Region:Africa

Author(s):Dev

Product Code:KRAB3041

Pages:95

Published On:October 2025

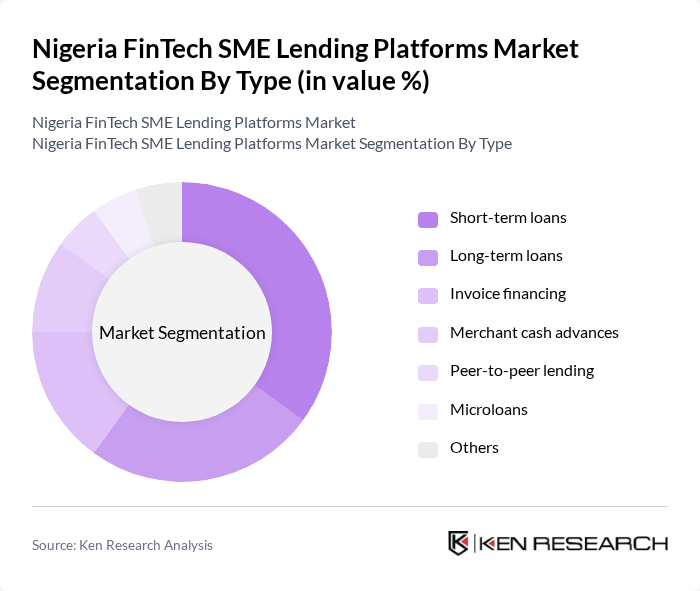

By Type:The market is segmented into various types of lending solutions, including short-term loans, long-term loans, invoice financing, merchant cash advances, peer-to-peer lending, microloans, and others. Among these, short-term loans are particularly popular due to their quick approval processes and flexibility, catering to the immediate financial needs of SMEs. Long-term loans are also significant, as they provide the necessary capital for expansion and investment in growth opportunities.

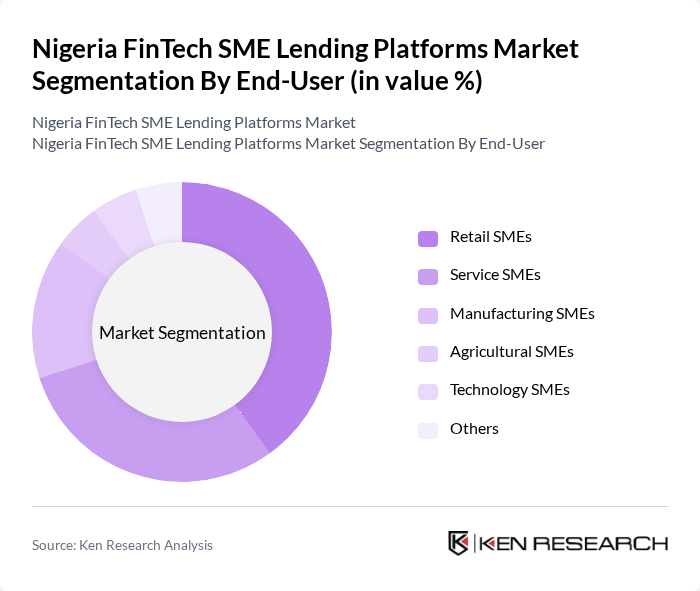

By End-User:The end-user segmentation includes retail SMEs, service SMEs, manufacturing SMEs, agricultural SMEs, technology SMEs, and others. Retail SMEs dominate the market due to their high demand for quick financing solutions to manage inventory and operational costs. Service SMEs also play a crucial role, as they require flexible funding options to support their diverse service offerings and customer engagements.

The Nigeria FinTech SME Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Paystack, Flutterwave, Carbon, Renmoney, Kuda Bank, Branch International, FairMoney, Lendigo, Aella Credit, Cowrywise, Zedvance, QuickCheck, Migo, Thrive Agric, CredPal contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's FinTech SME lending platforms appears promising, driven by technological advancements and increasing digital adoption. As more SMEs embrace digital solutions, lending platforms are likely to enhance their offerings through innovative technologies such as AI and machine learning. Additionally, the collaboration between FinTech companies and traditional banks is expected to grow, creating a more integrated financial ecosystem that supports SME growth and sustainability in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Short-term loans Long-term loans Invoice financing Merchant cash advances Peer-to-peer lending Microloans Others |

| By End-User | Retail SMEs Service SMEs Manufacturing SMEs Agricultural SMEs Technology SMEs Others |

| By Application | Working capital financing Equipment financing Expansion financing Inventory financing Others |

| By Investment Source | Domestic investors Foreign direct investment (FDI) Government grants Venture capital Others |

| By Distribution Channel | Online platforms Mobile applications Direct sales Partnerships with financial institutions Others |

| By Customer Segment | Startups Established SMEs High-growth SMEs Others |

| By Policy Support | Government subsidies Tax incentives Regulatory support programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Lending Platforms | 150 | CEOs, Founders, and Financial Officers |

| SME Borrowers | 200 | Business Owners, Financial Managers |

| Regulatory Bodies | 50 | Policy Makers, Financial Regulators |

| FinTech Industry Experts | 75 | Consultants, Analysts, and Researchers |

| Investment Firms | 60 | Venture Capitalists, Investment Analysts |

The Nigeria FinTech SME Lending Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the increasing demand for accessible financing solutions among small and medium enterprises (SMEs) and the rapid adoption of digital financial services.