Region:Africa

Author(s):Geetanshi

Product Code:KRAB1671

Pages:96

Published On:October 2025

By Product Category:The product category segmentation includes various subsegments such as Luxury Apparel, Luxury Footwear, Luxury Accessories, Jewelry & Timepieces, Handbags & Leather Goods, Home & Lifestyle Decor, and Fragrances & Beauty Products. Among these, Luxury Apparel is the leading subsegment, driven by the increasing demand for both traditional and contemporary styles. The rise of local designers and the influence of social media have significantly contributed to the popularity of luxury apparel, making it a focal point in the market. The luxury fashion market is characterized by a mix of informal and formal segments, with high-end boutiques and designer brands capturing the premium segment .

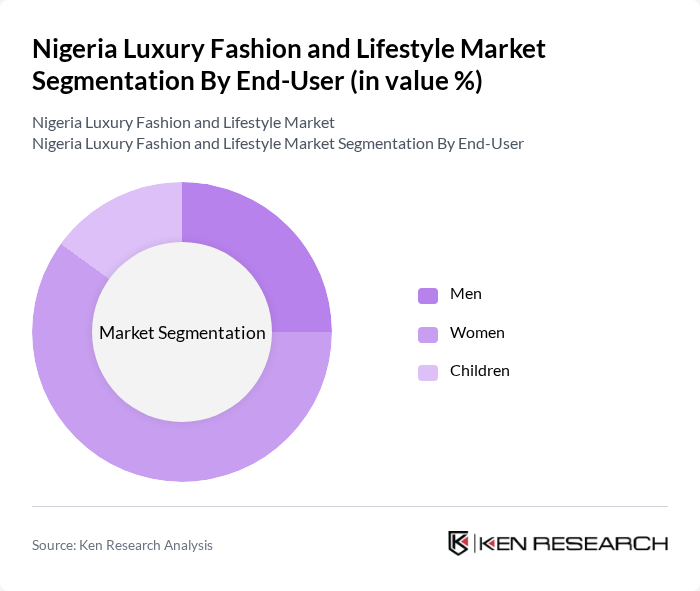

By End-User:This segmentation includes Men, Women, and Children. The Women segment dominates the market, driven by a growing interest in fashion and luxury products among female consumers. Women are increasingly investing in luxury apparel and accessories, influenced by social media trends and the desire for self-expression through fashion. The rise of female entrepreneurs and influencers in the fashion industry further contributes to the growth of this segment. Men and children also represent significant market shares, with men showing increased interest in luxury footwear and accessories .

The Nigeria Luxury Fashion and Lifestyle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Polo Luxury Group, Temple Muse, Tiffany Amber, Mai Atafo, Lisa Folawiyo, Alara Lagos, Zashadu, Deola Sagoe, David Wej, Grey Velvet, Lanre Da Silva Ajayi, Orange Culture, Ermenegildo Zegna (Nigeria), Montblanc (Nigeria), Hugo Boss (Nigeria) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's luxury fashion and lifestyle market appears promising, driven by increasing consumer awareness and a shift towards premium products. As disposable incomes rise and e-commerce continues to expand, brands are likely to invest in digital marketing strategies to engage consumers effectively. Additionally, the growing interest in sustainable fashion practices will encourage brands to adopt eco-friendly approaches, appealing to environmentally conscious consumers. Overall, the market is poised for growth, with innovative strategies shaping its trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Luxury Apparel (Ready-to-wear, Pret-a-porter, Traditional Attire) Luxury Footwear Luxury Accessories (Watches, Sunglasses, Belts, Scarves) Jewelry & Timepieces Handbags & Leather Goods Home & Lifestyle Decor Fragrances & Beauty Products |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail/E-commerce Department Stores Luxury Boutiques Specialty Retailers |

| By Price Tier | Premium High-End Ultra-Luxury |

| By Occasion | Everyday Wear Formal/Business Wear Special Events & Ceremonial |

| By Brand Origin | International Brands Nigerian Designer Brands Collaborative/Co-branded Collections |

| By Distribution Mode | Direct-to-Consumer Distributors/Wholesalers Online Marketplaces |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Purchases | 120 | Affluent Consumers, Fashion Enthusiasts |

| High-End Accessories Market | 90 | Luxury Brand Managers, Retail Buyers |

| Lifestyle and Home Decor Segment | 60 | Interior Designers, Homeowners with High Disposable Income |

| Luxury Event Participation | 50 | Event Organizers, Attendees of Fashion Shows |

| Online Luxury Shopping Trends | 100 | eCommerce Managers, Digital Marketing Specialists |

The Nigeria Luxury Fashion and Lifestyle Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increasing disposable incomes and a rising interest in luxury brands among consumers, particularly in urban centers like Lagos and Abuja.