Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9067

Pages:88

Published On:November 2025

By Mode of Transport:The modes of transport in the retail logistics market includeRoad Logistics, Rail Logistics, Air Freight, and Sea Freight. Road logistics is the most widely used mode due to the extensive road network and the flexibility it offers for last-mile delivery. Rail logistics is gaining traction for bulk goods, particularly with ongoing investments in rail infrastructure. Air freight is preferred for time-sensitive deliveries, especially for high-value and perishable goods. Sea freight remains essential for international trade, especially for large volumes of goods, leveraging Jeddah’s port and Red Sea access .

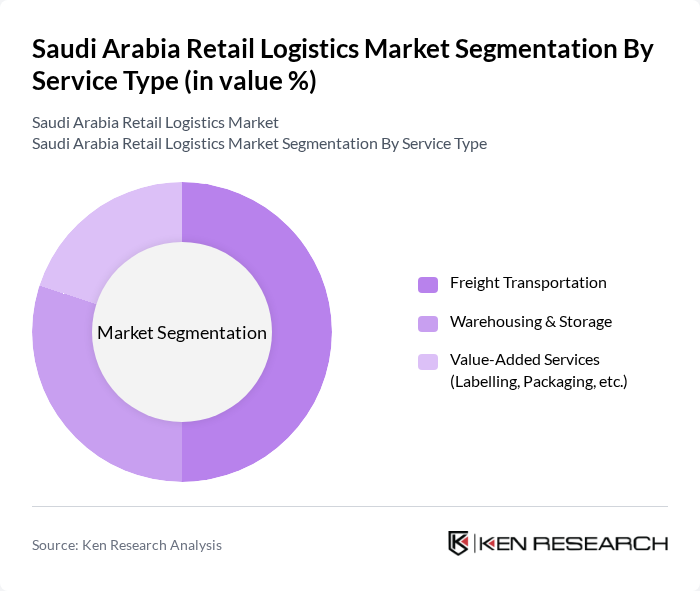

By Service Type:The service types in the retail logistics market encompassFreight Transportation, Warehousing & Storage, and Value-Added Services (Labelling, Packaging, etc.). Freight transportation is the backbone of logistics, facilitating the movement of goods across domestic and international markets. Warehousing and storage services are crucial for inventory management, supported by the expansion of modern distribution centers. Value-added services such as labelling, packaging, and order fulfillment are increasingly important for enhancing customer satisfaction and streamlining supply chains, especially in e-commerce .

The Saudi Arabia Retail Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Post, Aramex, DHL Supply Chain, Agility Logistics, Bahri (National Shipping Company of Saudi Arabia), SISCO (Saudi Industrial Services Co.), Almajdouie Logistics, Naqel Express, Zajil Express, Kuehne + Nagel, FedEx, UPS Saudi Arabia, Gulf Agency Company (GAC Saudi Arabia), Al-Futtaim Logistics, Almarai Logistics contribute to innovation, geographic expansion, and service delivery in this space. These companies leverage advanced technologies, invest in infrastructure, and adopt digital transformation strategies to enhance operational efficiency and customer experience .

The future of the retail logistics market in Saudi Arabia appears promising, driven by technological advancements and evolving consumer preferences. The integration of automation and AI in logistics operations is expected to enhance efficiency and reduce costs. Furthermore, the growing emphasis on sustainability will likely lead to increased investments in green logistics solutions, aligning with global trends. As the market adapts to these changes, companies that leverage technology and sustainability will gain a competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transport | Road Logistics Rail Logistics Air Freight Sea Freight |

| By Service Type | Freight Transportation Warehousing & Storage Value-Added Services (Labelling, Packaging, etc.) |

| By End-User Industry | Retail & Wholesale Trade Consumer Goods Pharmaceuticals & Healthcare Electronics & Appliances Automotive Food & Beverage Others |

| By Region | Riyadh (Central Region) Jeddah (Western Region) Dammam (Eastern Region) Other Regions |

| By Technology Adoption | Automated Warehousing IoT in Logistics Blockchain for Supply Chain Transparency Fleet Management Systems Others |

| By Application | Retail Distribution E-commerce Fulfillment Inventory Management Order Processing Last-Mile Delivery Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants Others |

| By Policy Support | Subsidies for Logistics Infrastructure Tax Incentives for Logistics Companies Regulatory Support for E-commerce Logistics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Grocery Retail Logistics | 100 | Logistics Managers, Supply Chain Managers |

| Electronics Retail Supply Chain | 60 | Operations Managers, Inventory Managers |

| Fashion Retail Distribution | 50 | Warehouse Supervisors, Logistics Coordinators |

| E-commerce Fulfillment Strategies | 70 | E-commerce Operations Managers, Customer Experience Managers |

| Pharmaceutical Logistics Management | 40 | Compliance Officers, Distribution Managers |

The Saudi Arabia Retail Logistics Market is valued at approximately USD 27 billion, driven by the rapid expansion of e-commerce, increasing consumer demand for faster delivery services, and significant investments in logistics infrastructure.