Region:Africa

Author(s):Rebecca

Product Code:KRAB2962

Pages:82

Published On:October 2025

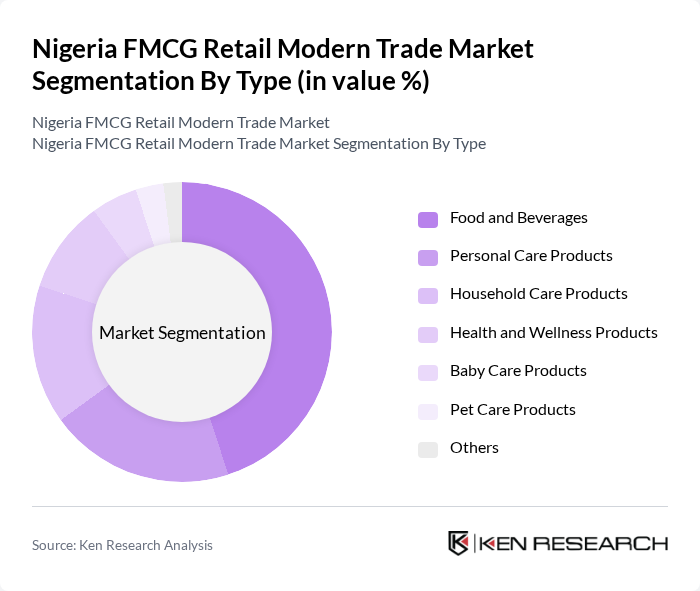

By Type:

The market is segmented into various types, including Food and Beverages, Personal Care Products, Household Care Products, Health and Wellness Products, Baby Care Products, Pet Care Products, and Others. Among these, Food and Beverages dominate the market due to the high demand for essential goods and the growing trend of convenience foods. The increasing urban population and changing lifestyles have led to a surge in the consumption of packaged and processed foods, making this sub-segment a key driver of market growth.

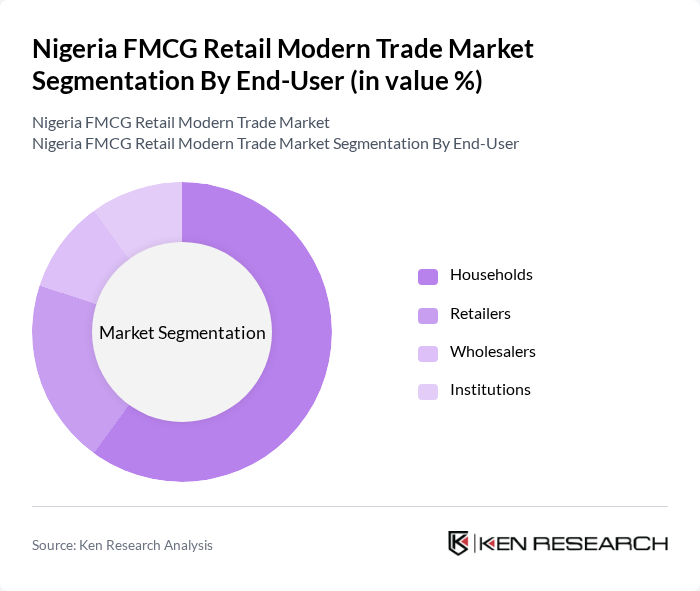

By End-User:

The end-user segmentation includes Households, Retailers, Wholesalers, and Institutions. Households represent the largest segment, driven by the increasing purchasing power and changing consumer preferences towards modern retail formats. The trend of bulk buying and the convenience offered by supermarkets have led to a significant rise in household consumption of FMCG products, making it the leading end-user segment in the market.

The Nigeria FMCG Retail Modern Trade Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestle Nigeria Plc, Unilever Nigeria Plc, Procter & Gamble Nigeria, Nigerian Breweries Plc, Cadbury Nigeria Plc, Flour Mills of Nigeria Plc, Dangote Group, Coca-Cola Nigeria Limited, PepsiCo Nigeria, Seven-Up Bottling Company Plc, Nigerian Bottling Company Plc, FrieslandCampina WAMCO Nigeria Plc, Chi Limited, Dufil Prima Foods Plc, Honeywell Flour Mills Plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's FMCG retail modern trade market appears promising, driven by ongoing urbanization and a growing middle class. As consumer preferences shift towards convenience and quality, retailers are likely to invest in technology and innovative retail formats. Additionally, the increasing adoption of digital payment solutions will enhance transaction efficiency. However, addressing infrastructure and regulatory challenges will be crucial for sustaining growth and attracting investment in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Food and Beverages Personal Care Products Household Care Products Health and Wellness Products Baby Care Products Pet Care Products Others |

| By End-User | Households Retailers Wholesalers Institutions |

| By Sales Channel | Supermarkets Hypermarkets Convenience Stores Online Retail Traditional Retail |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Distribution |

| By Price Range | Low Price Mid Price Premium Price |

| By Brand Ownership | National Brands Private Labels Regional Brands |

| By Packaging Type | Flexible Packaging Rigid Packaging Sustainable Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Modern Trade Retailers | 150 | Store Managers, Regional Directors |

| Consumer Insights on FMCG Purchases | 200 | General Consumers, Brand Loyalists |

| Supply Chain and Distribution Analysis | 100 | Logistics Managers, Distribution Coordinators |

| Market Trends and Consumer Behavior | 120 | Market Analysts, Retail Consultants |

| Product Category Insights | 80 | Category Managers, Product Development Teams |

The Nigeria FMCG Retail Modern Trade Market is valued at approximately USD 15 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and a growing middle class that seeks convenience and quality in shopping experiences.