Region:Africa

Author(s):Shubham

Product Code:KRAB5569

Pages:84

Published On:October 2025

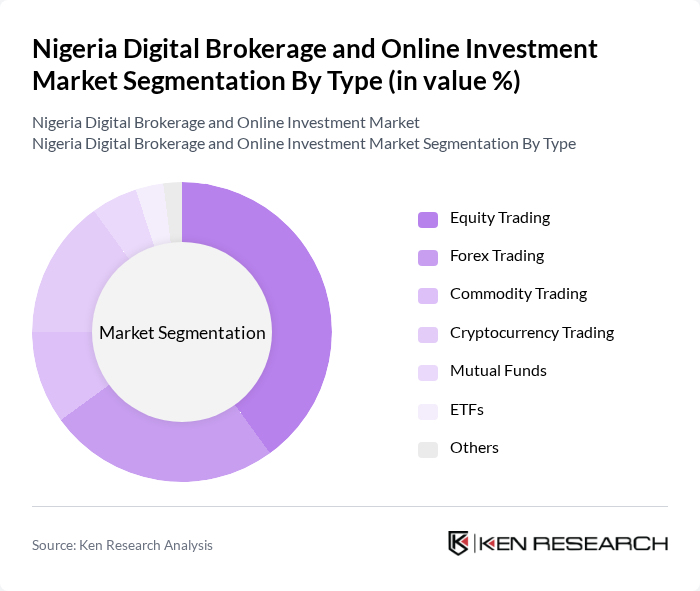

By Type:The market is segmented into various types, including Equity Trading, Forex Trading, Commodity Trading, Cryptocurrency Trading, Mutual Funds, ETFs, and Others. Among these, Equity Trading has emerged as the leading segment due to the increasing number of retail investors entering the stock market, driven by the accessibility of online trading platforms and the potential for high returns.

By End-User:The market is segmented by end-users, including Individual Investors, Institutional Investors, Corporates, and Financial Advisors. Individual Investors dominate the market, driven by the increasing financial literacy and the growing trend of self-directed investing among the younger population, who are more inclined to use digital platforms for trading.

The Nigeria Digital Brokerage and Online Investment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Access Bank Plc, First Bank of Nigeria, Stanbic IBTC Bank, Guaranty Trust Bank, Zenith Bank Plc, FBNQuest Securities, Afrinvest West Africa, Meristem Securities, EFG Hermes Nigeria, Cowry Asset Management, Chapel Hill Denham, Investment One Financial Services, United Capital Plc, Rencap Securities, Proshare Nigeria contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's digital brokerage and online investment market appears promising, driven by technological advancements and increasing consumer engagement. The integration of artificial intelligence in trading platforms is expected to enhance decision-making processes, while the rise of sustainable investing will attract socially conscious investors. Additionally, as regulatory frameworks evolve, they may provide clearer guidelines that foster innovation and growth, ultimately leading to a more robust investment ecosystem in Nigeria.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Trading Forex Trading Commodity Trading Cryptocurrency Trading Mutual Funds ETFs Others |

| By End-User | Individual Investors Institutional Investors Corporates Financial Advisors |

| By Investment Size | Small Investments Medium Investments Large Investments |

| By Service Type | Full-Service Brokerage Discount Brokerage Online-Only Brokerage |

| By Customer Demographics | Millennials Gen X Baby Boomers |

| By Geographic Presence | Urban Areas Rural Areas |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 150 | Individual Investors, Retail Traders |

| Brokerage Firm Operations | 100 | Operations Managers, Compliance Officers |

| Investment Advisory Services | 80 | Financial Advisors, Wealth Managers |

| Digital Platform User Experience | 120 | End Users, UX Researchers |

| Regulatory Impact Assessment | 70 | Regulatory Analysts, Policy Makers |

The Nigeria Digital Brokerage and Online Investment Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by technology adoption, a rising middle class, and increased retail investor participation in the stock market.