Region:Middle East

Author(s):Dev

Product Code:KRAC3336

Pages:84

Published On:October 2025

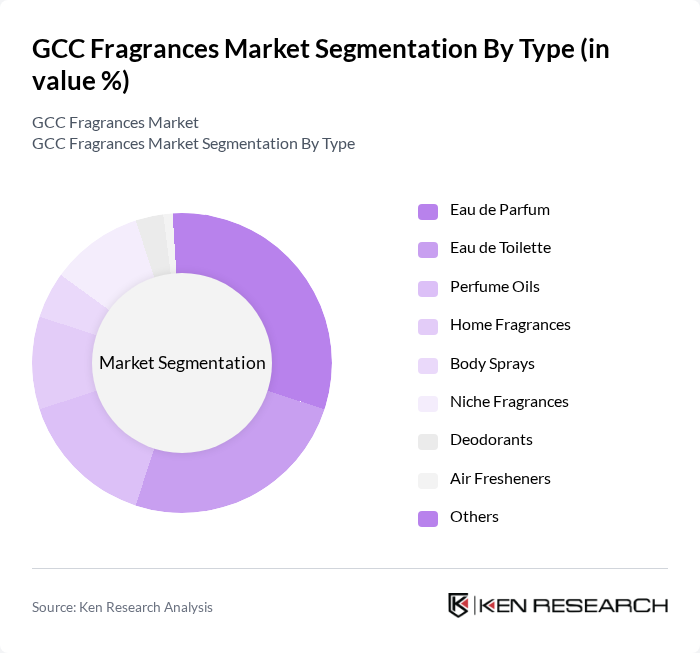

By Type:The market is segmented into various types of fragrances, each catering to different consumer preferences and occasions. The subsegments include Eau de Parfum, Eau de Toilette, Perfume Oils, Home Fragrances, Body Sprays, Niche Fragrances, Deodorants, Air Fresheners, and Others. Among these, Eau de Parfum and Perfume Oils are particularly popular due to their long-lasting scents and luxurious appeal. Eau de Parfum commands a leading share in the fine fragrances segment, reflecting its popularity for premium, enduring scents in the region’s climate . The trend toward personalization and unique fragrance experiences has also led to a rise in niche fragrances, appealing to consumers seeking exclusivity and bespoke scent profiles .

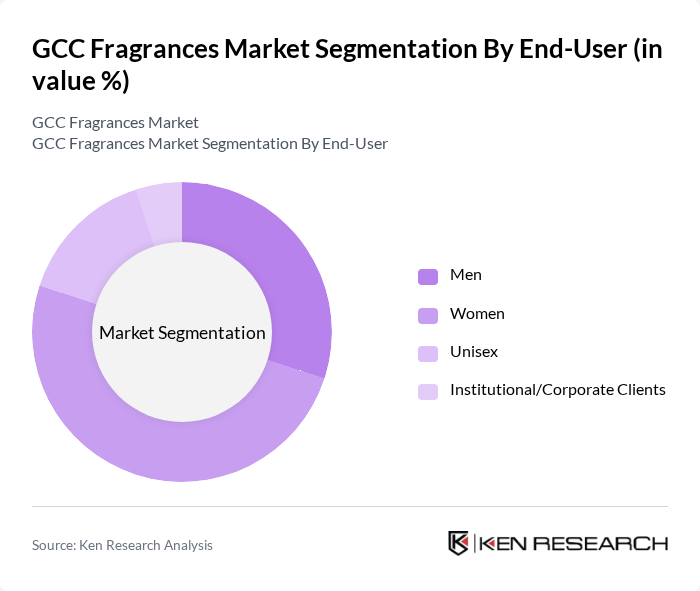

By End-User:The end-user segmentation includes Men, Women, Unisex, and Institutional/Corporate Clients. The market is predominantly driven by women, who are the largest consumers of fragrances, followed closely by men. The growing trend of unisex fragrances is also gaining traction, reflecting a shift in consumer preferences toward more inclusive and versatile scent options. Institutional clients, such as hotels and spas, are increasingly investing in fragrances to enhance customer experiences and brand ambiance .

The GCC Fragrances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Perfumes, Ajmal Perfumes, Swiss Arabian Perfumes, Abdul Samad Al Qurashi, Rasasi Perfumes, Arabian Oud, Al Rehab Perfumes, Afnan Perfumes, Nabeel Perfumes, The Fragrance Kitchen, Oudh Al Anfar, Asgharali Perfumes, Yas Perfumes, Ghawali, LVMH (Louis Vuitton Moët Hennessy), Kering (Gucci, Yves Saint Laurent Parfums), Amouage contribute to innovation, geographic expansion, and service delivery in this space.

The GCC fragrances market is poised for continued growth, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability will likely shape product development, with brands investing in eco-friendly practices. Additionally, the rise of personalized fragrances, supported by advancements in AI and data analytics, will cater to the growing demand for unique scent experiences. As e-commerce continues to thrive, brands will need to enhance their online presence to capture the expanding digital consumer base effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Eau de Parfum Eau de Toilette Perfume Oils Home Fragrances Body Sprays Niche Fragrances Deodorants Air Fresheners Others |

| By End-User | Men Women Unisex Institutional/Corporate Clients |

| By Distribution Channel | Specialty Fragrance Stores Online Platforms Department Stores Supermarkets/Hypermarkets Pharmacies & Drugstores Others |

| By Price Range | Premium Mass Market |

| By Fragrance Family | Floral Woody Oriental Fresh Fruity Others |

| By Packaging Type | Glass Bottles Plastic Bottles Metal Containers Refillable Packaging |

| By Occasion | Everyday Use Special Occasions Gifting Seasonal |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Fragrance Sales | 150 | Store Managers, Retail Buyers |

| Fragrance Manufacturing Insights | 100 | Production Managers, Quality Control Officers |

| Consumer Preferences in Fragrances | 150 | End Consumers, Brand Loyalists |

| Distribution Channel Analysis | 80 | Logistics Coordinators, Supply Chain Managers |

| Market Trends and Innovations | 70 | Product Development Managers, Marketing Executives |

The GCC Fragrances Market is valued at approximately USD 4.1 billion, driven by increasing demand for luxury and niche fragrances, personal grooming preferences, and cultural affinity for perfumes in the region.