Region:North America

Author(s):Shubham

Product Code:KRAC0622

Pages:85

Published On:August 2025

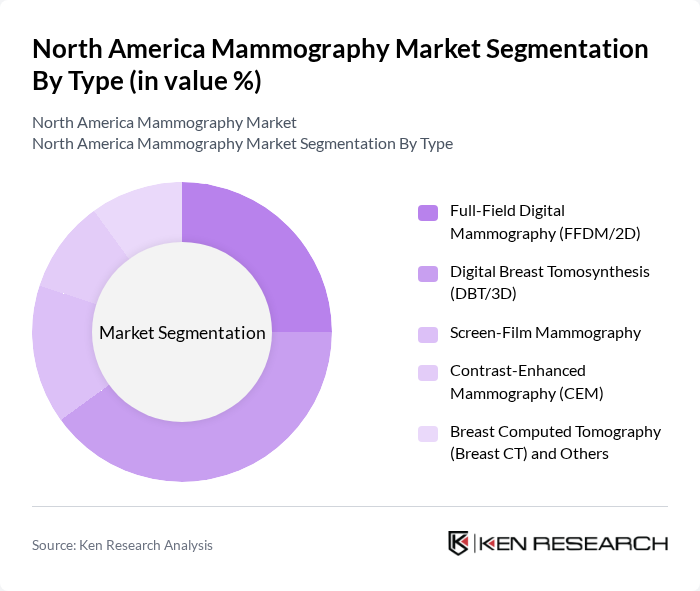

By Type:The mammography market can be segmented into various types, including Full-Field Digital Mammography (FFDM/2D), Digital Breast Tomosynthesis (DBT/3D), Screen-Film Mammography, Contrast-Enhanced Mammography (CEM), and Breast Computed Tomography (Breast CT) and Others. Among these, Digital Breast Tomosynthesis (DBT/3D) is currently leading the market due to its ability to provide three-dimensional images, which significantly improve cancer detection rates compared to traditional methods. The growing preference for DBT is driven by its enhanced diagnostic capabilities and the increasing adoption of advanced imaging technologies in healthcare facilities.

By End-User:The end-user segmentation includes Hospitals, Independent Diagnostic Imaging Centers, Breast Screening Programs and Mobile Units, and Academic & Research Institutes. Hospitals are the leading end-users in the mammography market, primarily due to their comprehensive healthcare services and advanced diagnostic capabilities. The increasing number of hospitals adopting state-of-the-art mammography technologies, along with the growing emphasis on early detection of breast cancer, has significantly contributed to the dominance of this segment.

The North America Mammography Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hologic, Inc., GE HealthCare Technologies Inc., Siemens Healthineers AG, Fujifilm Healthcare (Fujifilm Holdings Corporation), Philips (Koninklijke Philips N.V.), Canon Medical Systems Corporation, Carestream Health, Inc., Agfa HealthCare NV, Konica Minolta Healthcare Americas, Inc., Planmed Oy, iCAD, Inc., RadNet, Inc., ScreenPoint Medical B.V., Lunit Inc., Therapixel contribute to innovation, geographic expansion, and service delivery in this space.

The North America mammography market is poised for significant evolution, driven by technological advancements and increasing healthcare investments. The integration of artificial intelligence in mammography is expected to enhance diagnostic accuracy and efficiency, while the expansion of telemammography services will improve access for underserved populations. Additionally, the focus on patient-centered care will likely lead to more personalized screening approaches, ultimately improving patient outcomes and satisfaction in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Field Digital Mammography (FFDM/2D) Digital Breast Tomosynthesis (DBT/3D) Screen-Film Mammography Contrast-Enhanced Mammography (CEM) Breast Computed Tomography (Breast CT) and Others |

| By End-User | Hospitals Independent Diagnostic Imaging Centers Breast Screening Programs and Mobile Units Academic & Research Institutes |

| By Application | Population Screening Diagnostic/Diagnostic Workup Follow-up/Surveillance Pre?surgical Planning and Monitoring |

| By Distribution Channel | Direct Sales (OEM) Value?Added Resellers and Distributors Group Purchasing Organizations (GPOs) Online/Tenders and Others |

| By Region | United States Canada Mexico Others |

| By Price Range | Entry (Analog/Refurbished/Basic Digital) Mid (Standard FFDM/Selected DBT) Premium (Advanced DBT/CEM/AI?ready) |

| By Technology | Analog (Film?Screen) Digital (FFDM/DBT) AI?enabled CAD and Decision Support Portable/Mobile Mammography Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Radiology Departments | 120 | Radiologists, Imaging Technologists |

| Outpatient Imaging Centers | 90 | Center Managers, Radiology Technicians |

| Healthcare Policy Makers | 60 | Health Administrators, Policy Analysts |

| Patient Experience Focus Groups | 40 | Women aged 40+, Healthcare Consumers |

| Insurance Providers | 50 | Claims Adjusters, Underwriters |

The North America Mammography Market is valued at approximately USD 1.1 billion, driven by the increasing prevalence of breast cancer, advancements in technology, and heightened awareness regarding early detection among women.