Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4140

Pages:100

Published On:December 2025

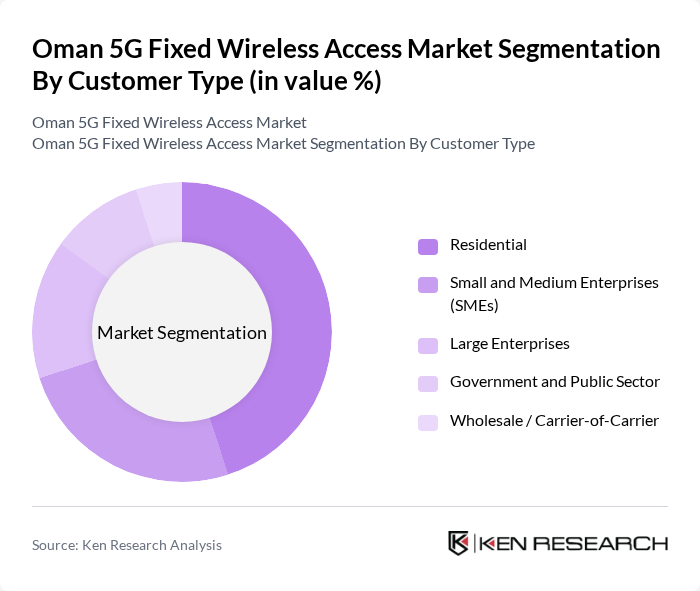

By Customer Type:The customer type segmentation includes various subsegments such as Residential, Small and Medium Enterprises (SMEs), Large Enterprises, Government and Public Sector, and Wholesale / Carrier-of-Carrier. Among these, the Residential segment is currently leading the market due to the increasing number of households seeking high-speed internet for remote work, online education, and entertainment. The demand for reliable home broadband solutions has surged, particularly during the pandemic, driving significant investments in infrastructure to meet consumer needs. SMEs are also increasingly adopting 5G FWA for flexible, low-latency connectivity, especially in retail, hospitality, and professional services.

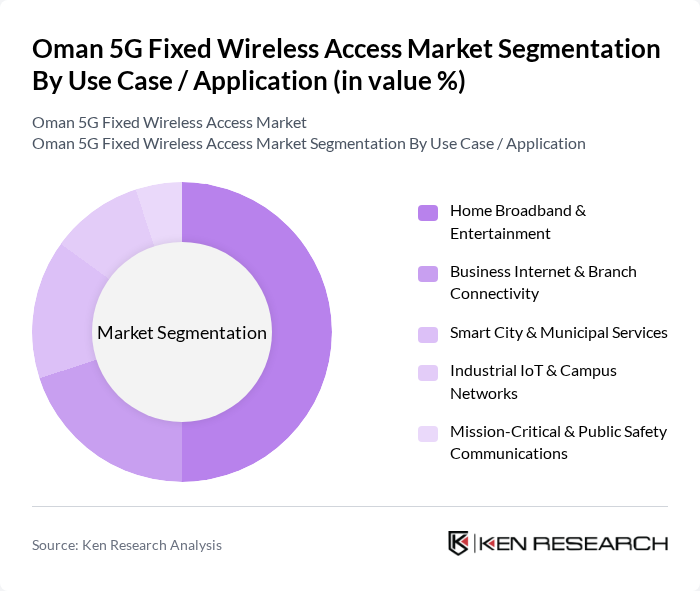

By Use Case / Application:The use case segmentation encompasses Home Broadband & Entertainment, Business Internet & Branch Connectivity, Smart City & Municipal Services, Industrial IoT & Campus Networks, and Mission-Critical & Public Safety Communications. The Home Broadband & Entertainment segment is the most dominant, driven by the increasing consumption of streaming services and online gaming. As more consumers seek high-speed internet for these applications, service providers are focusing on enhancing their offerings to capture this growing demand. Business Internet & Branch Connectivity is gaining traction as enterprises adopt 5G FWA for primary or backup connectivity, while Smart City & Municipal Services are being supported by government-led digital infrastructure projects.

The Oman 5G Fixed Wireless Access Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Telecommunications Company (Omantel), Ooredoo Oman (Omani Qatari Telecommunications Company SAOG), Vodafone Oman (Vodafone Oman Telecommunications Company LLC), Awasr (Arabian Network Information Services SAOC), Ministry of Transport, Communications and Information Technology (MTCIT), Telecommunications Regulatory Authority of Oman (TRA), Ericsson AB, Huawei Technologies Co., Ltd., Nokia Corporation, Zain Group, Cisco Systems, Inc., NEC Corporation, Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., Fujitsu Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman 5G fixed wireless access market appears promising, driven by ongoing government initiatives and increasing consumer demand for high-speed connectivity. As urban areas continue to develop smart city projects, the integration of 5G technology will become essential for enhancing public services. Additionally, the rise of IoT applications will further stimulate demand for reliable internet access, creating a robust ecosystem for 5G deployment and innovation in the telecommunications sector.

| Segment | Sub-Segments |

|---|---|

| By Customer Type | Residential Small and Medium Enterprises (SMEs) Large Enterprises Government and Public Sector Wholesale / Carrier-of-Carrier |

| By Use Case / Application | Home Broadband & Entertainment (video streaming, gaming, remote work) Business Internet & Branch Connectivity Smart City & Municipal Services Industrial IoT & Campus Networks (oil & gas, ports, logistics, manufacturing) Mission-Critical & Public Safety Communications |

| By Access & Spectrum Band | Sub-6 GHz (e.g. 3.5 GHz band) mmWave (24–39 GHz) Licensed Shared / Local Spectrum Unlicensed / Hybrid Spectrum |

| By Offering | Hardware (CPE, outdoor units, antennas, routers) Access Services (standalone FWA broadband) Bundled FWA with Mobile / Content / IPTV Managed & Value-Added Services (SLA-based, SD-WAN, security) |

| By Deployment Environment | Urban (Muscat, Salalah, Sohar and major cities) Suburban Rural & Remote Communities Enterprise / Campus & Industrial Sites |

| By Contract & Pricing Model | Postpaid Contract (12–36 month) Prepaid / Pay-as-you-go FWA Volume / Speed-based Tiered Plans Enterprise SLA-based & Custom Tariffs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Service Providers | 60 | Network Managers, Product Development Heads |

| End-User Households | 150 | Residential Customers, Technology Adopters |

| Business Enterprises | 90 | IT Managers, Operations Directors |

| Government Regulatory Bodies | 40 | Policy Makers, Telecommunications Analysts |

| Industry Experts and Analysts | 40 | Market Researchers, Technology Consultants |

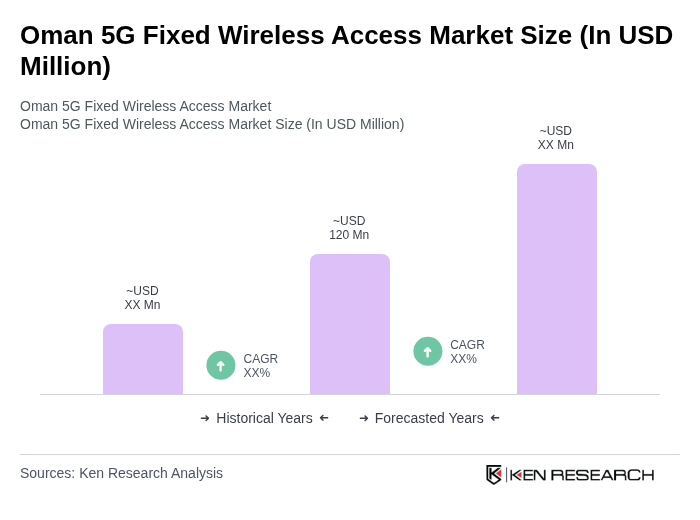

The Oman 5G Fixed Wireless Access Market is valued at approximately USD 120 million, reflecting a significant growth driven by the increasing demand for high-speed internet and government initiatives aimed at digital transformation.