Region:Africa

Author(s):Shubham

Product Code:KRAB6173

Pages:93

Published On:October 2025

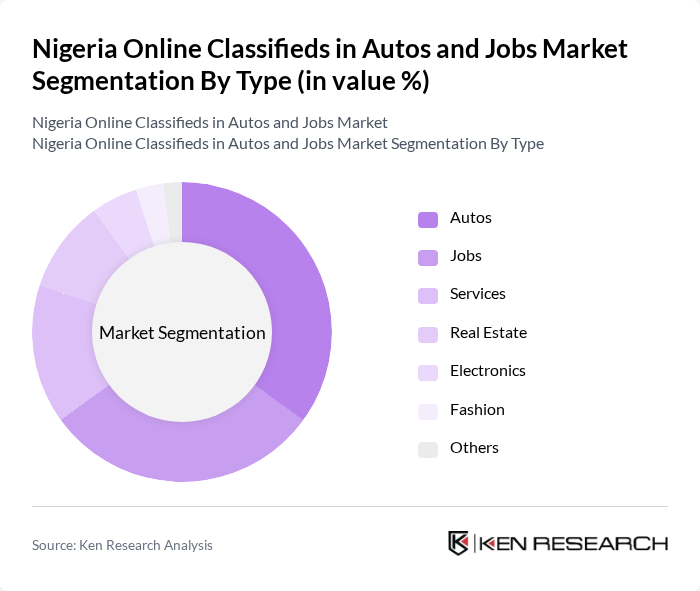

By Type:The market is segmented into various types, including Autos, Jobs, Services, Real Estate, Electronics, Fashion, and Others. Among these, the Autos and Jobs segments are particularly significant, with Autos being driven by the growing demand for personal and commercial vehicles, while the Jobs segment benefits from the increasing number of job seekers and employers utilizing online platforms for recruitment.

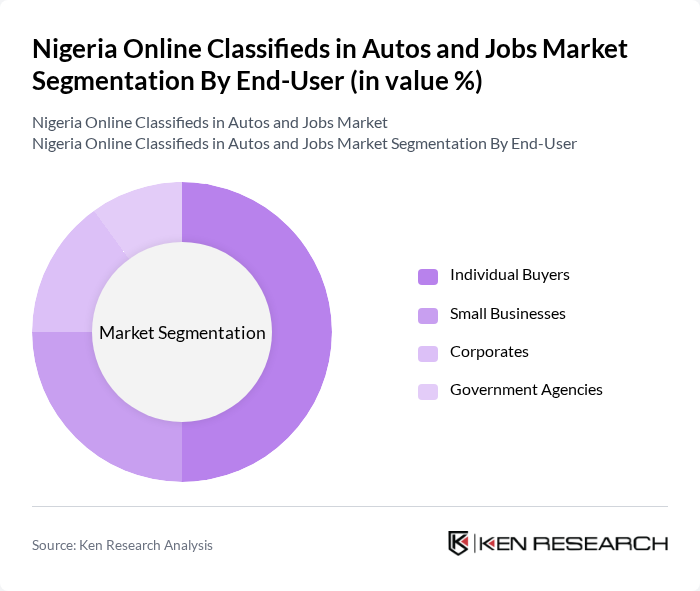

By End-User:This segmentation includes Individual Buyers, Small Businesses, Corporates, and Government Agencies. Individual Buyers and Small Businesses dominate the market, as they frequently utilize online classifieds for purchasing vehicles and seeking job opportunities, reflecting the growing trend of digital engagement among these groups.

The Nigeria Online Classifieds in Autos and Jobs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jiji Nigeria, OLX Nigeria, Cars45, Jobberman, Cheki Nigeria, MyJobMag, Nairaland, Ady.ng, Ngcareers, Konga, GIG Logistics, VConnect, JobGurus, DealDey, Olist contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's online classifieds market in autos and jobs appears promising, driven by technological advancements and changing consumer behaviors. As mobile usage continues to rise, platforms that prioritize user experience and security will likely gain a competitive edge. Additionally, the integration of AI and machine learning can enhance personalization and efficiency in job matching and vehicle listings, further attracting users. The market is poised for growth as digital literacy improves and more Nigerians embrace online solutions for their transportation and employment needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Autos Jobs Services Real Estate Electronics Fashion Others |

| By End-User | Individual Buyers Small Businesses Corporates Government Agencies |

| By Sales Channel | Online Platforms Mobile Applications Social Media Offline Channels |

| By Price Range | Low-End Mid-Range High-End |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By User Demographics | Age Groups Income Levels Education Levels |

| By Customer Loyalty | New Users Returning Users Loyal Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Job Seekers | 150 | Recent Graduates, Mid-Career Professionals |

| Car Buyers | 120 | First-Time Buyers, Used Car Shoppers |

| Advertisers on Classifieds | 100 | Small Business Owners, HR Managers |

| Platform Operators | 80 | Product Managers, Marketing Directors |

| Industry Experts | 50 | Market Analysts, Economic Researchers |

The Nigeria Online Classifieds market in Autos and Jobs is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a rising middle class seeking convenient platforms for transactions.