Region:Africa

Author(s):Rebecca

Product Code:KRAA1425

Pages:92

Published On:August 2025

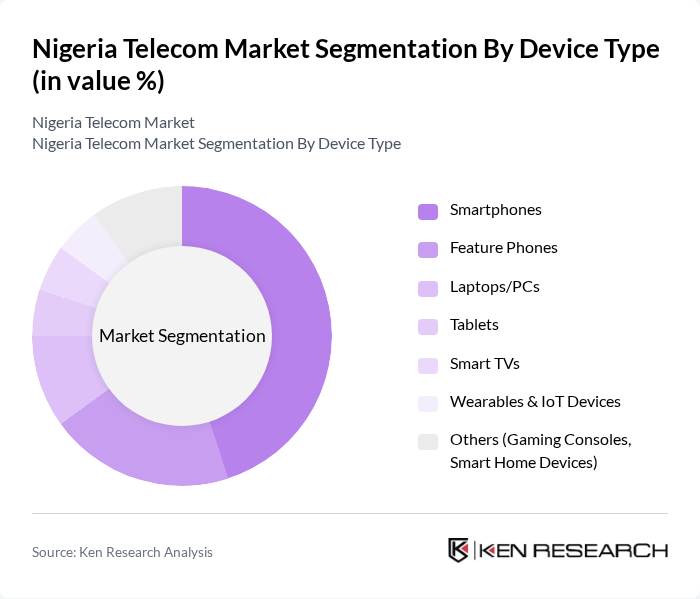

By Device Type:The device type segmentation includes various subsegments such as smartphones, feature phones, laptops/PCs, tablets, smart TVs, wearables & IoT devices, and others like gaming consoles and smart home devices. Among these, smartphones dominate the market due to their affordability, increasing internet penetration, and the growing trend of mobile applications. The rise in mobile commerce, social media usage, and the adoption of mobile money services has further fueled the demand for smartphones, making them the preferred choice for consumers. Feature phones continue to serve rural and lower-income populations, while laptops/PCs and tablets are primarily used in urban centers for business and education .

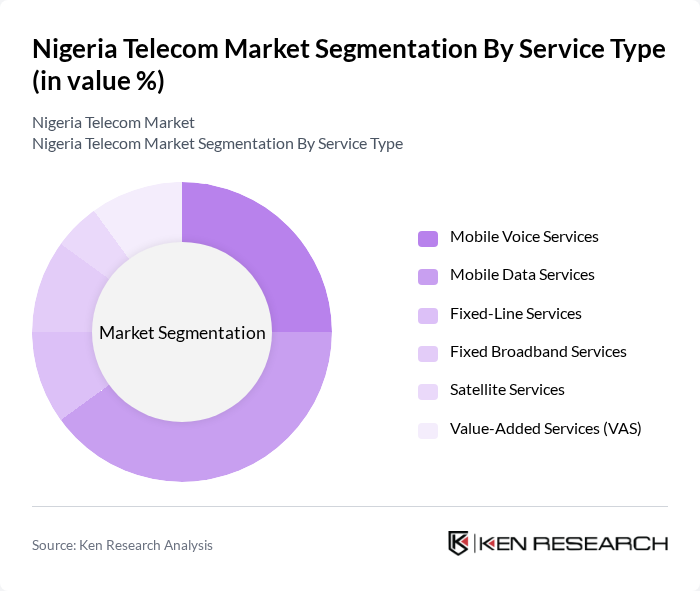

By Service Type:The service type segmentation encompasses mobile voice services, mobile data services, fixed-line services, fixed broadband services, satellite services, and value-added services (VAS). Mobile data services are the leading segment, driven by the increasing consumption of data for streaming, social media, online gaming, and mobile payments. The shift towards digital platforms and the growing reliance on mobile internet for daily activities have significantly boosted the demand for mobile data services. Fixed broadband and satellite services are expanding, particularly in underserved regions, while value-added services such as mobile money and enterprise solutions are gaining traction among both consumers and businesses .

The Nigeria Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as MTN Nigeria Communications Plc, Airtel Nigeria Limited, Globacom Limited, 9mobile (Emerging Markets Telecommunications Services Ltd), MainOne Cable Company, IHS Towers, Smile Communications Nigeria Limited, Spectranet Limited, Glo 1, Tizeti Network Limited, VDT Communications Limited, Airtel Africa Plc, StarTimes Nigeria, Ntel (Natcom Development & Investment Limited), 21st Century Technologies Limited, Mafab Communications Limited, NigComSat (Nigerian Communications Satellite Limited), ipNX Nigeria Limited, Swift Networks Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's telecom market appears promising, driven by technological advancements and increasing consumer demand for digital services. With the anticipated rollout of 5G networks and the expansion of mobile financial services, the sector is poised for significant transformation. Additionally, partnerships with technology startups are likely to foster innovation, enhancing service delivery and customer engagement. As the government continues to prioritize digital inclusion, the telecom landscape will evolve, creating new opportunities for growth and investment.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Smartphones Feature Phones Laptops/PCs Tablets Smart TVs Wearables & IoT Devices Others (Gaming Consoles, Smart Home Devices) |

| By Service Type | Mobile Voice Services Mobile Data Services Fixed-Line Services Fixed Broadband Services Satellite Services Value-Added Services (VAS) |

| By End-User | Residential Small and Medium Enterprises (SMEs) Large Enterprises Government & Public Sector |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors |

| By Service Plan | Prepaid Plans Postpaid Plans Bundled Plans |

| By Customer Segment | Individual Consumers Corporate Clients Government Institutions |

| By Geographic Coverage | Urban Areas Rural Areas Suburban Areas |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 120 | Consumers aged 18-45, Urban and Rural |

| Broadband Subscribers | 80 | Household Decision Makers, Small Business Owners |

| Telecom Industry Experts | 40 | Regulatory Officials, Telecom Analysts |

| Value-Added Service Users | 60 | Consumers using mobile apps and digital services |

| Corporate Telecom Clients | 50 | IT Managers, Procurement Officers in Corporates |

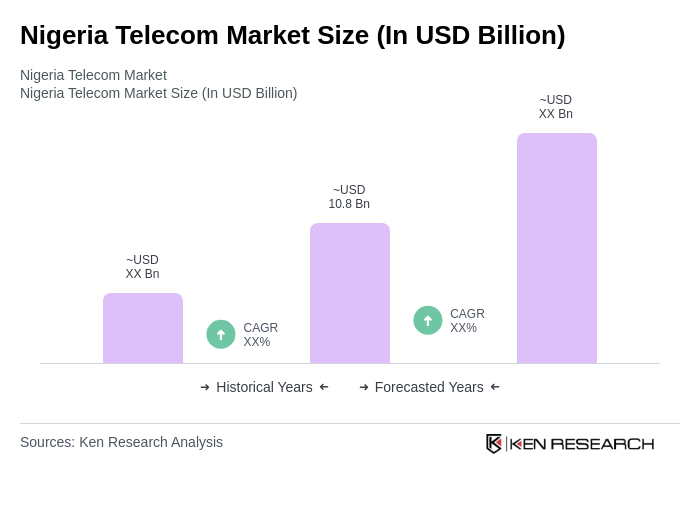

The Nigeria Telecom Market is valued at approximately USD 10.8 billion, driven by increased mobile connectivity, internet service expansion, and digital platform growth. Significant investments in infrastructure, including 4G and 5G networks, have enhanced service delivery and customer satisfaction.