Region:Africa

Author(s):Rebecca

Product Code:KRAB4745

Pages:84

Published On:October 2025

By Type:The market is segmented into Mobile Wallets, Payment Gateways, Digital Banking Solutions, Remittance Services, Buy Now Pay Later Services, Cryptocurrency Platforms, Agency Banking Platforms, POS (Point-of-Sale) Solutions, and Others. Mobile Wallets are the leading sub-segment, driven by convenience for everyday transactions, rapid smartphone adoption, and the increasing preference for cashless payments. Payment gateways and digital banking solutions also show strong growth due to the expansion of e-commerce and SME digitization. Remittance services are vital for cross-border transactions, while agency banking platforms have expanded financial access in rural areas by leveraging agent networks .

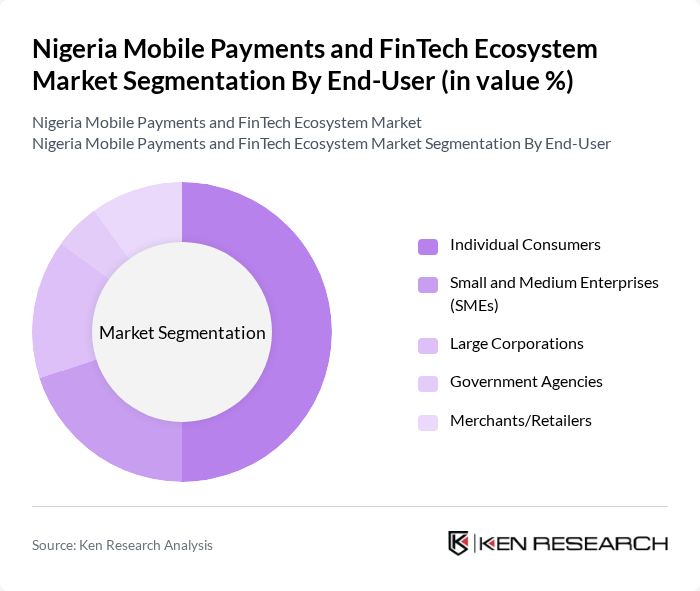

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Government Agencies, and Merchants/Retailers. Individual Consumers represent the largest segment, driven by widespread adoption of mobile payment solutions for personal transactions. SMEs and merchants increasingly leverage mobile payments for business operations, while government agencies and large corporations use digital platforms for efficiency and transparency. Urban areas show higher adoption rates due to better digital infrastructure and financial literacy .

The Nigeria Mobile Payments and FinTech Ecosystem Market is characterized by a dynamic mix of regional and international players. Leading participants such as Flutterwave, Paystack, Interswitch, OPay, Kuda Bank, Cowrywise, PalmPay, Moniepoint, Remita, Paga, Chipper Cash, Carbon (formerly Paylater), Quickteller, VFD Microfinance Bank, Zenith Bank, MTN Mobile Money (MoMo), Airtel Money, PocketMoni, VBank, FairMoney contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's mobile payments and fintech ecosystem appears promising, driven by technological advancements and increasing consumer acceptance. As digital literacy continues to rise, more users are expected to engage with mobile payment platforms. Additionally, the integration of artificial intelligence and machine learning into financial services is anticipated to enhance user experience and security. The ongoing expansion of internet connectivity will further facilitate access to these services, particularly in underserved regions, fostering greater financial inclusion across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Wallets Payment Gateways Digital Banking Solutions Remittance Services Buy Now Pay Later Services Cryptocurrency Platforms Agency Banking Platforms POS (Point-of-Sale) Solutions Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Agencies Merchants/Retailers |

| By Application | E-commerce Transactions Bill Payments Fund Transfers In-store Payments Salary Disbursements International Remittances |

| By Distribution Channel | Direct Sales Online Platforms Retail Partnerships Agent Networks |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Money USSD Payments QR Code Payments |

| By Customer Segment | Urban Customers Rural Customers Youth Segment Unbanked/Underbanked Population |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mobile Payment Users | 120 | Regular Users, Occasional Users |

| Small Business Owners Utilizing FinTech | 70 | Entrepreneurs, Business Managers |

| FinTech Service Providers | 40 | Product Managers, Marketing Directors |

| Regulatory Bodies and Policy Makers | 40 | Regulators, Compliance Officers |

| Financial Institutions Engaged in Mobile Payments | 50 | Banking Executives, Financial Analysts |

The Nigeria Mobile Payments and FinTech Ecosystem Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the adoption of digital payment solutions, smartphone penetration, and a large unbanked population seeking financial inclusion.