Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1013

Pages:82

Published On:October 2025

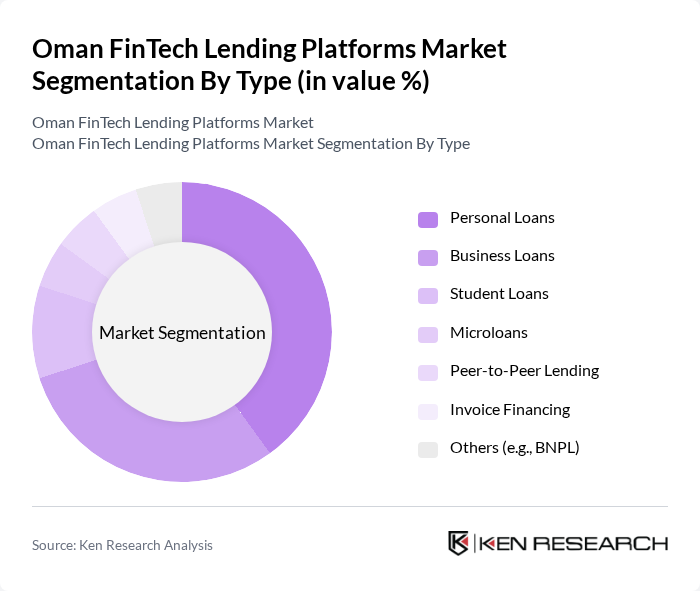

By Type:The market is segmented into various types of lending products, including Personal Loans, Business Loans, Student Loans, Microloans, Peer-to-Peer Lending, Invoice Financing, and Others (e.g., BNPL). Personal Loans are currently the most popular segment, driven by consumer demand for quick and accessible financing options. Business Loans follow closely, as SMEs increasingly seek alternative funding sources to support their growth. Short-term loans and invoice financing have gained particular traction among SME borrowers due to their flexibility and rapid approval processes, which cater to immediate working capital needs.

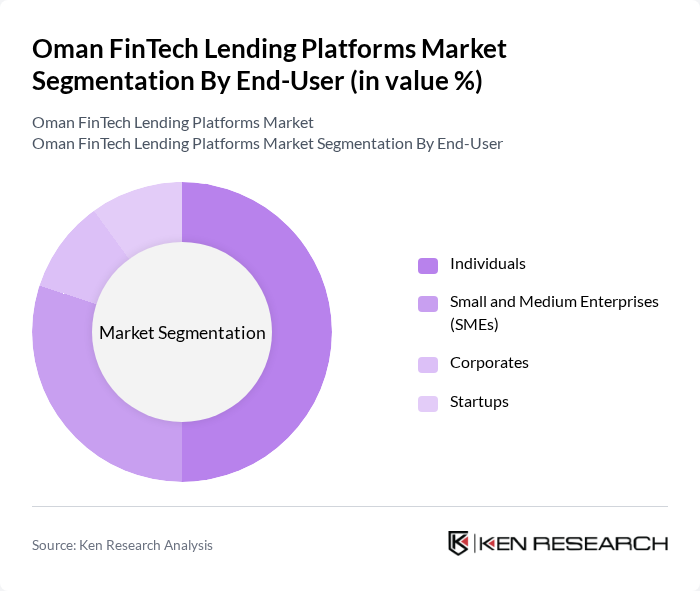

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Corporates, and Startups. Individuals represent the largest segment, as they seek personal loans for various needs, including home improvements and emergencies. SMEs are also significant contributors, leveraging FinTech platforms for quick access to capital to fuel their operations and growth. Retail SMEs lead this segment due to their high demand for quick financing solutions to manage inventory and seasonal fluctuations, with the growth of e-commerce and digital retailing in Oman further fueling the need for accessible funding. Among Oman's approximately 240,000 registered SMEs, digital lending platforms are playing an increasingly important role in bridging the financing gap, particularly for micro-enterprises.

The Oman FinTech Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bank Nizwa, Alizz Islamic Bank, Oman Arab Bank, Muscat Finance, Oman Development Bank, Al Yusr Islamic Finance, Ameen Finance, Bait Al Mal, Al Izz Islamic Bank, Oman Housing Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the FinTech lending market in Oman appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning in credit scoring is expected to enhance risk assessment and streamline lending processes. Additionally, the growth of e-commerce and digital transactions will likely create new opportunities for FinTech platforms to cater to a broader audience, fostering financial inclusion and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Microloans Peer-to-Peer Lending Invoice Financing Others (e.g., BNPL) |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Startups |

| By Application | Consumer Financing Business Financing Educational Financing Agricultural Financing |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales |

| By Loan Amount | Small Loans (up to OMR 1,000) Medium Loans (OMR 1,001 - OMR 5,000) Large Loans (above OMR 5,000) |

| By Interest Rate Type | Fixed Interest Rate Variable Interest Rate |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Lending Platforms | 100 | End-users, Financial Advisors |

| SME Lending Solutions | 80 | Business Owners, Financial Managers |

| Peer-to-Peer Lending Services | 60 | Investors, Borrowers |

| Regulatory Impact on FinTech | 40 | Regulatory Officials, Compliance Officers |

| Market Trends and Consumer Behavior | 50 | Market Analysts, Consumer Insights Specialists |

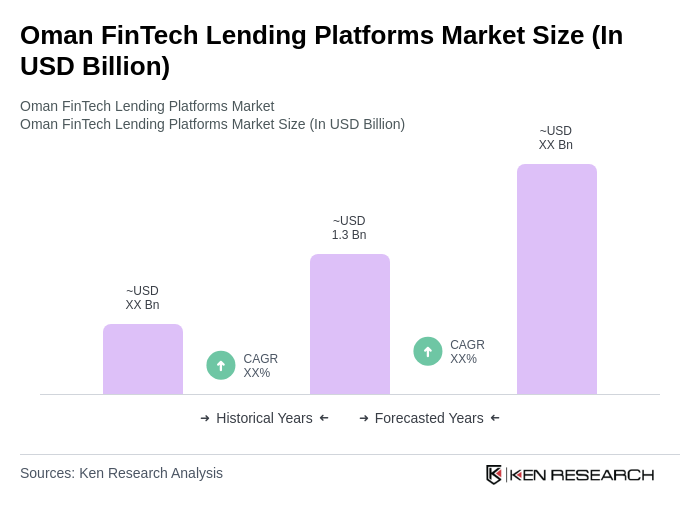

The Oman FinTech Lending Platforms Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by the increasing adoption of digital financial services and a rising demand for alternative lending solutions among consumers and businesses.