Region:Europe

Author(s):Shubham

Product Code:KRAB5638

Pages:98

Published On:October 2025

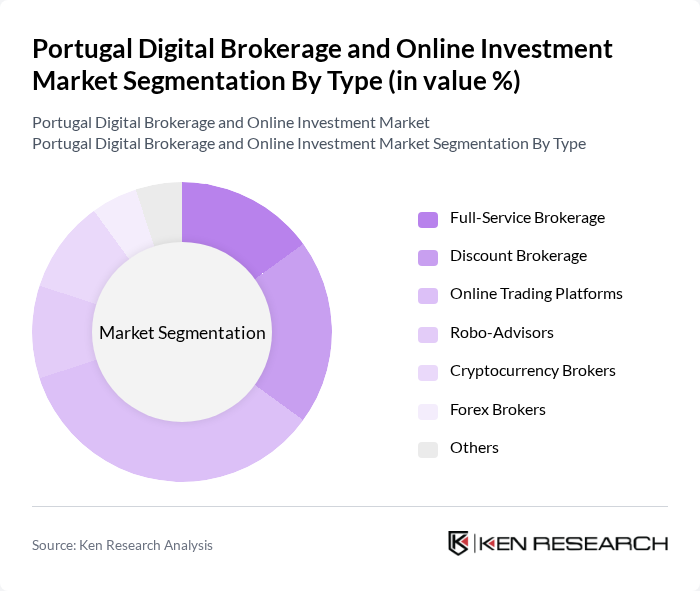

By Type:The market is segmented into various types, including Full-Service Brokerage, Discount Brokerage, Online Trading Platforms, Robo-Advisors, Cryptocurrency Brokers, Forex Brokers, and Others. Among these, Online Trading Platforms have gained significant traction due to their user-friendly interfaces and lower fees, appealing to a broader audience of retail investors.

By End-User:The end-user segmentation includes Individual Investors, Institutional Investors, Corporates, and Financial Advisors. Individual Investors dominate the market, driven by the increasing trend of self-directed investing and the accessibility of online platforms that cater to their needs.

The Portugal Digital Brokerage and Online Investment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Banco Best, ActivoBank, DEGIRO, XTB, eToro, Interactive Brokers, OANDA, Trading 212, Revolut, Boursorama, CMC Markets, IG Group, Saxo Bank, BinckBank, Freetrade contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital brokerage and online investment market in Portugal appears promising, driven by technological advancements and evolving consumer preferences. As more investors seek personalized services, the integration of artificial intelligence and machine learning into trading platforms is expected to enhance decision-making processes. Additionally, the growing trend towards sustainable investing will likely shape product offerings, as firms adapt to meet the increasing demand for environmentally and socially responsible investment options.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Brokerage Discount Brokerage Online Trading Platforms Robo-Advisors Cryptocurrency Brokers Forex Brokers Others |

| By End-User | Individual Investors Institutional Investors Corporates Financial Advisors |

| By Investment Type | Stocks Bonds ETFs Mutual Funds Options and Futures Cryptocurrencies Others |

| By Distribution Channel | Direct Online Sales Mobile Applications Third-Party Platforms Affiliate Marketing |

| By Customer Segment | Retail Investors High Net-Worth Individuals Millennials Gen Z Investors |

| By Geographic Presence | Urban Areas Suburban Areas Rural Areas |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 150 | Individual Investors, Retail Traders |

| Institutional Brokerage Services | 100 | Institutional Investors, Fund Managers |

| Regulatory Impact Assessment | 80 | Compliance Officers, Legal Advisors |

| Digital Platform User Experience | 120 | UX Designers, Product Managers |

| Market Trends and Forecasting | 90 | Market Analysts, Financial Advisors |

The Portugal Digital Brokerage and Online Investment Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital trading platforms and a rise in retail investor participation.