Region:North America

Author(s):Geetanshi

Product Code:KRAB5833

Pages:92

Published On:October 2025

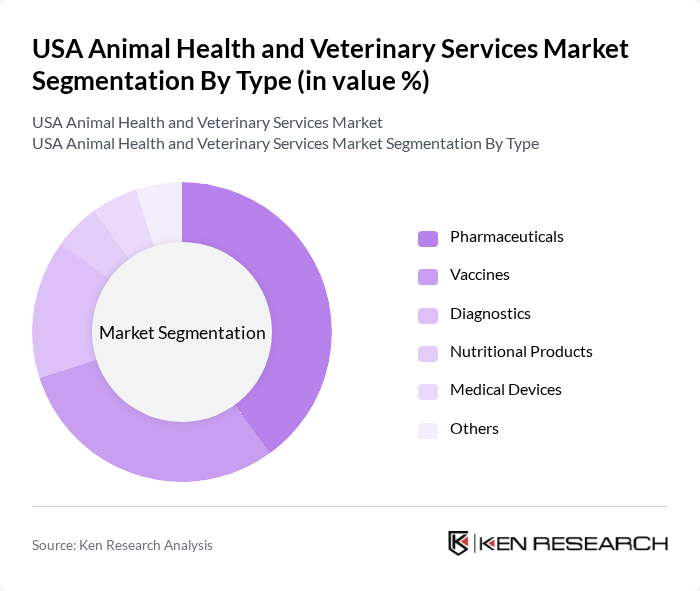

By Type:The market is segmented into various types, including Pharmaceuticals, Vaccines, Diagnostics, Nutritional Products, Medical Devices, and Others. Among these, Pharmaceuticals and Vaccines are the leading segments due to their critical role in disease prevention and treatment in both companion and production animals. The increasing prevalence of zoonotic diseases, the rise in chronic conditions among pets, and the growing demand for preventive healthcare are driving the growth of these segments. The diagnostics segment is also expanding, supported by technological advancements in rapid testing and imaging.

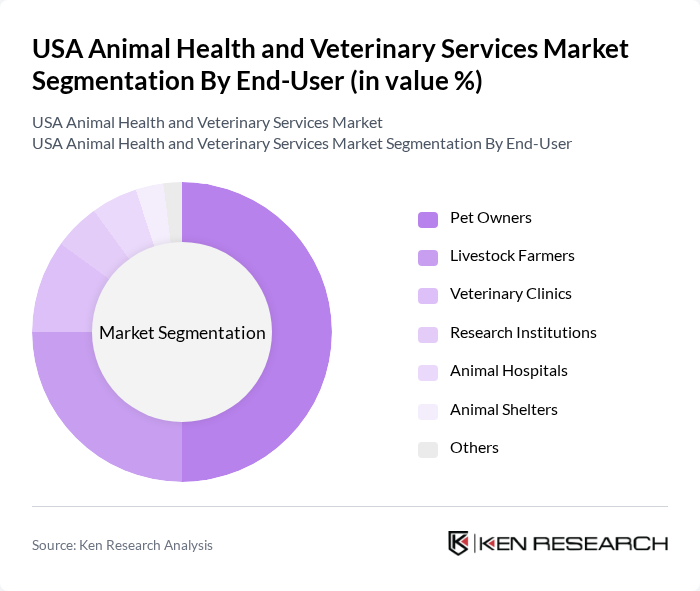

By End-User:The end-user segmentation includes Pet Owners, Livestock Farmers, Veterinary Clinics, Research Institutions, Animal Hospitals, Animal Shelters, and Others. Pet Owners and Livestock Farmers are the dominant segments, driven by the increasing trend of pet humanization and the need for effective livestock management practices. The growing awareness of animal health among pet owners, coupled with increased spending on veterinary services and products, continues to support market expansion. Veterinary clinics and animal hospitals are also seeing growth due to rising demand for specialized and emergency care.

The USA Animal Health and Veterinary Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health, Elanco Animal Health, Boehringer Ingelheim Animal Health, Ceva Santé Animale, IDEXX Laboratories, Inc., Virbac Corporation, Neogen Corporation, Vetoquinol S.A., PetIQ, Inc., Phibro Animal Health Corporation, Kemin Industries, Inc., Alltech, Inc., Animal Health International, Inc., VCA Inc., Banfield Pet Hospital, BluePearl Specialty and Emergency Pet Hospital, Southern Veterinary Partners, Mission Veterinary Partners contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA Animal Health and Veterinary Services market appears promising, driven by ongoing trends in pet ownership and technological advancements. As pet owners increasingly prioritize preventive care and innovative treatments, the demand for veterinary services is expected to rise. Additionally, the integration of artificial intelligence in diagnostics and treatment planning will enhance service delivery, making veterinary care more efficient and accessible, ultimately benefiting both pets and their owners.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceuticals Vaccines Diagnostics Nutritional Products Medical Devices Others |

| By End-User | Pet Owners Livestock Farmers Veterinary Clinics Research Institutions Animal Hospitals Animal Shelters Others |

| By Service Type | Medical Services Non-Medical Services Preventive Care Emergency Care Surgical Services Specialty Services Grooming & Boarding Behavioral Therapy Others |

| By Distribution Channel | Online Retail Veterinary Clinics Pharmacies Direct Sales Others |

| By Region | Northeast Midwest South West Others |

| By Animal Type | Companion Animals Dogs Cats Horses Production Animals Cattle Poultry Swine Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Pet Owners | 120 | Pet Owners, Animal Caregivers |

| Livestock Producers | 80 | Farm Owners, Animal Husbandry Experts |

| Animal Health Product Suppliers | 60 | Sales Representatives, Product Managers |

| Veterinary Technicians | 50 | Veterinary Technicians, Support Staff |

The USA Animal Health and Veterinary Services Market is valued at approximately USD 68 billion, driven by increasing pet ownership, advancements in veterinary technology, and rising awareness of animal health. This market reflects a growing commitment to animal welfare and health management.