Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB5709

Pages:93

Published On:October 2025

By Type:The online loan and credit platforms market is segmented into various types of loans, each catering to different consumer needs. The primary subsegments include Personal Loans, Business Loans, Student Loans, Auto Loans, Home Equity Loans, Credit Lines, Peer-to-Peer Loans, Payday Loans, Invoice Financing, and Others. Personal Loans are particularly popular due to their flexibility and ease of access, while Business Loans are essential for small and medium enterprises seeking growth capital. The diversity in loan types allows consumers to choose options that best fit their financial situations .

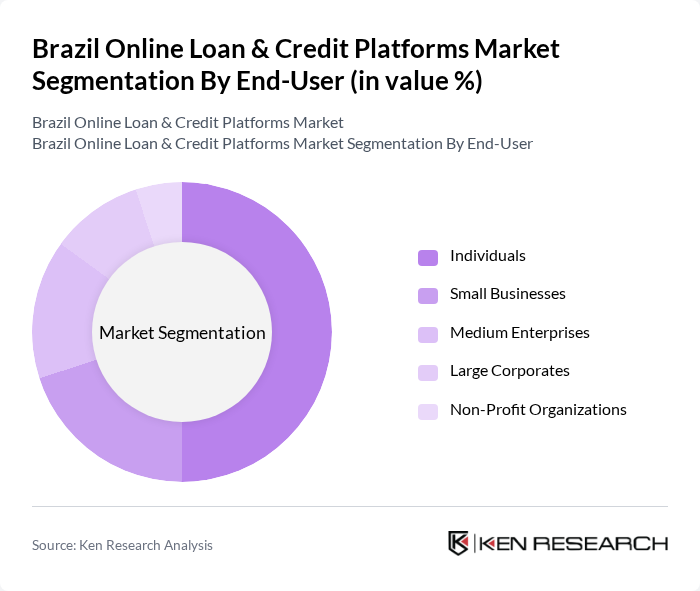

By End-User:The end-user segmentation of the online loan and credit platforms market includes Individuals, Small Businesses, Medium Enterprises, Large Corporates, and Non-Profit Organizations. Individuals represent the largest segment, driven by the need for personal financing solutions. Small and medium enterprises also significantly contribute to the market as they seek funding for operational expenses and growth initiatives. The diverse needs of these end-users drive the development of tailored loan products .

The Brazil Online Loan & Credit Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nubank, Creditas, Banco Inter, Geru, Lendico, Simplic, B3 S.A. – Brasil, Bolsa, Balcão, PagSeguro, Banco Original, Sofisa Direto, FinanZero, Rebel, Acesso Digital, C6 Bank, Banco Pan contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's online loan and credit platforms appears promising, driven by technological advancements and evolving consumer preferences. As fintech innovations continue to emerge, platforms are likely to enhance their service offerings, focusing on user experience and efficiency. Additionally, the integration of artificial intelligence in credit scoring will improve risk assessment, enabling lenders to make informed decisions. The market is expected to adapt to changing regulatory landscapes, ensuring compliance while fostering growth in the digital lending space.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Auto Loans Home Equity Loans Credit Lines Peer-to-Peer Loans Payday Loans Invoice Financing Others |

| By End-User | Individuals Small Businesses Medium Enterprises Large Corporates Non-Profit Organizations |

| By Loan Amount | Micro Loans (up to BRL 5,000) Small Loans (BRL 5,001 - BRL 50,000) Medium Loans (BRL 50,001 - BRL 500,000) Large Loans (above BRL 500,000) |

| By Loan Duration | Short-Term Loans (up to 12 months) Medium-Term Loans (13-60 months) Long-Term Loans (over 60 months) |

| By Interest Rate Type | Fixed Rate Variable Rate |

| By Application Method | Online Applications Mobile Applications API-Integrated Applications In-Person Applications |

| By Policy Support | Subsidized Loans Tax Incentives Government Backed Loans Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Users | 120 | Consumers aged 25-45, Middle-income bracket |

| Small Business Loan Applicants | 60 | Small business owners, Entrepreneurs |

| Credit Line Users | 40 | Consumers with existing credit lines, Financially literate individuals |

| Fintech Industry Experts | 40 | Financial analysts, Fintech consultants |

| Regulatory Stakeholders | 20 | Policy makers, Compliance officers |

The Brazil Online Loan & Credit Platforms Market is valued at approximately USD 220 million, reflecting significant growth driven by the increasing adoption of digital financial services and the expansion of fintech companies offering innovative lending solutions.