Region:North America

Author(s):Rebecca

Product Code:KRAD4946

Pages:84

Published On:December 2025

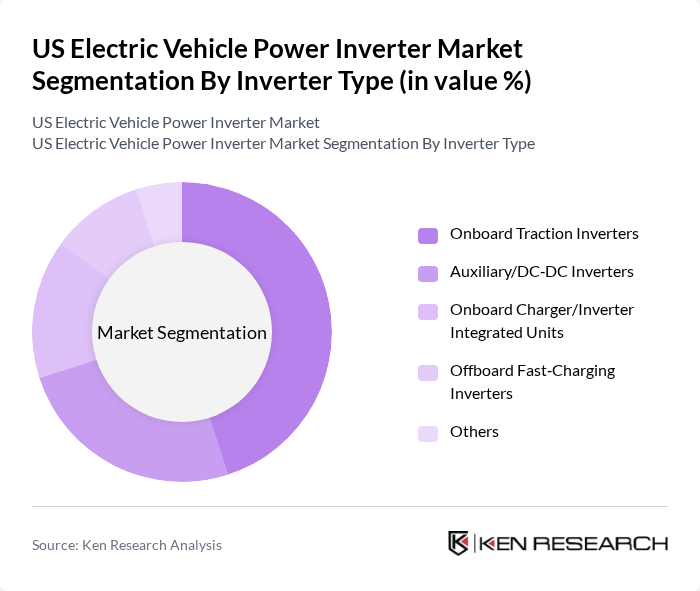

By Inverter Type:The inverter type segmentation includes various categories that cater to different functionalities within electric vehicles. The dominant subsegment is the Onboard Traction Inverters, which are essential for converting DC power from the battery to AC power for the electric motor and form the core of EV power electronics systems. This segment is favored due to the increasing number of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) in the market and the shift toward higher?voltage architectures to improve efficiency and range. Auxiliary/DC-DC Inverters also play a significant role, providing power conversion for low?voltage auxiliary systems and supporting advanced driver?assistance, infotainment, and thermal management loads. The demand for integrated solutions, such as Onboard Charger/Inverter Integrated Units and power electronics integration with e?axles or drive units, is rising as manufacturers seek to optimize space, reduce weight, and enhance overall system efficiency.

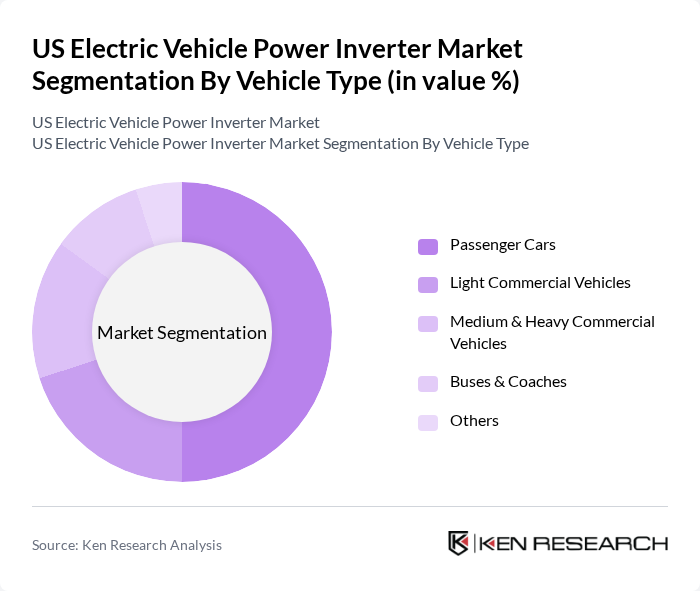

By Vehicle Type:The vehicle type segmentation encompasses various categories, with passenger cars being the most significant segment, in line with the dominance of BEVs and PHEVs in US light?duty EV sales. This is attributed to the growing consumer preference for electric passenger vehicles, driven by environmental concerns, total cost of ownership benefits, and federal and state incentives. Light commercial vehicles are also gaining traction as businesses transition to electric delivery and service fleets, supported by fleet?focused credits and corporate decarbonization targets. Medium & Heavy Commercial Vehicles and Buses & Coaches are emerging segments, supported by increasing investments in public transportation electrification, zero?emission truck corridors, and school bus replacement programs, all of which require high?power, high?reliability inverter systems. The Others category includes niche applications such as specialty vehicles and off?highway electrified platforms that are gradually expanding as OEMs electrify broader parts of their portfolios.

The US Electric Vehicle Power Inverter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tesla, Inc., BorgWarner Inc., Denso Corporation, Robert Bosch GmbH, Mitsubishi Electric Corporation, Hitachi Astemo, Ltd., Continental AG, Vitesco Technologies Group AG, Valeo SE, Texas Instruments Incorporated, Infineon Technologies AG, STMicroelectronics N.V., ON Semiconductor Corporation (onsemi), Aptiv PLC, Dana Incorporated contribute to innovation, geographic expansion, and service delivery in this space, particularly through SiC?based inverter platforms, integrated e?drive units, and advanced power module offerings for OEMs and Tier?1 suppliers.

The future of the US electric vehicle power inverter market appears promising, driven by technological advancements and increasing consumer acceptance of electric vehicles. As the market evolves, the integration of smart grid technologies and vehicle-to-grid systems will enhance energy management and efficiency. Additionally, the focus on sustainability will likely lead to innovations in manufacturing processes, further supporting the growth of the inverter market. Overall, the landscape is set for significant transformation, aligning with broader environmental goals and energy policies.

| Segment | Sub-Segments |

|---|---|

| By Inverter Type | Onboard Traction Inverters Auxiliary/DC?DC Inverters Onboard Charger/Inverter Integrated Units Offboard Fast?Charging Inverters Others |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Medium & Heavy Commercial Vehicles Buses & Coaches Others |

| By Propulsion | Battery Electric Vehicles (BEVs) Plug?in Hybrid Electric Vehicles (PHEVs) Hybrid Electric Vehicles (HEVs) Fuel Cell Electric Vehicles (FCEVs) Others |

| By Power Output | Up to 100 kW kW to 300 kW kW to 600 kW Above 600 kW Others |

| By Semiconductor Technology | IGBT?based Inverters SiC?based Inverters GaN?based Inverters Others |

| By Sales Channel | OEM?Installed Aftermarket Replacements Remanufactured/Refurbished Others |

| By Level of Integration | Standalone Inverters Integrated Power Electronics Modules Inverter?Motor Integrated Systems Inverter?OBC?DC/DC Integrated Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Electric Vehicle Manufacturers | 90 | Product Development Managers, Engineering Leads |

| Commercial Electric Vehicle Producers | 70 | Operations Managers, Fleet Directors |

| Power Inverter Suppliers | 55 | Sales Directors, Technical Support Engineers |

| Charging Infrastructure Providers | 65 | Business Development Managers, Project Managers |

| Regulatory Bodies and Policy Makers | 45 | Policy Analysts, Environmental Compliance Officers |

The US Electric Vehicle Power Inverter Market is valued at approximately USD 1.0 billion, driven by the increasing adoption of electric vehicles, advancements in semiconductor technology, and government initiatives promoting sustainable transportation.