Region:Asia

Author(s):Geetanshi

Product Code:KRAB4618

Pages:80

Published On:October 2025

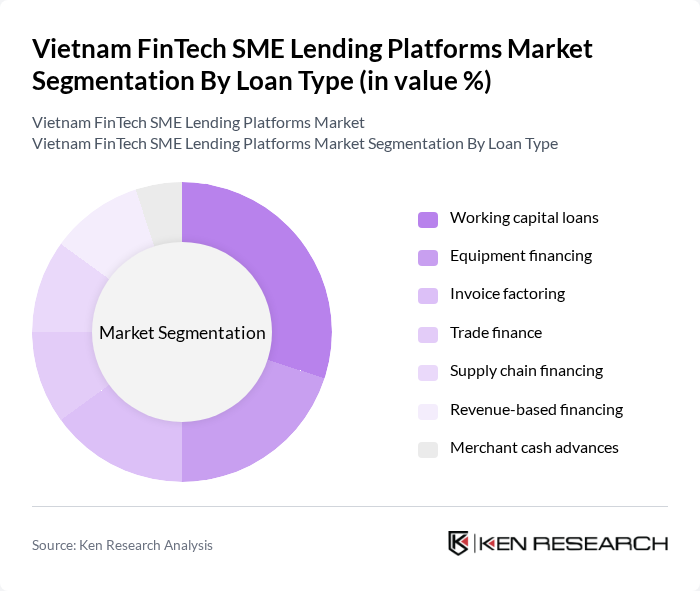

By Loan Type:The loan type segmentation includes various forms of financing tailored to meet the diverse needs of SMEs. The subsegments are working capital loans, equipment financing, invoice factoring, trade finance, supply chain financing, revenue-based financing, and merchant cash advances. Each of these loan types serves specific purposes, withworking capital loansbeing particularly popular due to their flexibility in addressing immediate financial needs. The adoption of digital platforms has enabled faster approval and disbursement, especially for short-term and unsecured loan products .

Theworking capital loanssegment is currently the leading subsegment, accounting for a significant portion of the market. This dominance is attributed to the immediate financial needs of SMEs, which often require quick access to funds for day-to-day operations. The flexibility and ease of obtaining working capital loans make them a preferred choice among small business owners, especially in a rapidly evolving economic landscape. Digital lending platforms have further streamlined the process, reducing approval times and expanding access for underserved SMEs .

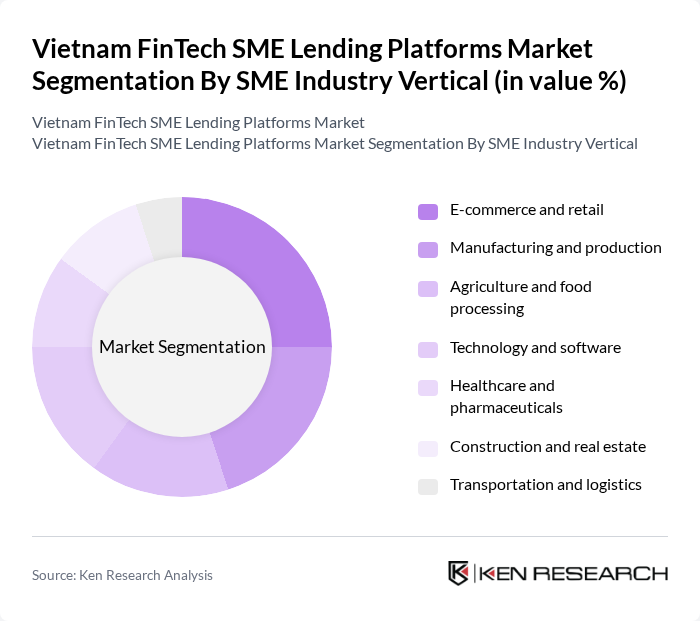

By SME Industry Vertical:This segmentation categorizes the market based on the various industry verticals that SMEs operate in. The subsegments include e-commerce and retail, manufacturing and production, agriculture and food processing, technology and software, healthcare and pharmaceuticals, construction and real estate, and transportation and logistics. Each vertical has unique financing needs, influencing the types of loans sought by SMEs. The rise of e-commerce and digital trade has particularly increased demand for short-term and inventory financing among retail SMEs .

Thee-commerce and retailsector is the dominant industry vertical, driven by the rapid growth of online shopping and digital payment solutions. SMEs in this sector often require financing to manage inventory, expand operations, and enhance their digital presence. The increasing consumer preference for online shopping has further fueled the demand for financial products tailored to this industry. The digitalization of retail and the expansion of omnichannel commerce are key trends shaping loan demand in this vertical .

The Vietnam FinTech SME Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trusting Social, Lendbiz, VayMuon, Tima, Fundiin, MoMo (M_Service), VNPay, ZaloPay, TPBank Ezy, Home Credit Vietnam, FE Credit, Kredivo Vietnam, Akulaku Vietnam, VietCapital Bank Digital, Sacombank F@st contribute to innovation, geographic expansion, and service delivery in this space.

The future of the FinTech SME lending market in Vietnam appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in credit assessments is expected to enhance risk evaluation, while mobile lending solutions will cater to the growing demand for convenience. Additionally, the rise of peer-to-peer lending platforms is likely to democratize access to credit, fostering a more inclusive financial ecosystem that supports the diverse needs of SMEs across the country.

| Segment | Sub-Segments |

|---|---|

| By Loan Type | Working capital loans Equipment financing Invoice factoring Trade finance Supply chain financing Revenue-based financing Merchant cash advances |

| By SME Industry Vertical | E-commerce and retail Manufacturing and production Agriculture and food processing Technology and software Healthcare and pharmaceuticals Construction and real estate Transportation and logistics |

| By Loan Amount | Micro loans (under VND 500 million) Small loans (VND 500 million - 3 billion) Medium loans (VND 3-20 billion) Large SME loans (above VND 20 billion) |

| By Platform Type | P2P lending platforms Digital banking platforms Alternative credit platforms Marketplace lending platforms |

| By Geographic Region | Northern Vietnam (Hanoi region) Southern Vietnam (Ho Chi Minh City region) Central Vietnam (Da Nang region) Mekong Delta region |

| By Credit Assessment Method | Traditional credit scoring Alternative data analytics AI-powered risk assessment Behavioral scoring models |

| By Funding Source | Bank partnerships Institutional investors Peer-to-peer funding Government-backed schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Owners in Technology Sector | 120 | Business Owners, Financial Managers |

| SME Owners in Retail Sector | 110 | Retail Managers, Operations Directors |

| SME Owners in Manufacturing Sector | 100 | Production Managers, Financial Analysts |

| FinTech Platform Executives | 40 | CEOs, Product Development Heads |

| Financial Advisors and Consultants | 50 | Financial Advisors, SME Consultants |

The Vietnam FinTech SME Lending Platforms Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the demand for accessible financing solutions tailored to small and medium enterprises (SMEs) in the region.