Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3476

Pages:84

Published On:January 2026

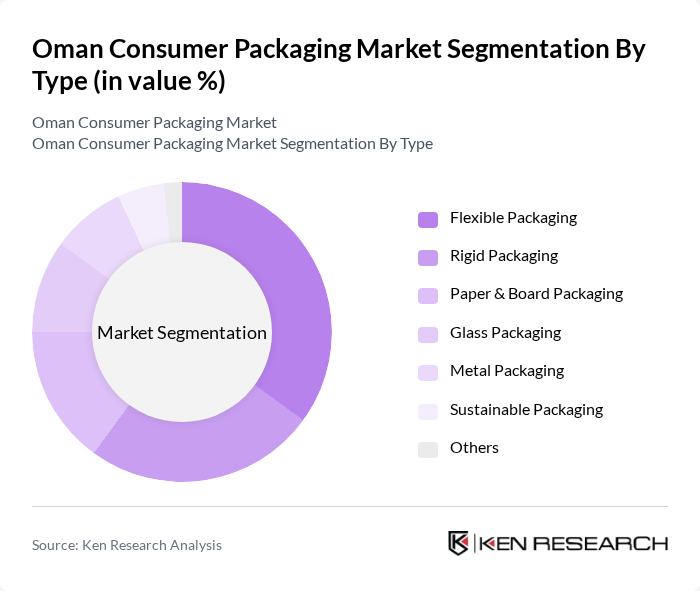

By Type:The consumer packaging market can be segmented into various types, including flexible packaging, rigid packaging, paper & paperboard packaging, glass packaging, metal packaging, and others. Among these, flexible packaging is gaining significant traction due to its lightweight nature and cost-effectiveness, making it a preferred choice for manufacturers and consumers alike. Rigid packaging also holds a substantial share, particularly in sectors like food and beverages, where durability and protection are paramount.

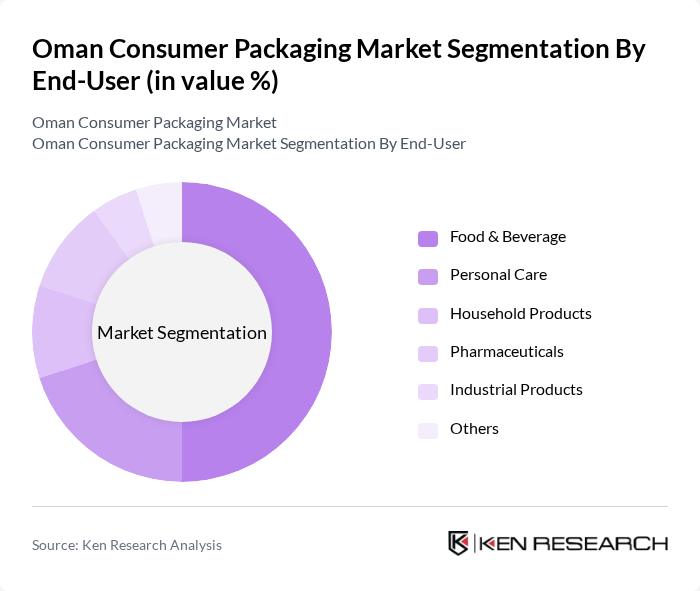

By End-User:The end-user segmentation includes food & beverage, personal care, household products, pharmaceuticals, and others. The food & beverage sector is the largest consumer of packaging solutions, driven by the increasing demand for convenience foods and beverages. Personal care products also contribute significantly to the market, as consumers seek attractive and functional packaging that enhances product appeal.

The Oman Consumer Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Packaging Company, Al Kamil Plastics, National Plastic Factory, Oman Refreshment Company, Al Jazeera Factory for Plastic Products, Gulf Packaging Industries, Oman National Engineering and Investment Company, Al Mufeedah Packaging, Muscat Packaging, Al Batinah Packaging, Oman Food Investment Holding Company, Al Harthy Packaging, Al Muna Packaging, Al Fawaz Group, Al Mufeedah Group contribute to innovation, geographic expansion, and service delivery in this space.

The Oman consumer packaging market is poised for transformative growth, driven by increasing consumer demand for sustainable and innovative packaging solutions. As the food and beverage sector expands, manufacturers are likely to invest in advanced technologies to enhance packaging efficiency and safety. Additionally, the government's focus on environmental regulations will further encourage the adoption of eco-friendly materials. Overall, the market is expected to evolve, aligning with global trends while addressing local consumer needs and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible Packaging Rigid Packaging Paper & Paperboard Packaging Glass Packaging Metal Packaging Others |

| By End-User | Food & Beverage Personal Care Household Products Pharmaceuticals Others |

| By Material | Plastic Paper Metal Glass Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Direct Sales Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| By Application | Food Packaging Beverage Packaging Cosmetic Packaging Pharmaceutical Packaging Others |

| By Sustainability Level | Eco-Friendly Packaging Recyclable Packaging Non-Recyclable Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Packaging | 120 | Product Managers, Quality Assurance Officers |

| Personal Care Products | 100 | Brand Managers, Marketing Executives |

| Pharmaceutical Packaging | 80 | Regulatory Affairs Specialists, Supply Chain Managers |

| Retail Packaging Solutions | 110 | Store Managers, Merchandising Directors |

| Eco-friendly Packaging Initiatives | 90 | Sustainability Coordinators, R&D Managers |

The Oman Consumer Packaging Market is valued at approximately USD 1.4 billion, driven by factors such as increasing consumer demand for packaged goods, urbanization, and rising disposable income, which have collectively boosted the market's growth over the past five years.