Region:Africa

Author(s):Shubham

Product Code:KRAB1175

Pages:85

Published On:October 2025

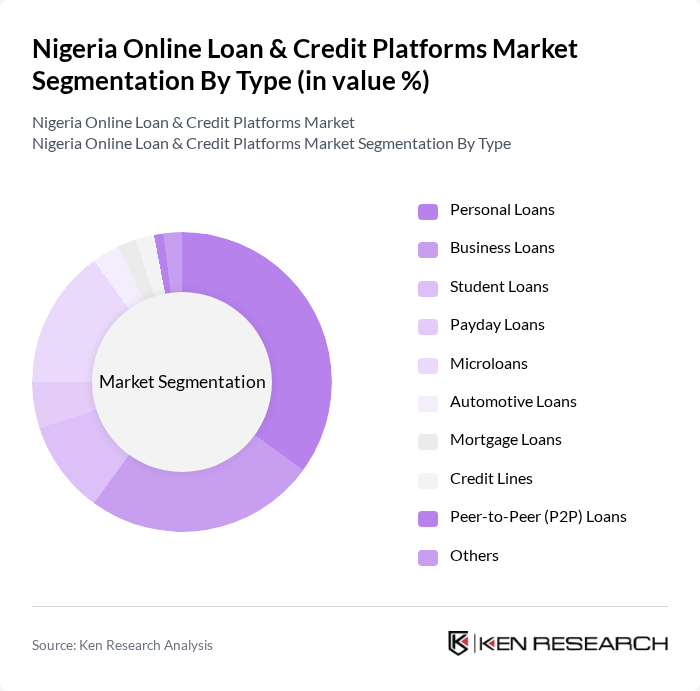

By Type:The online loan and credit platforms in Nigeria can be categorized into various types, including personal loans, business loans, student loans, payday loans, microloans, automotive loans, mortgage loans, credit lines, peer-to-peer (P2P) loans, and others. Among these,personal loansare the most popular due to their flexibility and ease of access, catering to a wide range of consumer needs.Business loansare also significant, driven by the growing number of small and medium enterprises (SMEs) seeking funding for operations and expansion. The demand formicroloanshas surged, particularly among low-income individuals and entrepreneurs, as they provide essential financial support for small-scale ventures .

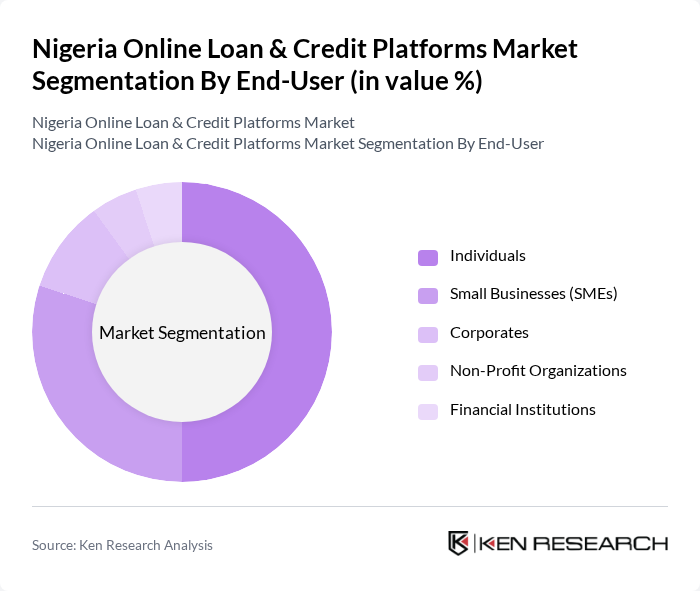

By End-User:The end-users of online loan and credit platforms in Nigeria include individuals, small businesses (SMEs), corporates, non-profit organizations, and financial institutions.Individualsrepresent the largest segment, driven by the need for personal financing solutions for education, healthcare, and emergencies.Small businessesare also a significant user group, as they often require quick access to funds for operational costs and growth.Corporatesandnon-profit organizationsutilize these platforms for larger financing needs, whilefinancial institutionsmay leverage online lending for portfolio diversification .

The Nigeria Online Loan & Credit Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carbon (formerly Paylater), Branch International, FairMoney, Renmoney, QuickCheck, Kuda Bank, PalmPay, Aella Credit, Lendigo, Fint, Zedvance, CredPal, Migo, KiaKia, Lidya contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's online loan and credit platforms is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As digital literacy improves, more individuals will engage with online lending services, particularly in underserved regions. Additionally, partnerships between fintech companies and traditional banks are likely to enhance service offerings, creating a more robust financial ecosystem. The integration of artificial intelligence in credit assessments will further streamline processes, making lending more efficient and accessible to a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Payday Loans Microloans Automotive Loans Mortgage Loans Credit Lines Peer-to-Peer (P2P) Loans Others |

| By End-User | Individuals Small Businesses (SMEs) Corporates Non-Profit Organizations Financial Institutions |

| By Loan Amount | Below ?50,000 ?50,000 - ?200,000 ?200,000 - ?1,000,000 Above ?1,000,000 |

| By Repayment Period | Short-term (up to 6 months) Medium-term (6 months to 2 years) Long-term (above 2 years) |

| By Interest Rate Type | Fixed Rate Variable Rate |

| By Distribution Channel | Online Platforms Mobile Apps Agent Networks Bank Partnerships |

| By Customer Segment | Low-Income Borrowers Middle-Income Borrowers High-Income Borrowers Unbanked/Underbanked Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Users | 120 | Individuals aged 18-45, employed, with varying income levels |

| Small Business Loan Applicants | 90 | Small business owners, entrepreneurs, and startup founders |

| Credit Score Improvement Seekers | 70 | Consumers actively seeking to improve their credit ratings |

| Financial Advisors | 40 | Certified financial planners and credit counselors |

| Regulatory Stakeholders | 40 | Officials from financial regulatory bodies and consumer protection agencies |

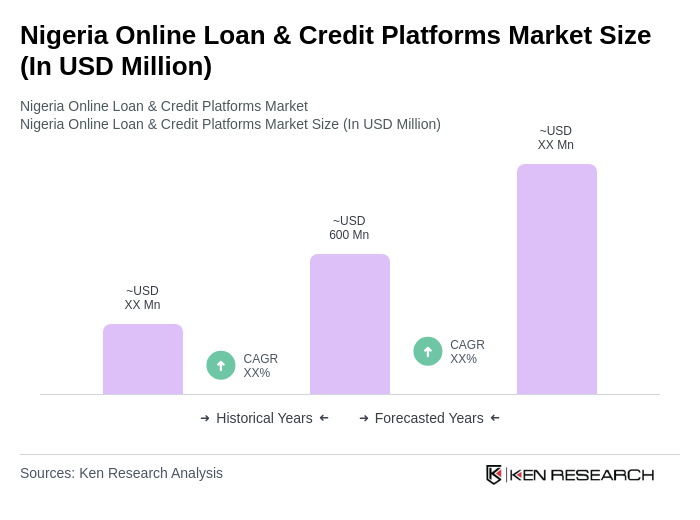

The Nigeria Online Loan & Credit Platforms Market is valued at approximately USD 600 million, driven by the increasing demand for accessible credit solutions and the rapid expansion of digital financial services in the country.