Region:Middle East

Author(s):Rebecca

Product Code:KRAB2874

Pages:100

Published On:October 2025

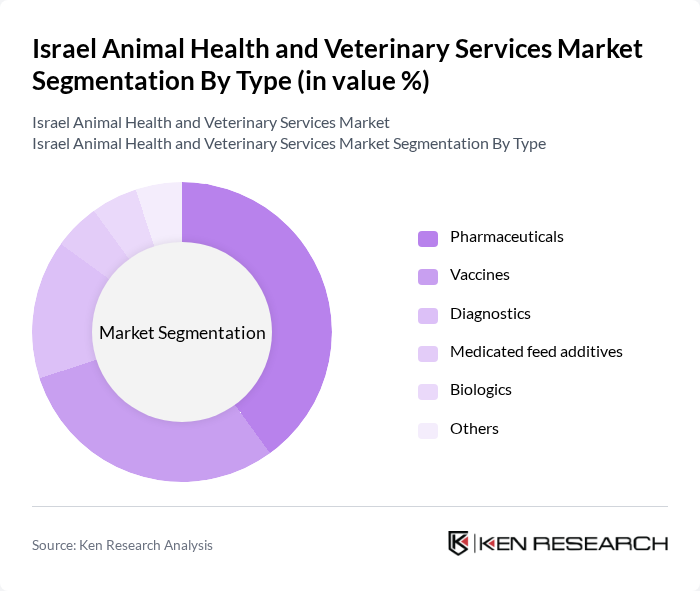

By Type:The market is segmented into various types, including Pharmaceuticals, Vaccines, Diagnostics, Medicated feed additives, Biologics, and Others. Among these, Pharmaceuticals and Vaccines are the leading subsegments due to the increasing prevalence of diseases in animals and the growing demand for preventive healthcare solutions. The trend towards preventive care is driving the adoption of vaccines, while pharmaceuticals are essential for treating existing health issues. Pharmaceuticals account for the largest share, reflecting the dominance of prescription and over-the-counter animal medicines in the market .

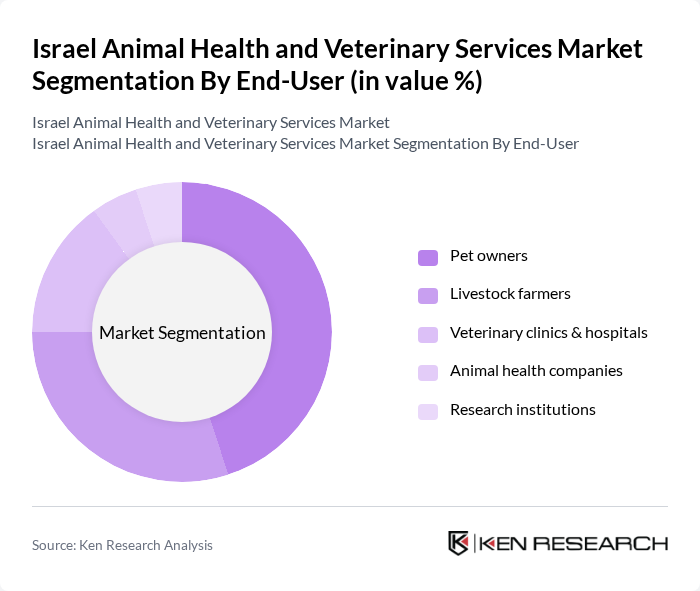

By End-User:The end-user segmentation includes Pet owners, Livestock farmers, Veterinary clinics & hospitals, Animal health companies, and Research institutions. Pet owners and livestock farmers are the primary consumers, driven by the increasing need for pet care and livestock health management. The rise in pet ownership and the demand for high-quality livestock products are propelling growth in these segments. Veterinary clinics and hospitals are also significant end-users, reflecting the importance of professionalized animal healthcare delivery .

The Israel Animal Health and Veterinary Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health, Elanco Animal Health, Boehringer Ingelheim Animal Health, Ceva Santé Animale, Vetoquinol, IDEXX Laboratories, Phibro Animal Health Corporation, Neogen Corporation, Allflex Livestock Intelligence (subsidiary of MSD Animal Health), Henry Schein Animal Health, Virbac, Covetrus, BioPet Laboratories Ltd., Medivet Israel, Israel Veterinary Association, Petnet Israel, AgriVet Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Israel Animal Health and Veterinary Services market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The integration of telemedicine and AI in veterinary diagnostics is expected to enhance service delivery and accessibility. Additionally, the growing focus on preventive healthcare will likely lead to increased investments in wellness programs for pets and livestock, fostering a more proactive approach to animal health management. This evolution will create a dynamic environment for both established players and new entrants in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceuticals Vaccines Diagnostics Medicated feed additives Biologics Others |

| By End-User | Pet owners Livestock farmers Veterinary clinics & hospitals Animal health companies Research institutions |

| By Service Type | Preventive care Emergency care Surgical services Specialty services Diagnostic imaging & laboratory services |

| By Distribution Channel | Direct sales Online platforms Veterinary clinics & hospitals Distributors/wholesalers |

| By Product Category | Companion animals Farm animals Aquaculture Others |

| By Geographic Region | Central Israel Northern Israel Southern Israel Jerusalem District Others |

| By Price Range | Budget Mid-range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 60 | Veterinarians, Clinic Managers |

| Livestock Farmers | 50 | Farm Owners, Animal Husbandry Specialists |

| Pet Owners | 100 | Pet Owners, Animal Caregivers |

| Animal Health Product Distributors | 40 | Sales Managers, Distribution Coordinators |

| Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

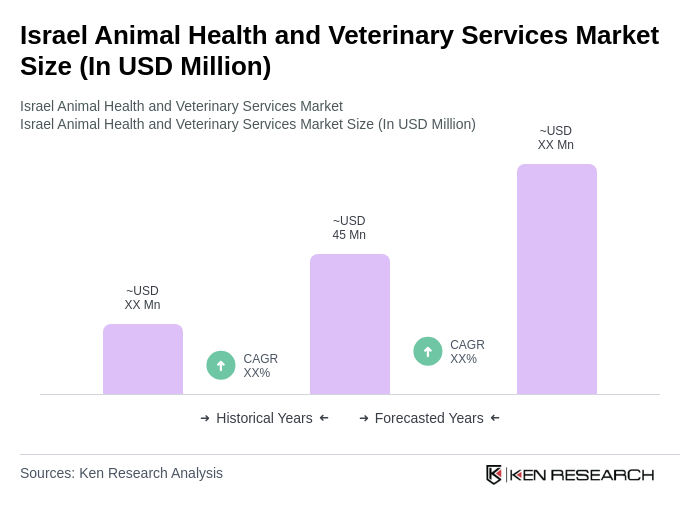

The Israel Animal Health and Veterinary Services Market is valued at approximately USD 45 million, driven by increasing pet ownership, advancements in veterinary technology, and a growing commitment to animal welfare and health management.