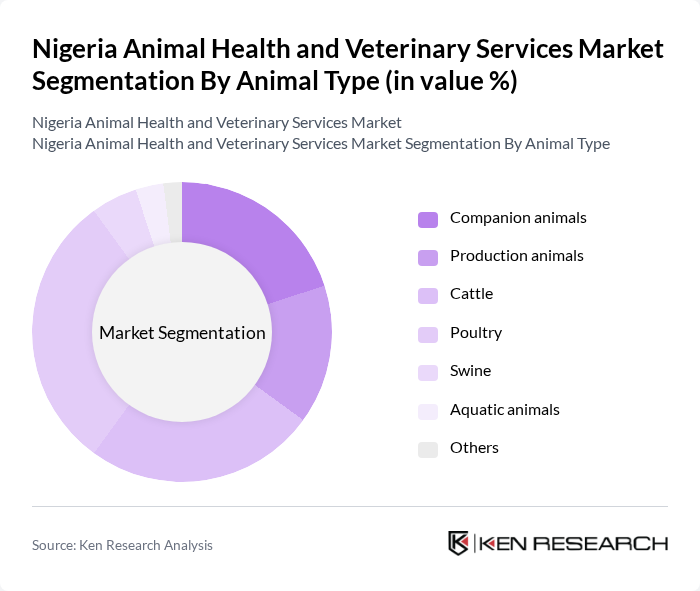

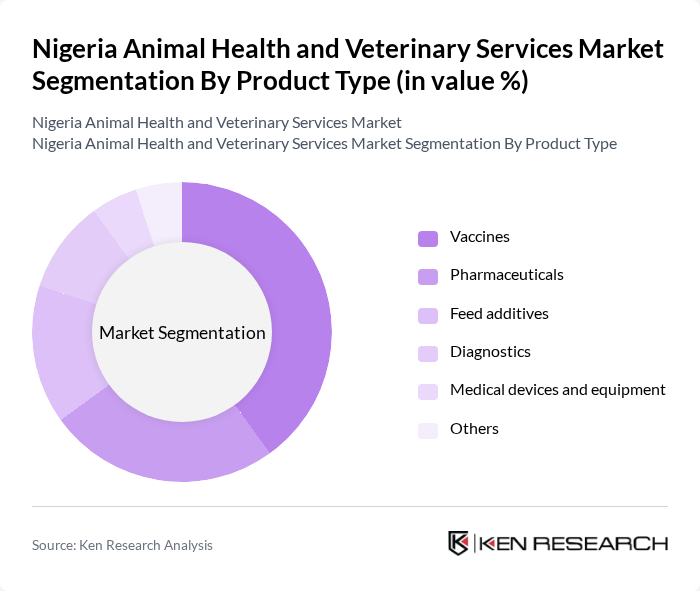

Nigeria Animal Health and Veterinary Services Market Segmentation

By Product Type:The product type segmentation includes various categories such as vaccines, pharmaceuticals, feed additives, diagnostics, medical devices and equipment, and others. Among these, vaccines are the leading sub-segment due to the increasing prevalence of infectious diseases in livestock and pets, driving demand for preventive healthcare solutions. The growing awareness of zoonotic diseases and the implementation of mass vaccination programs further propel the need for effective vaccination, making vaccines a critical component of animal health management .

By Animal Type:The animal type segmentation encompasses companion animals, production animals, cattle, poultry, swine, aquatic animals, and others. The poultry segment is the dominant sub-segment, driven by the high demand for poultry products in Nigeria. The rapid growth of the poultry industry, supported by government initiatives, disease control programs, and private investments, has led to increased focus on health management practices, making poultry a key area for veterinary services and products .

Nigeria Animal Health and Veterinary Services Market Competitive Landscape

The Nigeria Animal Health and Veterinary Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health, Elanco Animal Health, Boehringer Ingelheim Animal Health, Bayer Animal Health, Virbac, Vetoquinol, Neogen Corporation, Allflex Livestock Intelligence, Phibro Animal Health Corporation, Huvepharma, Kemin Industries, Ceva Santé Animale, Hipra, Dechra Pharmaceuticals contribute to innovation, geographic expansion, and service delivery in this space.

Nigeria Animal Health and Veterinary Services Market Industry Analysis

Growth Drivers

- Increasing Livestock Population:Nigeria's livestock population has reached approximately 20 million cattle, 40 million sheep, and 70 million goats. This growth is driven by rising domestic demand for animal products and the need for sustainable agricultural practices. The increasing livestock population directly correlates with the demand for veterinary services and products, as healthier animals contribute to improved productivity and economic stability in rural areas, enhancing food security and livelihoods.

- Rising Demand for Animal Protein:The per capita consumption of meat in Nigeria is projected to reach less than 10 kg, reflecting a growing demand for animal protein. This increase is fueled by population growth, urbanization, and changing dietary preferences. As consumers seek higher-quality protein sources, the demand for healthy livestock rises, necessitating enhanced veterinary services and animal health products to ensure livestock health and productivity, thereby supporting the overall market growth.

- Advancements in Veterinary Technology:The veterinary sector in Nigeria is witnessing significant technological advancements, with investments in telemedicine and diagnostic tools increasing by 30%. These innovations improve access to veterinary care, especially in rural areas, and enhance disease management. The integration of technology in veterinary practices not only streamlines operations but also boosts the efficiency of animal health services, leading to better outcomes for livestock and increased market demand for veterinary products.

Market Challenges

- Limited Access to Veterinary Services:Approximately 60% of Nigeria's rural population lacks access to basic veterinary services, which hampers livestock health and productivity. This limited access is exacerbated by inadequate infrastructure and a shortage of trained veterinary professionals. The disparity in service availability leads to increased mortality rates among livestock, negatively impacting the overall animal health market and hindering growth opportunities in the sector.

- High Cost of Veterinary Products:The cost of veterinary medicines and services has risen by 25% over the past two years, primarily due to inflation and supply chain disruptions. This increase poses a significant barrier for smallholder farmers who struggle to afford necessary treatments for their livestock. Consequently, the high cost of veterinary products limits the adoption of essential health measures, adversely affecting animal health outcomes and market growth potential.

Nigeria Animal Health and Veterinary Services Market Future Outlook

The future of Nigeria's animal health and veterinary services market appears promising, driven by increasing investments in veterinary education and technology. As awareness of animal health rises, farmers are expected to prioritize preventive care, leading to improved livestock productivity. Additionally, the integration of digital solutions will enhance service delivery, making veterinary care more accessible. These trends indicate a shift towards a more robust and sustainable animal health sector, positioning Nigeria as a key player in the regional livestock market.

Market Opportunities

- Growth in Export Markets for Livestock:Nigeria's livestock export market is projected to grow significantly, with exports expected to reach $200 million in future. This growth presents opportunities for veterinary service providers to enhance animal health standards, ensuring compliance with international regulations and boosting the country's competitiveness in global markets.

- Development of Telemedicine in Veterinary Care:The rise of telemedicine in veterinary care is set to transform service delivery, with an estimated 40% of consultations expected to occur remotely in future. This development will improve access to veterinary expertise, particularly in underserved areas, and facilitate timely interventions, ultimately enhancing animal health outcomes and market growth.