Region:Africa

Author(s):Shubham

Product Code:KRAB5672

Pages:95

Published On:October 2025

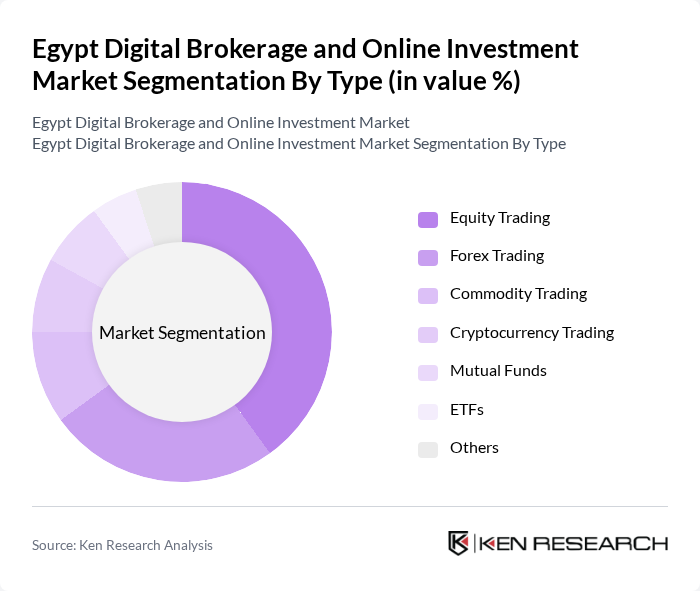

By Type:The market is segmented into various types, including Equity Trading, Forex Trading, Commodity Trading, Cryptocurrency Trading, Mutual Funds, ETFs, and Others. Among these, Equity Trading is the most dominant segment, driven by the increasing number of retail investors entering the market and the growing popularity of stock trading platforms. Forex Trading also holds a significant share, as traders seek to capitalize on currency fluctuations. The rise of digital platforms has made it easier for investors to access these markets, leading to increased participation.

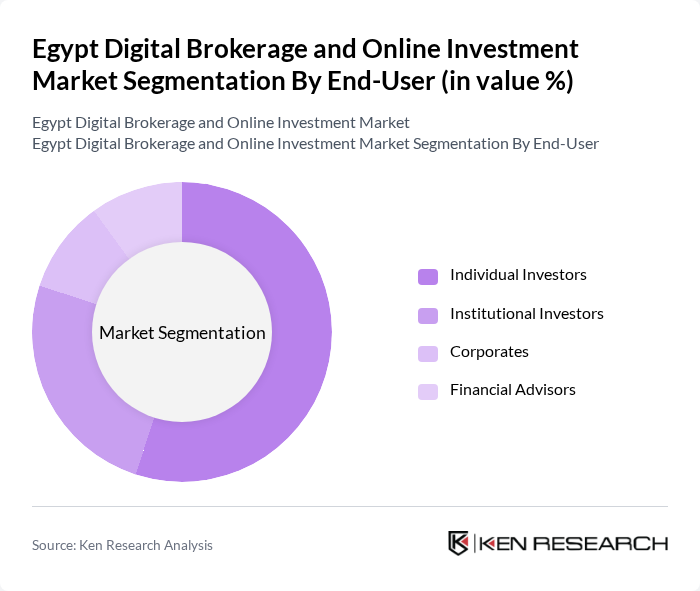

By End-User:The market is segmented by end-user into Individual Investors, Institutional Investors, Corporates, and Financial Advisors. Individual Investors dominate the market, driven by the increasing accessibility of online trading platforms and the growing interest in personal finance management. Institutional Investors also play a crucial role, as they contribute significantly to trading volumes and market liquidity. The rise of financial literacy among the general population has led to a surge in individual participation, making them the leading segment.

The Egypt Digital Brokerage and Online Investment Market is characterized by a dynamic mix of regional and international players. Leading participants such as EFG Hermes, Pharos Holding, CI Capital, Beltone Financial, Mubasher Financial Services, Arab African International Securities, Prime Holding, Naeem Holding, Pioneers Holding, Al Ahly Pharos, ALEXBANK, Misr for Central Clearing, Depository and Registry, Egyptian Exchange, Arab Finance, AUC Venture Lab contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's digital brokerage and online investment market appears promising, driven by technological advancements and increasing investor engagement. As more individuals gain access to digital platforms, the market is likely to see a rise in participation from diverse demographics. Additionally, the integration of advanced technologies such as AI and machine learning will enhance trading strategies, making them more efficient. The focus on sustainable investing and ESG factors will also shape investment preferences, leading to a more responsible investment landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Trading Forex Trading Commodity Trading Cryptocurrency Trading Mutual Funds ETFs Others |

| By End-User | Individual Investors Institutional Investors Corporates Financial Advisors |

| By Investment Size | Small Investments Medium Investments Large Investments |

| By Trading Platform | Web-Based Platforms Mobile Applications Desktop Software |

| By Service Type | Full-Service Brokerage Discount Brokerage Robo-Advisory Services |

| By Customer Segment | Retail Investors High Net-Worth Individuals Family Offices |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 150 | Individual Investors, Financial Planners |

| Brokerage Service Evaluation | 100 | Brokerage Executives, Customer Service Managers |

| Investment Behavior Analysis | 120 | Active Traders, Casual Investors |

| Regulatory Impact Assessment | 80 | Regulatory Officials, Compliance Officers |

| Technology Adoption in Brokerage | 90 | IT Managers, Digital Transformation Leads |

The Egypt Digital Brokerage and Online Investment Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased digital trading adoption and retail investor participation.