Region:Global

Author(s):Rebecca

Product Code:KRAA2464

Pages:89

Published On:August 2025

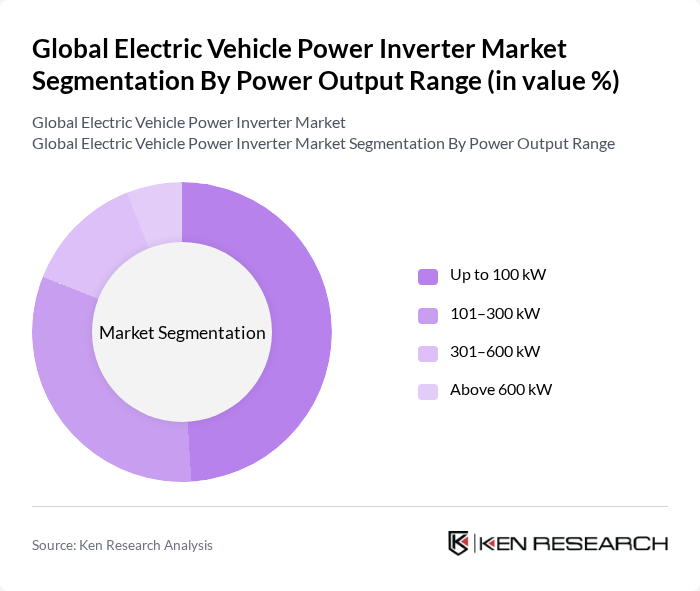

By Power Output Range:The power output range of electric vehicle inverters is crucial for determining their application in various vehicle types. The segments include Up to 100 kW, 101–300 kW, 301–600 kW, and Above 600 kW. The demand for inverters in the 101–300 kW range is particularly strong, as this output is suitable for a wide variety of electric vehicles, including passenger cars and commercial vehicles. However, recent data indicates that the Up to 100 kW segment leads the market, primarily due to its widespread use in compact passenger vehicles, while the 101–300 kW segment remains significant for mid-sized and performance vehicles .

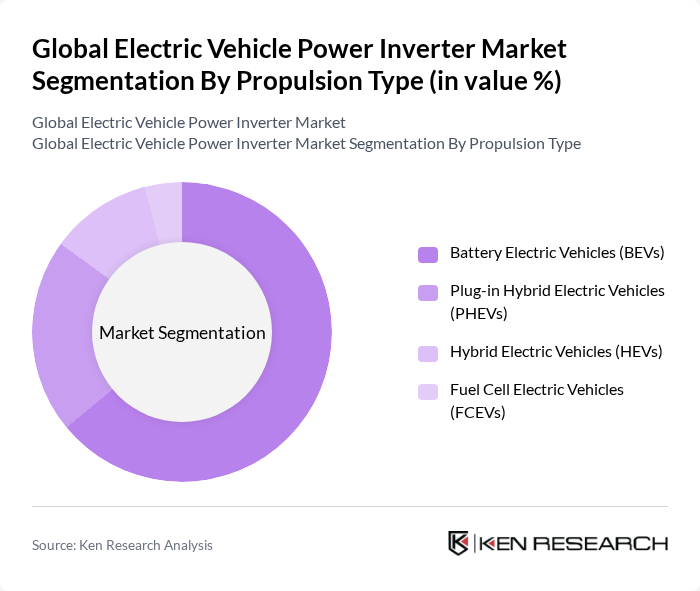

By Propulsion Type:The propulsion type of electric vehicles significantly influences the design and functionality of power inverters. The segments include Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs), and Fuel Cell Electric Vehicles (FCEVs). The BEV segment is leading the market due to the increasing consumer preference for fully electric vehicles, driven by environmental concerns and advancements in battery technology. BEVs currently account for the largest share, followed by PHEVs and HEVs, with FCEVs representing a niche segment .

The Global Electric Vehicle Power Inverter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tesla, Inc., Robert Bosch GmbH, Infineon Technologies AG, Siemens AG, ABB Ltd., Mitsubishi Electric Corporation, Delta Electronics, Inc., NXP Semiconductors N.V., Texas Instruments Incorporated, ON Semiconductor Corporation, Schneider Electric SE, Panasonic Corporation, LG Electronics Inc., Renesas Electronics Corporation, STMicroelectronics N.V., Denso Corporation, Valeo SA, Aptiv PLC, Marelli Holdings Co., Ltd., Hitachi Astemo, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric vehicle power inverter market appears promising, driven by technological advancements and increasing environmental awareness. As governments worldwide enforce stricter emission regulations, the demand for efficient inverters will rise. Additionally, the integration of renewable energy sources into the grid will create new opportunities for inverter manufacturers, particularly in developing smart grid technologies. The focus on sustainability will further accelerate innovation in inverter designs, enhancing their efficiency and performance.

| Segment | Sub-Segments |

|---|---|

| By Power Output Range | Up to 100 kW –300 kW –600 kW Above 600 kW |

| By Propulsion Type | Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Hybrid Electric Vehicles (HEVs) Fuel Cell Electric Vehicles (FCEVs) |

| By Vehicle Type | Passenger Cars Commercial Vehicles Buses Trucks Two-Wheelers Others |

| By Technology | Silicon-based Inverters Silicon Carbide (SiC) Inverters Gallium Nitride (GaN) Inverters Others |

| By Region | North America Europe Asia Pacific Rest of World |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Electric Vehicle Manufacturers | 100 | Product Development Managers, Engineering Leads |

| Commercial Electric Vehicle Producers | 80 | Operations Managers, Fleet Managers |

| Power Inverter Suppliers | 60 | Sales Directors, Technical Support Engineers |

| Charging Infrastructure Providers | 50 | Business Development Managers, Technical Directors |

| Regulatory Bodies and Policy Makers | 40 | Policy Analysts, Environmental Officers |

The Global Electric Vehicle Power Inverter Market is valued at approximately USD 8.3 billion, driven by the increasing adoption of electric vehicles and advancements in inverter technology, including the use of silicon carbide (SiC) and gallium nitride (GaN) semiconductors.