Region:Middle East

Author(s):Rebecca

Product Code:KRAC3880

Pages:84

Published On:October 2025

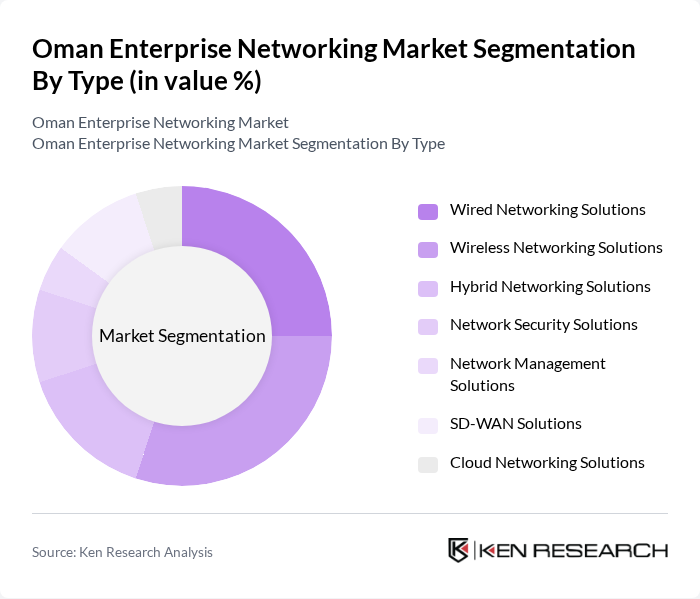

By Type:The market is segmented into various types of networking solutions, including Wired Networking Solutions, Wireless Networking Solutions, Hybrid Networking Solutions, Network Security Solutions, Network Management Solutions, SD-WAN Solutions, and Cloud Networking Solutions. Each of these segments addresses specific customer needs, with wireless and cloud networking solutions gaining traction due to the increasing adoption of remote work, IoT, and cloud-based applications. Network security solutions are also witnessing robust demand as enterprises prioritize data protection and regulatory compliance .

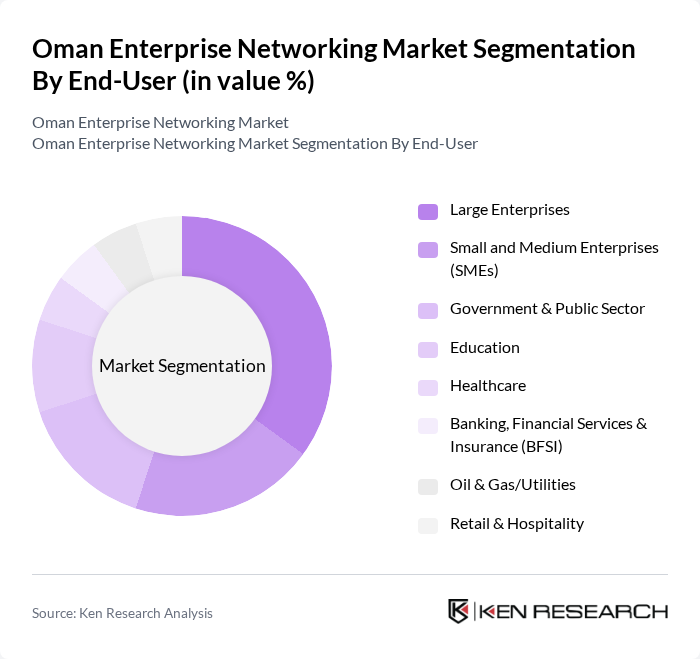

By End-User:The end-user segmentation includes Large Enterprises, Small and Medium Enterprises (SMEs), Government & Public Sector, Education, Healthcare, Banking, Financial Services & Insurance (BFSI), Oil & Gas/Utilities, and Retail & Hospitality. Large enterprises and the government sector are the primary adopters, driven by the need for scalable, secure, and high-performance networks. SMEs are increasingly investing in cloud-based and managed networking solutions to support business agility and digital transformation. Sectors such as BFSI and healthcare are focusing on network security and compliance, while education and retail are leveraging wireless and cloud networking for operational efficiency .

The Oman Enterprise Networking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Huawei Technologies Co., Ltd., Juniper Networks, Inc., Arista Networks, Inc., Hewlett Packard Enterprise (HPE), Dell Technologies Inc., Extreme Networks, Inc., Netgear, Inc., TP-Link Technologies Co., Ltd., Fortinet, Inc., Palo Alto Networks, Inc., Check Point Software Technologies Ltd., ZTE Corporation, Nokia Corporation, Ericsson AB, Ooredoo Oman, Oman Broadband Company SAOC, Gulf Business Machines (GBM) Oman, Bahwan IT, and Oman Data Park contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman enterprise networking market appears promising, driven by technological advancements and government support. The shift towards Software-Defined Networking (SDN) and the rollout of 5G technology are expected to revolutionize connectivity, enhancing network flexibility and speed. Additionally, the integration of artificial intelligence in network management will optimize operations, while sustainable networking solutions will gain traction as businesses prioritize environmental responsibility. These trends indicate a robust growth trajectory for the sector in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Wired Networking Solutions Wireless Networking Solutions Hybrid Networking Solutions Network Security Solutions Network Management Solutions SD-WAN Solutions Cloud Networking Solutions |

| By End-User | Large Enterprises Small and Medium Enterprises (SMEs) Government & Public Sector Education Healthcare Banking, Financial Services & Insurance (BFSI) Oil & Gas/Utilities Retail & Hospitality |

| By Component | Hardware (Routers, Switches, Access Points, Firewalls) Software (Network Management, Security, Analytics) Services (Consulting, Integration, Managed Services) |

| By Application | Data Center Networking Enterprise WAN Local Area Networking (LAN) Network Security Remote Access & VPN |

| By Sales Channel | Direct Sales Distributors/Value-Added Resellers (VARs) Online Sales |

| By Distribution Mode | Retail Wholesale E-commerce |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Networking Solutions | 100 | Network Engineers, IT Directors |

| Enterprise Networking in Healthcare | 60 | Healthcare IT Managers, System Administrators |

| Networking Solutions for SMEs | 50 | Business Owners, IT Consultants |

| Government Sector Networking Needs | 40 | Public Sector IT Managers, Procurement Officers |

| Education Sector Networking Infrastructure | 70 | IT Coordinators, Network Administrators |

The Oman Enterprise Networking Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for advanced networking solutions across various sectors, including government, healthcare, and education.