Region:Africa

Author(s):Shubham

Product Code:KRAB5694

Pages:87

Published On:October 2025

By Type:The online loan and credit platforms market is segmented into various types, including Personal Loans, Business Loans, Payday Loans, Student Loans, Home Loans, Vehicle Loans, and Others. Personal Loans are currently the most dominant segment, driven by consumer demand for flexible financing options for personal expenses. Business Loans are also significant, as small and medium enterprises increasingly seek online solutions for quick funding. The Payday Loans segment has seen a rise due to the urgent financial needs of consumers, while Student Loans cater to the educational financing market.

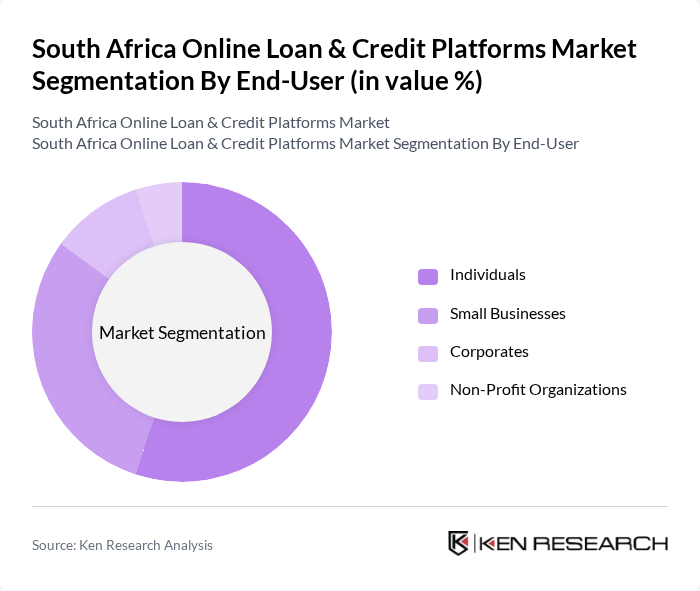

By End-User:The market is also segmented by end-users, which include Individuals, Small Businesses, Corporates, and Non-Profit Organizations. Individuals represent the largest segment, as they seek personal loans for various needs, including emergencies and consumer purchases. Small Businesses are increasingly turning to online platforms for quick access to capital, while Corporates utilize these services for operational financing. Non-Profit Organizations also participate in this market, seeking funding for their initiatives.

The South Africa Online Loan & Credit Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Capitec Bank, African Bank, Wonga, PayJustNow, Lendico, GetBucks, Finbond, DirectAxis, Standard Bank, Absa Bank, Nedbank, FNB, MobiMoney, Lendico, LoanFinder contribute to innovation, geographic expansion, and service delivery in this space.

The South African online loan and credit platforms market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital lending solutions become more prevalent, platforms will increasingly leverage artificial intelligence and big data analytics to enhance credit scoring and risk assessment. Additionally, the focus on customer experience will intensify, with personalized offerings becoming a key differentiator. This dynamic environment presents opportunities for innovation and growth, particularly in underserved markets where access to credit remains limited.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Payday Loans Student Loans Home Loans Vehicle Loans Others |

| By End-User | Individuals Small Businesses Corporates Non-Profit Organizations |

| By Loan Amount | Micro Loans Small Loans Medium Loans Large Loans |

| By Loan Duration | Short-Term Loans Medium-Term Loans Long-Term Loans |

| By Application Method | Online Applications Mobile Applications In-Branch Applications |

| By Credit Score Requirement | Low Credit Score Medium Credit Score High Credit Score |

| By Geographic Reach | Urban Areas Suburban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Users | 150 | Individuals aged 25-45, employed, with prior loan experience |

| Small Business Loan Applicants | 100 | Small business owners, entrepreneurs seeking funding |

| Credit Platform Users | 120 | Consumers who have used online credit services in the last year |

| Financial Advisors | 80 | Certified financial planners, credit counselors |

| Regulatory Experts | 50 | Policy makers, compliance officers in financial institutions |

The South Africa Online Loan & Credit Platforms Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by the demand for accessible financial solutions, particularly among unbanked and underbanked populations.