Italy Luxury Fashion and Lifestyle Market Overview

- The Italy Luxury Fashion and Lifestyle Market is valued at USD 18 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for high-quality, luxury products among affluent consumers, coupled with a resurgence in tourism and international shopping. The market has seen a significant uptick in spending on luxury goods, particularly in the apparel and accessories segments, as consumers prioritize quality and brand prestige. Rising disposable incomes and the expansion of e-commerce platforms have further accelerated market growth, with online sales accounting for 21.7% of total luxury revenue.

- Key cities such as Milan, Florence, and Rome dominate the luxury fashion market due to their historical significance in fashion design and culture. Milan, often referred to as the fashion capital of the world, hosts major fashion events and is home to numerous flagship stores of luxury brands. Florence, with its rich artisanal heritage, attracts consumers seeking unique, handcrafted luxury items, while Rome's status as a tourist hub enhances its appeal in the luxury retail sector. The wholesale sales for Italian brands have demonstrated remarkable resilience, growing by 20% in the first five months of 2025 compared to the previous year.

- The EU Digital Product Passports regulation, mandated to be implemented by 2030, requires luxury brands to disclose detailed environmental data for every product, including material traceability and emissions disclosure. This comprehensive framework pushes brands to adopt sustainable practices throughout their production processes and supply chains. The initiative is part of a broader strategy to enhance the country's reputation as a leader in sustainable luxury, encouraging brands to innovate while meeting consumer demand for eco-friendly products.

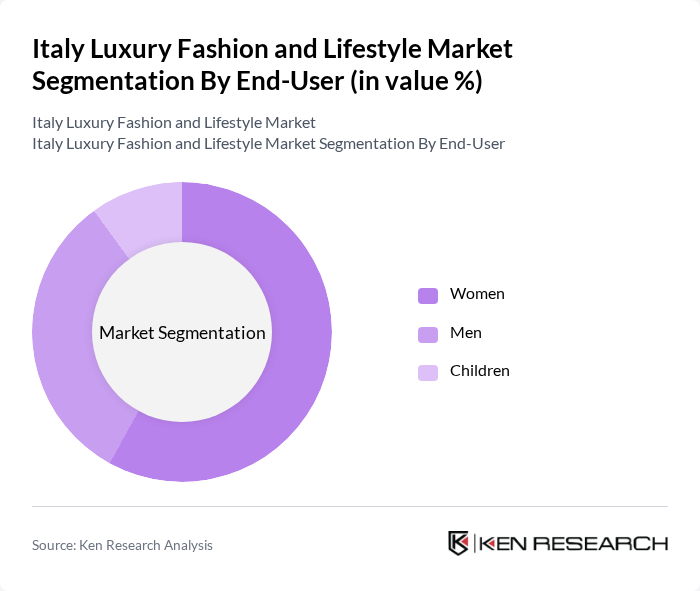

Italy Luxury Fashion and Lifestyle Market Segmentation

By Type:The luxury fashion and lifestyle market can be segmented into various types, including apparel, footwear, accessories, jewelry, handbags, fragrances, watches, cosmetics & beauty products, home & lifestyle goods, and others. Each of these segments caters to different consumer preferences and trends, with specific sub-segments showing varying levels of demand. The luxury fashion segment represents the largest category, generating USD 5.34 billion in revenue, while watches demonstrate the fastest growth trajectory with strong demand for collectible timepieces and authenticity certification.

By End-User:The market can also be segmented by end-user demographics, which include women, men, and children. Each demographic has distinct preferences and purchasing behaviors, influencing the types of products that are most popular within the luxury sector. Women command a dominant position with 58.45% market share, driven by robust demand in apparel, leather goods, jewelry, and beauty products. The men's luxury segment is experiencing accelerated growth, with shifting gender norms leading to increased male participation in categories like skincare, fine jewelry, and accessories.

Italy Luxury Fashion and Lifestyle Market Competitive Landscape

The Italy Luxury Fashion and Lifestyle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gucci, Prada, Dolce & Gabbana, Valentino, Fendi, Bulgari, Salvatore Ferragamo, Giorgio Armani, Versace, Tod's, Moschino, Max Mara, Ermenegildo Zegna, Brunello Cucinelli, Loro Piana, Miu Miu, Marni, Bottega Veneta, Roberto Cavalli, Etro contribute to innovation, geographic expansion, and service delivery in this space.

Italy Luxury Fashion and Lifestyle Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The rise in disposable income among Italian consumers is a significant driver for the luxury fashion market. In future, the average disposable income in Italy is projected to reach €22,780 per capita, reflecting a 0% increase from 2023. This increase allows consumers to allocate more funds towards luxury goods, enhancing their purchasing power. As a result, brands are witnessing a surge in demand for high-end products, particularly in urban areas where wealth concentration is higher.

- Rising Demand for Sustainable Fashion:The luxury fashion sector is increasingly influenced by sustainability trends. In future, approximately 50% of Italian consumers are expected to prioritize eco-friendly products, leading to a market shift. The Italian government has set a target to reduce carbon emissions by 55% by 2030, encouraging brands to adopt sustainable practices. This shift not only meets consumer demand but also aligns with regulatory frameworks, fostering growth in sustainable luxury fashion segments.

- Growth of E-commerce Platforms:E-commerce is revolutionizing the luxury fashion landscape in Italy. In future, online luxury sales are anticipated to account for €8 billion, representing a 20% increase from 2023. The convenience of online shopping, coupled with enhanced digital marketing strategies, is attracting a younger demographic. Additionally, the COVID-19 pandemic has accelerated the shift towards online retail, prompting luxury brands to invest in robust e-commerce platforms to capture this growing market segment.

Market Challenges

- Economic Uncertainty:Economic instability poses a significant challenge to the luxury fashion market in Italy. The IMF forecasts a GDP growth rate of only 0.5% for Italy in future, which may dampen consumer confidence. High inflation rates, projected at 2%, further strain household budgets, leading to cautious spending on luxury items. This uncertainty can result in fluctuating sales and hinder long-term investment strategies for luxury brands.

- Intense Competition:The luxury fashion market in Italy is characterized by fierce competition among established brands and emerging designers. In future, over 150 luxury brands are expected to operate in the Italian market, intensifying the battle for market share. This saturation can lead to price wars and increased marketing expenditures, impacting profit margins. Brands must innovate and differentiate themselves to maintain a competitive edge in this crowded marketplace.

Italy Luxury Fashion and Lifestyle Market Future Outlook

The future of the luxury fashion market in Italy appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value for consumers, brands that prioritize ethical practices are likely to thrive. Additionally, the integration of augmented reality and artificial intelligence in retail experiences is expected to enhance customer engagement. The market will continue to adapt to digital trends, ensuring that luxury brands remain relevant and appealing to a diverse consumer base.

Market Opportunities

- Expansion into Emerging Markets:Luxury brands have a significant opportunity to expand into emerging markets, particularly in Asia and Africa. With a growing middle class and increasing disposable incomes, these regions present untapped potential for luxury fashion sales. By establishing a presence in these markets, brands can diversify their revenue streams and mitigate risks associated with economic fluctuations in Europe.

- Collaborations with Influencers:Collaborating with social media influencers can enhance brand visibility and attract younger consumers. In future, influencer marketing is projected to generate €1 billion in revenue for the fashion industry in Italy. By leveraging the reach of influencers, luxury brands can effectively engage with target audiences, driving sales and fostering brand loyalty in an increasingly digital marketplace.