Region:North America

Author(s):Dev

Product Code:KRAD0538

Pages:86

Published On:August 2025

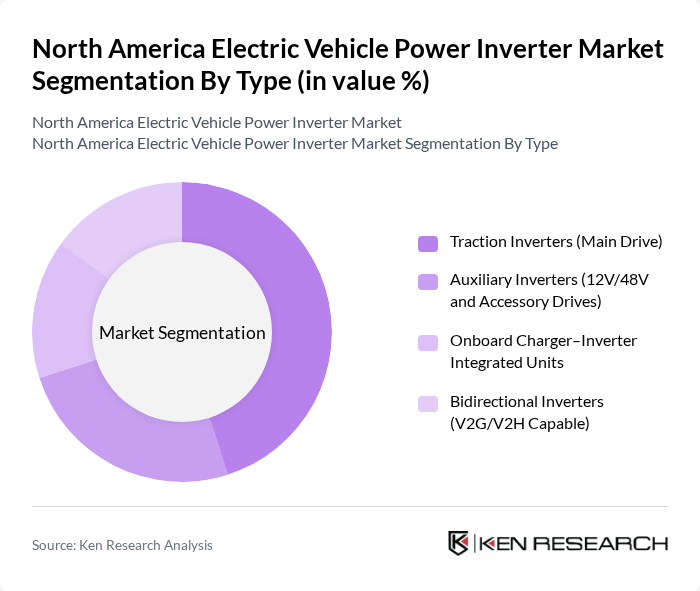

By Type:The market is segmented into various types of inverters, each serving distinct functions within electric vehicles. The primary subsegments include Traction Inverters, which are essential for the main drive of electric vehicles, and Auxiliary Inverters, which support lower voltage systems. Onboard Charger–Inverter Integrated Units combine charging and inverter functions, while Bidirectional Inverters enable vehicle-to-grid (V2G) and vehicle-to-home (V2H) capabilities. Among these, Traction Inverters dominate the market due to their critical role in vehicle propulsion and efficiency.

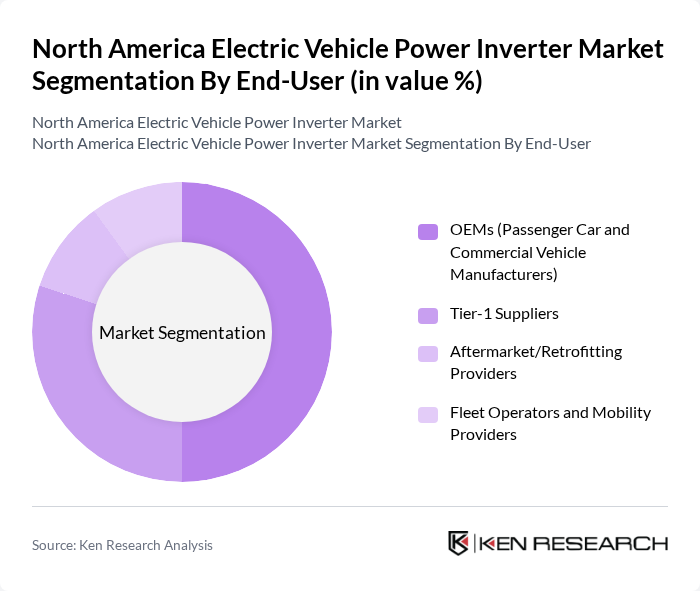

By End-User:The end-user segmentation includes OEMs, Tier-1 suppliers, aftermarket providers, and fleet operators. OEMs, particularly those manufacturing passenger cars and commercial vehicles, are the largest segment due to their direct involvement in vehicle production. Tier-1 suppliers play a crucial role in providing components to OEMs, while aftermarket providers cater to retrofitting needs. Fleet operators are increasingly adopting electric vehicles, further driving demand for power inverters. OEMs lead this segment due to their scale and integration in the EV supply chain.

The North America Electric Vehicle Power Inverter Market is characterized by a dynamic mix of regional and international players. Leading participants such as BorgWarner Inc., Vitesco Technologies Group AG, DENSO Corporation, Hitachi Astemo, Ltd., Toyota Industries Corporation (Aisin Group), Lear Corporation, Magna International Inc., Robert Bosch GmbH, Mitsubishi Electric Corporation, Valeo SE, ZF Friedrichshafen AG, Infineon Technologies AG, onsemi (ON Semiconductor Corporation), Wolfspeed, Inc., Texas Instruments Incorporated contribute to innovation, geographic expansion, and service delivery in this space.

The future of the North American electric vehicle power inverter market appears promising, driven by ongoing technological innovations and supportive government policies. As the market shifts towards integrated power solutions, manufacturers are expected to focus on enhancing energy efficiency and developing smart grid technologies. Additionally, the rise of vehicle-to-grid technologies will create new avenues for power inverter applications, further solidifying their role in the evolving electric vehicle ecosystem and promoting sustainable energy practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Traction Inverters (Main Drive) Auxiliary Inverters (12V/48V and Accessory Drives) Onboard Charger–Inverter Integrated Units Bidirectional Inverters (V2G/V2H Capable) |

| By End-User | OEMs (Passenger Car and Commercial Vehicle Manufacturers) Tier-1 Suppliers Aftermarket/Retrofitting Providers Fleet Operators and Mobility Providers |

| By Application | Passenger Electric Cars (BEV, PHEV) Light Commercial Vehicles (eLCV, Delivery Vans) Medium & Heavy Electric Trucks Electric Buses and Coaches |

| By Distribution Channel | Direct to OEM (Program Awards) Tier-1/Tier-2 Supply Networks Aftermarket/Service Networks Online and Specialist Distributors |

| By Component | Power Modules (IGBT, SiC MOSFET) Gate Drivers & Control Electronics DC-Link Capacitors & Magnetics Thermal Management (Liquid Cooling, TIMs) Enclosure & Busbar Assemblies |

| By Price Range | Entry-Level (Low Power/Cost-Optimized) Mid-Range (Mainstream Volume Programs) Premium/High-Performance (High Voltage/Power Density) |

| By Technology | Silicon IGBT-Based Inverters Silicon Carbide (SiC) Inverters Gallium Nitride (GaN) Inverters Multilevel/Advanced Topologies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Electric Vehicle Manufacturers | 120 | Product Development Managers, Engineering Leads |

| Commercial Electric Vehicle Producers | 90 | Operations Managers, Fleet Directors |

| Power Inverter Suppliers | 80 | Sales Directors, Technical Engineers |

| Automotive Industry Consultants | 60 | Market Analysts, Strategy Consultants |

| Regulatory Bodies and Policy Makers | 50 | Policy Advisors, Regulatory Affairs Managers |

The North America Electric Vehicle Power Inverter Market is valued at approximately USD 3.4 billion, reflecting a significant growth driven by the increasing adoption of electric vehicles and advancements in inverter technology.