Region:Middle East

Author(s):Rebecca

Product Code:KRAC9857

Pages:93

Published On:November 2025

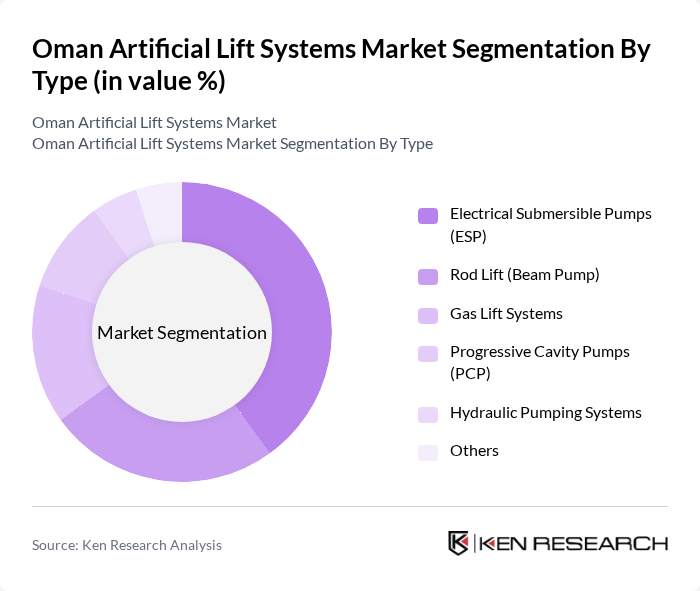

By Type:The market is segmented into various types of artificial lift systems, including Electrical Submersible Pumps (ESP), Rod Lift (Beam Pump), Gas Lift Systems, Progressive Cavity Pumps (PCP), Hydraulic Pumping Systems, and Others. Each type serves specific operational needs and is chosen based on factors such as well depth, fluid characteristics, and production requirements. Among these, Electrical Submersible Pumps (ESP) are the most widely used due to their efficiency and ability to handle high production rates. Recent trends indicate a growing preference for ESPs and PCPs in mature oil fields, driven by their reliability and adaptability to varying well conditions .

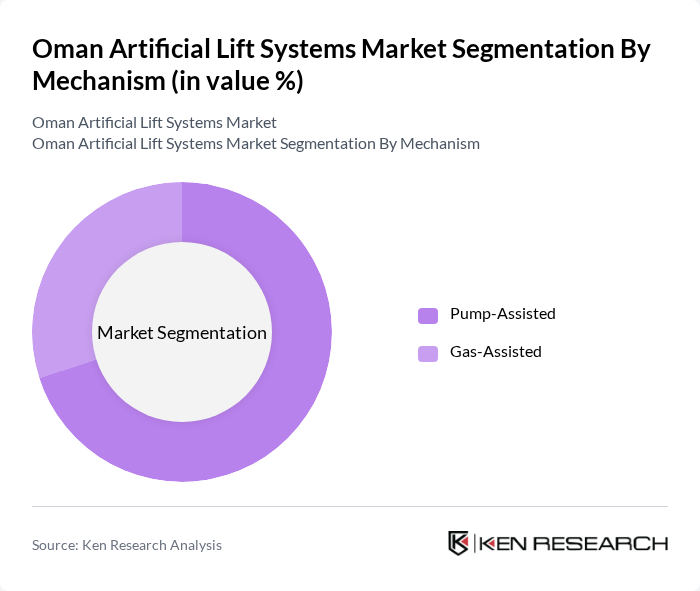

By Mechanism:The market is categorized into Pump-Assisted and Gas-Assisted mechanisms. Pump-Assisted systems are prevalent due to their reliability and effectiveness in various well conditions. Gas-Assisted systems, while less common, are utilized in specific applications where gas injection can enhance production efficiency. The Pump-Assisted segment leads the market, driven by its widespread adoption in both onshore and offshore operations. Notably, gas-assisted mechanisms have seen increased utilization in Oman’s offshore fields, reflecting a broader regional trend .

The Oman Artificial Lift Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petroleum Development Oman (PDO), Schlumberger, Halliburton, Baker Hughes, Weatherford International, National Oilwell Varco, Occidental Petroleum Corporation, Aker Solutions, Alkhorayef Petroleum Company, PetroLift Systems, Inc., GE Oil & Gas, Petrofac, Saipem, KCA Deutag, BCP Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman artificial lift systems market appears promising, driven by technological innovations and a focus on sustainability. As operators increasingly adopt automation and IoT integration, efficiency gains are expected to enhance production capabilities. Additionally, the government's push for renewable energy sources will likely lead to hybrid systems that combine traditional and renewable technologies, fostering a more resilient energy landscape. This evolution will create a competitive environment, encouraging further investments and advancements in artificial lift technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Electrical Submersible Pumps (ESP) Rod Lift (Beam Pump) Gas Lift Systems Progressive Cavity Pumps (PCP) Hydraulic Pumping Systems Others |

| By Mechanism | Pump-Assisted Gas-Assisted |

| By Application | Onshore Offshore Enhanced Oil Recovery (EOR) Others |

| By End-User | Oil & Gas Operators National Oil Companies (NOCs) International Oil Companies (IOCs) Oilfield Service Providers Others |

| By Region | Muscat Dhofar Al Batinah Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Field Operators | 100 | Field Engineers, Production Managers |

| Artificial Lift Equipment Suppliers | 60 | Sales Managers, Technical Support Engineers |

| Oil and Gas Regulatory Bodies | 50 | Policy Makers, Regulatory Affairs Specialists |

| Research and Development in Oil Technologies | 45 | R&D Managers, Innovation Leads |

| Consultants in Oil Production Optimization | 40 | Consultants, Industry Analysts |

The Oman Artificial Lift Systems Market is valued at approximately USD 1 billion, reflecting a five-year historical analysis. This growth is driven by increasing oil and gas production demands and investments in enhanced recovery techniques.