Region:Middle East

Author(s):Rebecca

Product Code:KRAB8762

Pages:80

Published On:October 2025

Market.png)

By Type:The market is segmented into various types of drivetrain components, including Electric Motors, Transmissions, Drive Shafts, Differentials, Axles, Gearboxes, and Others. Each of these components plays a crucial role in the overall performance and efficiency of vehicles, catering to both electric and internal combustion engine models. The demand for these components is influenced by technological advancements and consumer preferences for high-performance vehicles.

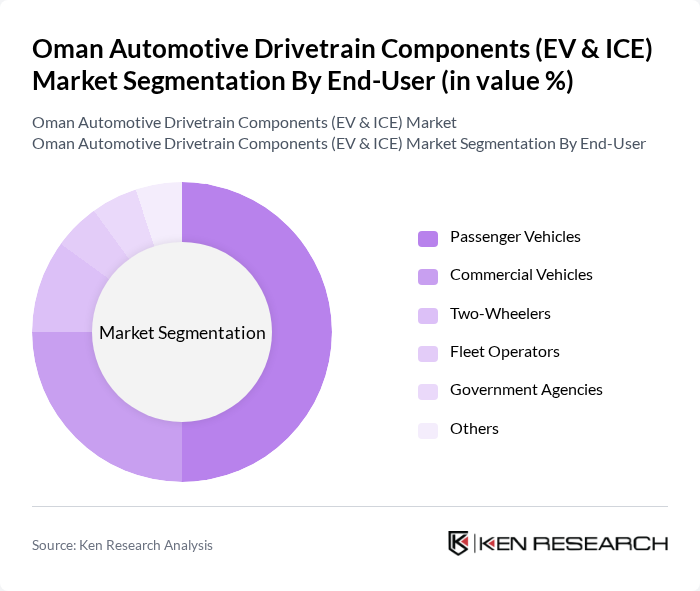

By End-User:The end-user segmentation includes Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Fleet Operators, Government Agencies, and Others. The passenger vehicle segment is particularly dominant due to the increasing consumer demand for personal transportation and the growing trend of vehicle ownership in Oman. Commercial vehicles are also significant, driven by the expansion of logistics and transportation services in the region.

The Oman Automotive Drivetrain Components (EV & ICE) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Automotive Components Co., Muscat Motors LLC, Al-Futtaim Automotive, Bahwan Automotive LLC, Oman Drivetrain Solutions, Al-Muheet Automotive, Gulf Automotive Components, Al-Harthy Automotive, Oman Electric Vehicles Co., Al-Mahrouqi Automotive, Al-Saadi Automotive, Oman Vehicle Components, Al-Balushi Automotive, Muscat Electric Drivetrains, Oman Hybrid Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman automotive drivetrain components market appears promising, driven by a strong push towards electrification and sustainability. As the government continues to implement supportive policies, including emission reduction targets and EV purchase subsidies, the market is expected to evolve rapidly. Additionally, the integration of smart technologies and the rise of shared mobility solutions will further transform the automotive landscape, creating new avenues for growth and innovation in drivetrain components.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Motors Transmissions Drive Shafts Differentials Axles Gearboxes Others |

| By End-User | Passenger Vehicles Commercial Vehicles Two-Wheelers Fleet Operators Government Agencies Others |

| By Component | Electric Drivetrain Components Internal Combustion Engine Components Hybrid Components Control Systems Cooling Systems Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Distribution Mode | Wholesale Distribution Retail Distribution E-commerce Distribution Direct-to-Consumer Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Application | Personal Use Commercial Use Government Use Industrial Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| EV Drivetrain Component Manufacturers | 100 | Product Managers, R&D Engineers |

| ICE Drivetrain Component Suppliers | 80 | Procurement Managers, Operations Directors |

| Automotive OEMs in Oman | 60 | Supply Chain Managers, Technical Directors |

| Aftermarket Component Distributors | 50 | Sales Managers, Business Development Executives |

| Fleet Operators and Service Providers | 70 | Fleet Managers, Maintenance Supervisors |

The Oman Automotive Drivetrain Components market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the increasing demand for both electric and internal combustion engine vehicles, as well as government initiatives promoting sustainable transportation solutions.