Region:Middle East

Author(s):Dev

Product Code:KRAC4150

Pages:99

Published On:October 2025

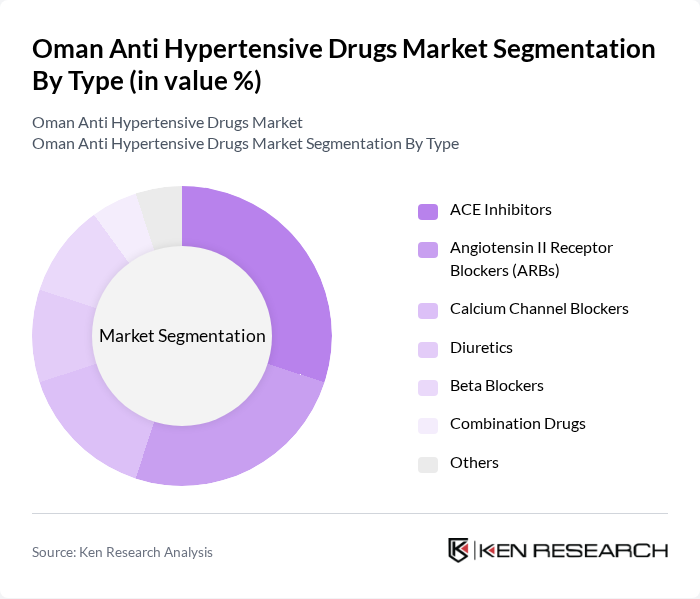

By Type:The market is segmented into various types of antihypertensive drugs, including ACE Inhibitors, Angiotensin II Receptor Blockers (ARBs), Calcium Channel Blockers, Diuretics, Beta Blockers, Combination Drugs, and Others. Among these, ACE Inhibitors and ARBs are particularly popular due to their effectiveness and favorable side effect profiles. The increasing prevalence of hypertension has led to a higher demand for these medications, making them the leading subsegments in the market .

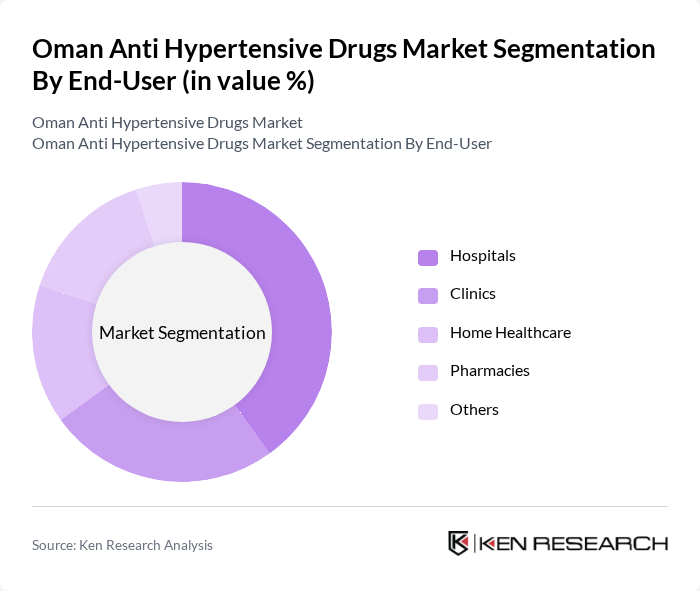

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare, Pharmacies, and Others. Hospitals are the leading end-users of antihypertensive drugs due to their capacity to manage complex cases and provide comprehensive care. The increasing number of patients diagnosed with hypertension in hospitals drives the demand for these medications, making them a critical segment in the market .

The Oman Anti Hypertensive Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as AstraZeneca, Novartis, Pfizer, Sanofi, Merck & Co., Boehringer Ingelheim, GSK (GlaxoSmithKline), Teva Pharmaceutical Industries Ltd., Amgen Inc., Bayer AG, Johnson & Johnson, Eli Lilly and Company, Astellas Pharma Inc., Takeda Pharmaceutical Company Limited, Sandoz (a Novartis division) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman antihypertensive drugs market appears promising, driven by demographic shifts and increasing health awareness. As the population ages and the prevalence of hypertension rises, the demand for effective treatment options will likely grow. Additionally, advancements in telemedicine and digital health solutions are expected to enhance patient access to care. The focus on preventive healthcare will further encourage the development of innovative therapies, ensuring that the market remains dynamic and responsive to patient needs.

| Segment | Sub-Segments |

|---|---|

| By Type | ACE Inhibitors Angiotensin II Receptor Blockers (ARBs) Calcium Channel Blockers Diuretics Beta Blockers Combination Drugs Others |

| By End-User | Hospitals Clinics Home Healthcare Pharmacies Others |

| By Distribution Channel | Retail Pharmacies Online Pharmacies Hospital Pharmacies Wholesalers Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Discount Pricing Others |

| By Patient Demographics | Age Group (Adults, Seniors) Gender (Male, Female) Socioeconomic Status (Low, Middle, High) Others |

| By Therapeutic Area | Cardiovascular Diseases Diabetes Management Chronic Kidney Disease Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 150 | Cardiologists, General Practitioners |

| Pharmacists | 100 | Community Pharmacists, Hospital Pharmacists |

| Patients with Hypertension | 150 | Hypertension Patients, Caregivers |

| Health Policy Experts | 50 | Healthcare Economists, Policy Analysts |

| Pharmaceutical Sales Representatives | 80 | Sales Managers, Product Managers |

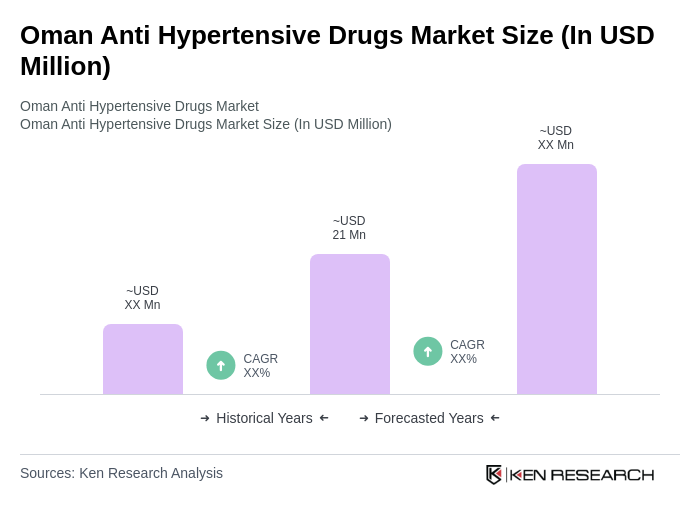

The Oman Anti Hypertensive Drugs Market is valued at approximately USD 21 million, reflecting a significant growth driven by the increasing prevalence of hypertension and enhanced healthcare infrastructure in the region.